Dear Friends,

Tangents: Happy Friday.

Fiesta de San Fermi: Running of the Bulls, Pamplona Spain….ahh! nostalgia for Ernest Hemmingway…

Tanabata: Star Festival, Japan.

July 7, 1860: Florence Nightingale, known as the founder of modern nursing, establishes her nursing school in London, pioneering the professionalization of nursing as a respected profession.

1987: Lt. Col. Oliver North began his public testimony at the Iran-Contra hearing, telling Congress that he had “never carried out a single act, not one” without authorization. Go to article >>

Gustav Mahler, composer, b. 1860.

Marc Chagall, artist, b. 1887.

Robert A. Heinlein, writer, b. 1907.

Ringo Starr, b.1940.

Global temperatures have been the hottest on record for 3 days in a row

The world’s average temperature was the hottest on record from July 3 to July 5, 2023. Climate change and El Niño are to blame, scientists say. Read More.

1,200-year-old ‘Viking graffiti’ is the oldest drawing ever discovered in Iceland

The record-setting Viking carving, which dates to shortly after A.D. 800, looks like a partly drawn boat. Read More.

Dozens of 2,500-year-old skeletons unearthed at ancient crossroads in Negev desert. Archaeologists in Israel unearthed a burial site holding dozens of skeletons from 2,500 years ago — possibly the remains of trafficked women. Full Story: Live Science (7/6)

James Webb telescope detects the earliest strand in the ‘cosmic web’ ever seen

Astronomers have discovered a clump of ancient galaxies that may be the oldest strand of the cosmic web, which links galaxies across the universe, ever detected. Read More.

Adorable extinct penguin was one of the smallest of its kind to ever walk Earth, tiny skull fossils reveal

Scientists have uncovered the twee remains of one of the smallest extinct penguin species ever found, which waddled around New Zealand around 3 million years ago. Read More.

The Eagles announce ‘final’ tour dates after 52 years as a band. Fans are getting excited to belt “Hotel California” one last time with the Rock and Roll Hall of Famers.

VW to test self-driving tech in retro-styled electric Microbuses. In a few years, you may see these iconic VW buses back on the road! The automaker said it plans to launch some commercial services in 2026.

Powerful images from environmental photography prize show challenges and hope. These striking photos took home prizes at the Prince Albert II of Monaco Foundation’s Environmental Photography award.

PHOTOS OF THE DAY

Pamplona, Spain: The Pamplonesa municipal band performs during the opening ceremony of the San Fermín bull festival. Photograph: Ander Gillenea/AFP/Getty Images

Hautes-Pyrénées, France: Team Jumbo-Visma’s Belgian rider Wout Van Aert leads a breakaway in the ascent of the Col du Tourmalet during a stage of the Tour de France between Tarbes and Cauterets-Cambasque in the Pyrenees. Photograph: Anne-Christine Poujoulat/AFP/Getty Images

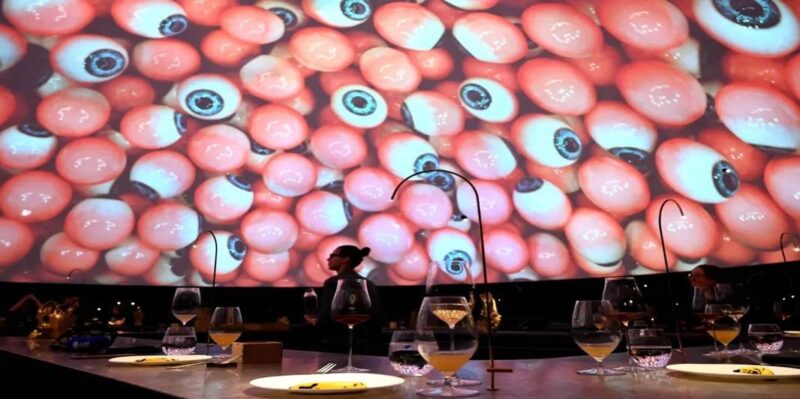

Buenos Aires, Argentina: People visit the Secret Garden exhibit at the Carlos Thays botanical garden, home to more than 1,500 plant species. The show transforms the traditional public space into a museum to mark the park’s 125th anniversary and honour its creator, the French landscape architect Carlos Thays. Photograph: Natacha Pisarenko/A

