June, 30, 2023 Newsletter

Dear Friends,

Tangents: Happy Friday. Happy Canada Day weekend!

This weekend will be the full moon it’s a Supermoon! July’s full moon is known as the buck moon because this is when deer antlers are in full growth after shedding during the spring. “Bucks shed and regrow their antlers each year, producing a larger and more impressive set as the years go by,” the Old Farmer’s Almanac said.

Burning of he Three Firs, France.

June 30, 1908: The Tunguska event, one of the largest recorded meteorite impacts, occurs in Siberia, causing a massive explosion. The blast trees across 2,000 square kilometers (770 square miles) and released an estimated 10 to 15 megatons of energy, equivalent to the detonation of about 10,000 Hiroshima atomic bombs.

On June 30, 1971, the Supreme Court, in a 6-3 decision, freed The New York Times and The Washington Post to resume immediate publication of articles based on the secret Pentagon Papers on the origins of the Vietnam War. Go to article

‘Ghost particle’ image is the 1st view of our galaxy in ‘anything other than light’

Scientists at the Ice Cube Neutrino Observatory have used 60,000 neutrinos to create the first map of the Milky Way made with matter. Read More

Euclid space telescope launches this week. Here’s what the groundbreaking mission will do.

The European Space Agency’s Euclid space telescope is set to launch atop a SpaceX Falcon 9 rocket this Saturday (July 1). Read More

Rare streaks of light above US are a sign that solar maximum is fast approaching

The ethereal light show could become a more common sight over the next few years as the sun’s activity ramps up. Read More

Handbag ‘smaller than a grain of salt’ sells for over $63,000. It holds everything you need: A few quarks for a night out, some loose electrons just in case. So practical!

PHOTOS OF THE DAY

Zanzibar, Tanzania

A man walks near a restaurant named The Rock at Pingwe beach. Photograph: Anadolu Agency/Getty Images.

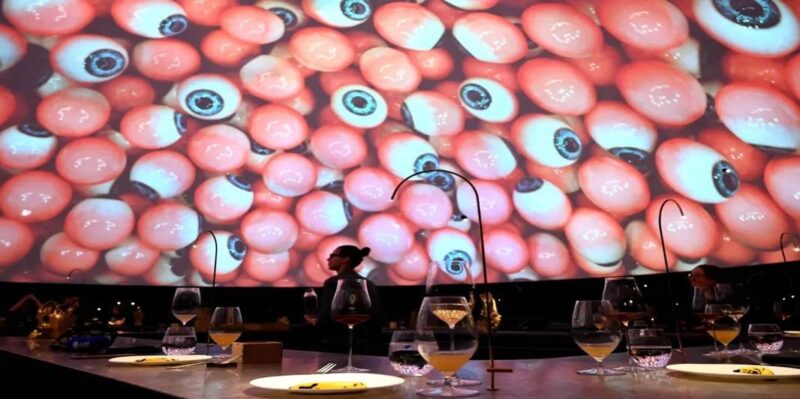

Copenhagen, Denmark

A waiter working at the Alchemist restaurant. With quirky dishes such as butterfly wings, restaurants in Denmark, the recent darling of the culinary world, are vying to emulate the success of the soon-to-be-closed Michelin-starred Noma. Photograph: Sergei Gapon/AFP/Getty Images.

Copenhagen, Denmark

A creation called Butterfly at the Alchemist restaurant. The insects were fed on honey water. Photograph: Sergei Gapon/AFP/Getty Images

Market Closes for June 30th, 2023

| Market Index |

Close | Change |

| Dow

Jones |

34407.60 | +285.18 |

| +0.84% | ||

| S&P 500 | 4450.38 | +53.94 |

| +1.23% | ||

| NASDAQ | 13787.92 | +196.59 |

| +1.45% | ||

| TSX | 20155.29 | +242.12 |

| +1.22% |

International Markets

| Market Index |

Close | Change |

| NIKKEI | 33189.04 | -45.10 |

| -0.14% | ||

| HANG

SENG |

18916.43 | -17.93 |

| -0.09% | ||

| SENSEX | 64718.56 | +803.14 |

| +1.26 | ||

| FTSE 100* | 7531.53 | +59.84 |

| +0.80% |

Bonds

| Bonds | % Yield | Previous % Yield |

| CND. 10 Year Bond |

3.269 | 3.362 |

| CND. 30 Year Bond |

3.093 | 3.185 |

| U.S. 10 Year Bond |

3.8366 | 3.8403 |

| U.S. 30 Year Bond |

3.8605 | 3.8989 |

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.7550 | 0.7548 |

| US $ |

1.3245 | 1.3249 |

| Euro Rate 1 Euro= |

Inverse | |

| Canadian $ | 1.4448 | 0.6921 |

| US

$ |

1.0908 | 0.9168 |

Commodities

| Gold | Close | Previous |

| London Gold Fix |

1899.60 | 1908.40 |

| Oil | ||

| WTI Crude Future | 70.64 | 69.86 |

Market Commentary:

📈 On this day in 1938, in a move the New York Stock Exchange had resisted for a decade, William McChesney Martin was elected the NYSE’s first paid, independent president. In a striking sign that he took his independence seriously, Martin immediately sold his stake in his own brokerage firm and auctioned off his seat on the exchange. His starting salary: $48,000, or about $1 million in today’s money.

