May 31st 2011, Newsletter

Dear Friends,

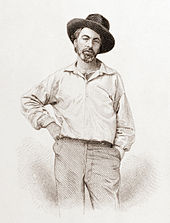

BIRTHDAY: Walt Whitman, May 31

Walt Whitman, age 37, frontispiece to Leaves of Grass, Fulton St., Brooklyn, N.Y., steel engraving by Samuel Hollyer from a lost daguerreotype by Gabriel Harrison.

SONG OF MYSELF

I celebrate myself, and sing myself,

And what I assume you shall assume,

For every atom belonging to me as good belongs to you.

I loafe and invite my soul.

I lean and loafe at my ease observing a spear of summer grass…

-Walt Whitman from Song of Myself in Leaves of Grass

June 1st tomorrow so summer is not far away.

A new Facebook app is coming out that will remind users exactly what they were doing a year ago from that day. Nine times out of 10, the answer will be: “Wasting your time on Facebook.”

– Conan O’Brien

photos of the day

May 31, 2011

Cows graze as dark clouds appear over a chapel near Murnau, southern Germany, on Tuesday.

Matthias Schrader/AP

A guide looks in from the entrance of a hall for a Louis Vuitton Voyages exhibition at the National Museum of China in Beijing. Luxury goods makers may boast familiarity with China, but the pace of change in the world’s fastest-growing country still startles them. The world’s biggest luxury market within five years has become a second home for brands that tap Chinese appetite for fast super sports cars, 10,000-euro ($14,060) handbags and diamonds.

Jason Lee/Reuters

A Great Pied Hornbill chick, about 40 days old, is displayed at the Jurong Bird Park on Tuesday in Singapore. This is one of two chicks hatched successfully through artificial incubation and are notoriously difficult species to breed in captivity. Artificial incubation was necessary as the breeding pair of Great Pied Hornbills had cannibalized the chicks the previous year.

Wong Maye-E/AP

Canada

By Inyoung Hwang

May 31 (Bloomberg) — Canadian stocks fell, completing a third-straight monthly decline, as Research in Motion Ltd. sank to its lowest price in more than four years and an index of U.S. consumer confidence dropped unexpectedly to a six-month low.

Research in Motion Ltd., maker of the BlackBerry smartphone, erased 4.4 percent after rival Nokia Oyj cut sales forecasts. Royal Bank of Canada lost 0.8 percent as Keefe, Bruyette & Woods Inc. lowered its earnings estimate. Goldcorp Inc., the second-biggest producer of the metal, declined 1.2 percent as gold futures retreated.

The Standard & Poor’s/TSX Composite Index dropped 26.78 points, or 0.2 percent, to 13,802.88 at 4 p.m. in Toronto, after rising as much as 0.5 percent earlier. Global stocks rallied today amid speculation European officials will pledge additional aid for Greece by the end of June.

“The market was happy about the news overnight that there was some optimism on the European debt crisis, but then we got hit with some bad economic news out of the U.S.,” said Marcus Xu, director of equity investments at Genus Capital Management in Vancouver, which oversees C$1.7 billion ($1.8 billion). “The biggest news was the consumer confidence number, which was lower than before. The main challenge there is there are more and more people saying jobs are harder to come by.”

The S&P/TSX fell 1 percent this month, its first three- month series of declines since February 2009.

Telecommunications, consumer-staple and utility stocks have led gains in the past month, while materials stocks were the one of worst performing groups out of 10 in the gauge as prices of raw materials such as oil, gold and silver slumped.

Confidence among U.S. consumers declined in May as Americans’ outlook for business conditions and the labor market soured. The Conference Board’s index dropped to 60.8 from a revised 66 reading in April, figures from the New York-based private research group showed today.

The median forecast of economists surveyed by Bloomberg News called for a rise to 66.6. Other data today showed a drop in home prices and weakening manufacturing.

Research in Motion fell 4.4 percent to C$41.35, the lowest price since October 2006. Nokia Oyj cut its forecasts for its devices and services unit on lower prices and competition from Google Inc. and Apple Inc. Nokia said second-quarter sales at the devices and services division will be “substantially” less than its projected range, raising concern Research in Motion is also losing market share.

“When you have a major cellphone maker cutting forecasts, that’s not good for RIM either,” Xu said. “It’s pretty clear that Apple has taken the high-end market and it’s really hard to challenge that, so the low-end market is going to be an ugly dog fight.”