Market Closes for July 7th, 2023

| Market Index |

Close | Change |

| Dow Jones |

33734.88 | -187.38 |

| -0.55% | ||

| S&P 500 | 4398.95 | -12.64 |

| -0.29% | ||

| NASDAQ | 13660.71 | -18.33 |

| -0.13% | ||

| TSX | 19831.04 | +20.35 |

| +0.10% |

International Markets

| Market Index |

Close | Change |

| NIKKEI | 32388.42 | -384.60 |

| -1.17% | ||

| HANG SENG |

18365.70 | -167.35 |

| -0.90% | ||

| SENSEX | 65280.45 | -505.19 |

| -0.77% | ||

| FTSE 100* | 7256.94 | -23.56 |

| -0.32% |

Bonds

| Bonds | % Yield | Previous % Yield | |||

| CND. 10 Year Bond |

3.571 | 3.486 | |||

| CND. 30 Year Bond |

3.339 | 3.249 | |||

| U.S. 10 Year Bond |

4.0616 | 4.0291 | |||

| U.S. 30 Year Bond |

4.0444 | 3.9969 | |||

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.7531 | 0.7479 |

| US $ |

1.3273 | 1.3371 |

| Euro Rate 1 Euro= |

Inverse | |

| Canadian $ | 1.4561 | 0.6868 |

| US $ |

1.0966 | 0.9119 |

Commodities

| Gold | Close | Previous |

| London Gold Fix |

1908.80 | 1924.65 |

| Oil | ||

| WTI Crude Future | 73.86 | 71.80 |

Market Commentary:

📈 On this day in 1993, Charles W. Knapp was found guilty on three counts of conspiracy after his savings-and-loan empire collapsed, costing the taxpayer $2 billion. Knapp’s American Savings & Loan Association was once the nation’s largest thrift.

Canada

By Bloomberg Automation

(Bloomberg) — The S&P/TSX Composite rose 0.1% at 19,831.04 in Toronto. The move follows the previous session’s decrease of 1.5%.

Today, energy stocks led the market higher, as 4 of 11 sectors gained; 137 of 229 shares rose, while 89 fell.

Canadian Natural Resources Ltd. contributed the most to the index gain, increasing 2.7%. Bausch Health Cos. had the largest increase, rising 7.7%.

Insights

* So far this week, the index fell 1.6%

* The index advanced 4% in the past 52 weeks. The MSCI AC Americas Index gained 12% in the same period

* The S&P/TSX Composite is 4.9% below its 52-week high on Feb. 2, 2023 and 11% above its low on Oct. 13, 2022

* S&P/TSX Composite is trading at a price-to-earnings ratio of 12.9 on a trailing basis and 13.8 times estimated earnings of its members for the coming year

* The index’s dividend yield is 3.4% on a trailing 12-month basis

* S&P/TSX Composite’s members have a total market capitalization of C$3.14t

* 30-day price volatility fell to 11.51% compared with 11.72% in the previous session and the average of 11.53% over the past month

================================================================

| Index Points | |

Sector Name | Move | % Change | Adv/Dec

================================================================

Energy | 47.8873| 1.5| 35/5

Materials | 29.3236| 1.3| 42/8

Financials | 12.0808| 0.2| 20/9

Health Care | 2.0968| 4.1| 4/0

Real Estate | -1.7781| -0.4| 6/14

Communication Services | -5.5104| -0.7| 0/5

Consumer Discretionary | -5.5947| -0.7| 8/7

Consumer Staples | -6.9564| -0.8| 3/8

Information Technology | -7.7765| -0.5| 4/7

Utilities | -9.0380| -1.0| 2/14

Industrials | -34.3965| -1.3| 13/12

================================================================

| | |Volume VS| YTD

|Index Points | | 20D AVG | Change

Top Contributors | Move | % Change | (%) | (%)

================================================================

Canadian Natural Resources | 14.9600| 2.7| 17.4| -1.4

Suncor Energy | 7.5120| 2.2| -34.9| -9.6

Nutrien | 7.4260| 2.7| 25.1| -18.2

Thomson Reuters | -7.2100| -3.8| 0.0| 11.6

Canadian Pacific Kansas | -7.9440| -1.2| -18.0| 3.1

Canadian National | -13.2600| -2.0| 1.5| -4.6

US

By Isabelle Lee and Vildana Hajric

(Bloomberg) — US stocks started July logging losses as traders parsed a batch of labor market readouts.