Canada

By Bloomberg Automation

(Bloomberg) — The S&P/TSX Composite rose for the fifth day, climbing 1.2%, or 242.12 to 20,155.29 in Toronto.

The move was the biggest since rising 1.8% on June 2.

Brookfield Corp. contributed the most to the index gain, increasing 3.2%. Canada Goose Holdings Inc. had the largest increase, rising 5.7%.

Today, 203 of 229 shares rose, while 23 fell; all sectors were higher, led by financials stocks.

Insights

* In the past year, the index had a similar or greater gain 16 times. The next day, it advanced 10 times for an average 0.8% and declined six times for an average 0.9%

* This quarter, the index rose 0.3%

* This month, the index rose 3%

* So far this week, the index rose 3.8%, heading for the biggest advance since the week ended Feb. 5

* The index advanced 6.9% in the past 52 weeks. The MSCI AC Americas Index gained 17% in the same period

* The S&P/TSX Composite is 3.3% below its 52-week high on Feb. 2, 2023 and 12.8% above its low on Oct. 13, 2022

* S&P/TSX Composite is trading at a price-to-earnings ratio of 13.1 on a trailing basis and 13.9 times estimated earnings of its members for the coming year

* The index’s dividend yield is 3.4% on a trailing 12-month basis

* S&P/TSX Composite’s members have a total market capitalization of C$3.16t

* 30-day price volatility rose to 11.84% compared with 11.25% in the previous session and the average of 11.65% over the past month

================================================================

|Index Points | |

Sector Name | Move | % Change | Adv/Dec

================================================================

Financials | 66.7120| 1.1| 27/2

Materials | 40.1955| 1.7| 44/6

Industrials | 37.7126| 1.4| 23/3

Information Technology | 24.7813| 1.6| 11/0

Energy | 18.5025| 0.6| 35/5

Utilities | 12.0440| 1.4| 13/3

Consumer Discretionary | 10.7421| 1.4| 13/1

Real Estate | 7.8102| 1.6| 21/0

Communication Services | 6.5405| 0.8| 4/1

Consumer Staples | 5.9259| 0.7| 9/1

Health Care | 0.3827| 0.7| 3/1

================================================================

| | |Volume VS | YTD

| Index | | 20D AVG | Change

Top Contributors |Points Move| % Change | (%) | (%)

================================================================

Brookfield Corp | 13.9500| 3.2| 15.5| 4.7

Canadian Pacific Kansas | 12.3700| 1.8| 24.3| 6.0

RBC | 9.8250| 0.8| 61.3| -0.6

Primo Water | -0.3490| -1.8| 30.9| -21.0

Tilray Brands | -0.3560| -3.8| 17.9| -44.1

TFI International | -1.0590| -1.3| -11.7| 11.3

US

By Rita Nazareth

(Bloomberg) — The rally in tech mega-caps gained further traction, with the Nasdaq 100 notching its best ever first-half of a year and Apple Inc. hitting the $3 trillion milestone.

Traders looked at the glass half full after data signaled inflation is moderating at the expense of economic growth.

Equities extended this year’s surge, with tech consolidating its leadership amid the ascent of artificial intelligence.

Big banks saw their first monthly gain since January after passing the Federal Reserve’s stress test.

After the close, JPMorgan Chase & Co., Wells Fargo & Co., Morgan Stanley and Goldman Sachs Group Inc. announced higher dividends.

Nearly $5 trillion has been added to the value of companies in the Nasdaq 100 since the start of the year, with the tech-heavy gauge defying bubble warnings and jumping almost 40%.

The advance in the most-influential group in the S&P 500 helped push the index up 16% in 2023.

Gains have been even more pronounced when narrowed down to the mega-cap space — which has soared 74%.

“I still do like big tech,” Larry Adam, chief investment officer at Raymond James, told Bloomberg Television. “I do believe in technology continuing to reinvent itself — obviously with the latest addition being AI. That’ll continue to drive earnings.”

The “Big Seven” — including Apple, Microsoft Corp., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc., Nvidia Corp. and Tesla Inc. — boosted profits by 14% a year during the decade through 2022.

While their combined earnings slumped more than 20% last year, they’re expected to recover swiftly.