The S&P 500 fell 1.2% over the shortened holiday week while the Nasdaq 100 slid 0.9%.

Yield on the two-year Treasury drifted down to 4.94% Friday.

Investors were digesting government jobs data that fell short of estimates but brought signs that wage inflation remained a threat to the Fed’s fight against price gains.

Overall, the data showed signs of cracks in the American labor market, a day after a private payrolls report suggested resilience that may warrant several more rate hikes.

Instead, traders reverted to expectations that the Fed will lift rates at its meeting later this month.

The odds for another hike this year were less than 50%.

Among notable movers, Levi Strauss & Co. fell sharply after lowering its outlook for the year while electric-vehicle manufacturer Rivian Automotive Inc. climbed for the eighth-straight session.

Chicago Fed President Austan Goolsbee left the door open for more data to sway officials ahead the central bank’s next meeting.

“We’re getting to a more sustainable pace, which is what we need to do for inflation,” Goolsbee said of Friday jobs data in an interview on CNBC.

Friday’s payroll numbers are not yet weak enough to stop the central bank’s tightening, according to Seema Shah, chief global strategist at Principal Asset Management.

“Jobs growth has slowed but remains too strong to justify an extended Fed pause,” she said. “More significantly, with average hourly earnings surprising to the upside, wage pressures are still too strong. Today’s report will give the Fed little reason to hold off from hiking at the July meeting.”

June’s 0.4% wage growth indicates businesses are still desperate to draw in and keep workers, according to Jeffrey Roach, chief economist at LPL Financial.

“The latest jobs report all but ensures the Fed will increase rates later this month,” he wrote.

Stocks have been losing ground in July after a strong first half of the year as hawkishness from central banks from the US to the UK dampens hopes of a soft landing for the global economy.

Technology shares have been one of the hottest trades, driven by the buzz around AI, but Bank of America Corp. strategists said investors who piled into the sector risk being caught off-guard in the selloff sparked by rate hikes.

“We say ‘sell the last hike’ will hit tech hardest,” the BofA team led by Michael Hartnett wrote in a note.

But if excitement over AI continues, they said the “baby bubble” that currently exists in a handful of Big Tech shares will mature into a larger one in the second half.

Dallas Fed President Lorie Logan voiced her concerns on Thursday that inflation was still running too hot and more tightening was needed.

Policymakers elsewhere share that view, with European Central Bank President Christine Lagarde saying there is still “work to do” to bring inflation under control.

Meanwhile, gold advanced while crude futures traded above $73 a barrel.

Key Events This Week:

* ECB’s Christine Lagarde addresses an event in France, Friday

Some of the main moves in markets today:

Stocks

* The S&P 500 fell 0.3% as of 4:03 p.m. New York time

* The Nasdaq 100 fell 0.3%

* The Dow Jones Industrial Average fell 0.6%

* The MSCI World index was little changed

Currencies

* The Bloomberg Dollar Spot Index fell 0.7%

* The euro rose 0.7% to $1.0967

* The British pound rose 0.7% to $1.2834

* The Japanese yen rose 1.4% to 142.10 per dollar

Cryptocurrencies

* Bitcoin fell 0.3% to $30,230.46

* Ether fell 1.1% to $1,863.42

Bonds

* The yield on 10-year Treasuries advanced three basis points to 4.06%

* Germany’s 10-year yield advanced one basis point to 2.64%

* Britain’s 10-year yield declined one basis point to 4.65%

Commodities

* West Texas Intermediate crude rose 2.6% to $73.66 a barrel

* Gold futures rose 0.8% to $1,931.30 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Viljoen, Tassia Sipahutar, Macarena Muñoz and Sydney Maki.

Have a wonderful weekend everyone.

Be magnificent!

As ever,

Carolann

To gain your own voice, forget about having it heard. -Allen Ginsberg, 1926-1997.

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Senior Investment Advisor

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7

Tel: 778.430.5808

(C): 250.881.0801

Toll Free: 1.877.430.5895

Fax: 778.430.5828

www.carolannsteinhoff.com

The Temple of Poseidon near Athens, Greece, in front of the buck supermoon

The Temple of Poseidon near Athens, Greece, in front of the buck supermoon