The Nasdaq 100 rose over 1.5% Friday, while the S&P 500 hit the highest since April 2022.

The US equity benchmark posted its best first half since 2019.

Nvidia, which has almost tripled this year, was up about 3.5%.

If history is any guide, the Nasdaq 100’s strength this year augurs well for the rest of 2023.

Years that start with rallies in the index of at least 10% average returns of about 14% over the second half of the year, though that shrinks to an 8.3% gain when the first-half gain tops 20%, according to an analysis of data compiled by Bloomberg.

The market’s fascination with the power of generative AI has trumped every major issue that could potentially drag down sentiment this year: recession fears, elevated levels of inflation, prospects for more Fed hikes, geopolitical risks, the debt-ceiling debate and the collapse of a few regional banks.

While the rally in AI has drawn comparisons with the dot-com bubble of 2000, when the market was driven by a similarly narrow breadth of tech stocks before a crash, BlackRock’s Tony DeSpirito said earnings growth is coming.

“Demand is really real,” said DeSpirito, the firm’s chief investment officer of US fundamental equities. “That contrasts what’s going on in AI versus the metaverse a year ago, or virtual reality. The orders are there.”

Still, after such a strong advance, there’s growing concern about valuations, and that has recently spurred a surge in bearish bets against the largest tech companies.

Short interest as a percentage of shares available to trade is near 12-month highs for Microsoft, Tesla and Amazon, according to data compiled by S3 Partners.

“We don’t believe the AI trend is a bubble, but advise investors to be selective on AI-related stocks after the strong year-to-date rally,” said Sundeep Gantori, equity strategist at UBS Global Wealth Management. “From a positioning point of view, we recently closed our self-help theme as we see better risk-reward in mid-cycle industries (software, internet) and tech laggards.”

Barring evidence of any technical deterioration, it’s likely that markets will push even higher into mid-to-late July ahead of a possible minor correction into August, according to Mark Newton at Fundstrat Global Advisors.

“Until evidence of more rampant overbought conditions joins forces with more bullish sentiment and some evidence of defensive strength and/or waning technical breadth, it’s arguably wrong to consider abandoning this rally based on overbought conditions alone when technical trends remain very much intact,” Newton noted.

Also helping tech on Friday was the fact that action in the bond market was subdued.

Treasury 10-year yields fell to around 3.8%.

The dollar dropped, extending this year’s losses.

Key measures of US inflation cooled in May and consumer spending stagnated, suggesting the economy’s main engine is starting to lose some momentum.

The personal consumption expenditures price index, one of the Fed’s preferred inflation gauges, rose 0.1%.

From a year ago, the measure stepped down to 3.8%, the smallest annual advance in more than two years.

“The May PCE report released today is relatively benign from a Fed perspective and leans in the direction of the Fed ultimately delivering only one more rather than two more rate increases,” said Krishna Guha, vice chairman of Evercore ISI. “This should curb a bit the recent back-up in yields and favor big tech.”

Elsewhere, Brent oil posted its longest run of quarterly losses in data going back more than three decades amid robust supplies and persistent concerns over demand.

The global benchmark settled below $75 a barrel on Friday, marking its fourth straight quarterly loss, while West Texas Intermediate posted its first back-to-back quarterly declines since 2019.

Some of the main moves in markets:

Stocks

* The S&P 500 rose 1.2% as of 4 p.m. New York time

* The Nasdaq 100 rose 1.6%

* The Dow Jones Industrial Average rose 0.8%

* The MSCI World index rose 1.1%

Currencies

* The Bloomberg Dollar Spot Index fell 0.3%

* The euro rose 0.4% to $1.0913

* The British pound rose 0.7% to $1.2699

* The Japanese yen rose 0.3% to 144.27 per dollar

Cryptocurrencies

* Bitcoin was little changed at $30,400.96

* Ether rose 4.3% to $1,927.95

Bonds

* The yield on 10-year Treasuries declined three basis points to 3.81%

* Germany’s 10-year yield declined two basis points to 2.39%

* Britain’s 10-year yield was little changed at 4.39%

Commodities

* West Texas Intermediate crude rose 1% to $70.57 a barrel

* Gold futures rose 0.5% to $1,927.60 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rob Verdonck, Tassia Sipahutar, Robert Brand, Denitsa Tsekova, Peyton Forte, Ryan Vlastelica, Carmen Reinicke and Elena Popina.

Have a wonderful weekend everyone.

Be magnificent!

As ever,

Carolann

No person was ever honored for what he received. Honor has been the reward for what he gave. –Calvin Coolidge, 1872-1933.

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Senior Investment Advisor

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7

Tel: 778.430.5808

(C): 250.881.0801

Toll Free: 1.877.430.5895

Fax: 778.430.5828

www.carolannsteinhoff.com