The Washington Post reported yesterday that the federal government is allowing more of its workers to use products by Apple Inc. such as the iPhone and iPad instead of the BlackBerry and laptops. The Waterloo, Ontario-based company has plunged 23 percent since April 28 when it cut its profit forecasts on lower-than-expected demand for its smartphones.

Royal Bank of Canada, the country’s biggest lender, slumped 0.8 percent to C$56.62 after KBW analyst Brian Klock lowered his profit forecast, citing volatility in the Fixed Income Clearing Corp. business. Klock rates Royal Bank of Canada “market- perform.”

Goldcorp fell 1.2 percent to C$48.46 as gold slipped 50 cents to $1,536.80 an ounce in New York. Barrick Gold Corp., the biggest producer, fell 0.1 percent to C$46.39, its first decline in nine days.

North American Palladium Ltd. rallied 8.7 percent to C$4.02, the most since April 20. The precious-metals producer with operations in Ontario received a “sector outperform” rating from Leily Omoumi, an analyst at Scotiabank.

US

By Rita Nazareth

May 31 (Bloomberg) — U.S. stocks advanced, trimming the biggest monthly drop since August for the Standard & Poor’s 500 Index, amid speculation about additional aid for Greece.

Apple Inc. rallied 3.1 percent after saying Chief Executive Officer Steve Jobs will introduce a cloud-computing product and new software next week. Intel Corp. gained 1.4 percent as the world’s largest chipmaker seeks to challenge tablet makers with a new type of thinner laptop called an “ultrabook.” General Dynamics Corp. climbed 4.2 percent after receiving a $744 million contract from the U.S. Navy.

The S&P 500 rose 1.1 percent to 1,345.20 at 4 p.m. in New York, for its fourth consecutive day of gains. The index declined 1.4 percent in May. The Dow Jones Industrial Average added 128.21 points, or 1 percent, to 12,569.79 today. Equities advanced even as data on consumer confidence and business activity trailed economists’ estimates.

“There’s a roadmap to getting Greece through its crisis,” said Madelynn Matlock, who helps oversee $14.8 billion at Huntington Asset Advisors in Cincinnati. “That’s why investors are reacting positively. In the U.S., we got some softening in economic data. That doesn’t tell me we’re going to have a QE3.

It tells me that monetary policy is going to be easy for a while. That should provide room for stocks to move higher.”

The benchmark gauge fell from an almost three-year high on April 29 on concern about Europe’s debt crisis. Still, the gauge rose 7 percent this year amid higher-than-forecast corporate profits and government stimulus measures. The Federal Reserve plans to complete its second round of asset purchases, known as quantitative easing, or QE2, in June, while holding interest rates “exceptionally low” for an “extended period.”

Benchmark indexes had a four-week drop, the longest losing streak in more than 15 months. Over the last 100 years, the Dow has returned an average 0.4 percent gain in June, according to data compiled by Bespoke Investment Group. The gauge has fallen 0.6 percent and 1.2 percent in June, respectively, over the last 50 years and 20 years, the data showed.

Global stocks rallied as Jean-Claude Juncker, head of the group of euro-area finance ministers, said European Union leaders will decide on additional aid for Greece by the end of June and have ruled out a “total restructuring” of its debt.

Stocks gained even after the Institute for Supply Management-Chicago Inc. said its business barometer fell to 56.6 this month from 67.6 in April. Figures greater than 50 signal expansion. Economists forecast the gauge would fall to 62, according to the median estimate in a Bloomberg News survey.

Confidence among U.S. consumers unexpectedly declined in May to a six-month low as Americans’ outlook for business conditions and the labor market soured. Another report showed that home prices in 20 U.S. cities dropped in March to the lowest level since 2003, showing housing remains mired in a slump almost two years into the economic recovery.

“Economic data has been patchy,” Mike Ryan, the New York- based chief investment strategist for Wealth Management Americas at UBS Financial Services Inc., wrote in a note today. “The apparently much more mixed picture represents mostly a transitory headwind. It remains our view that equity markets will outperform over the balance of the year given a still solid earnings outlook, undemanding valuations and continued accommodative policy conditions.”

The longest stretch of declines on a weekly basis for the S&P 500 in a year has left valuations at the lowest level ever compared with speculative-grade debt.

Earnings from the past 12 months for companies in the benchmark gauge for U.S. equities reached 6.64 percent of share prices this month, according to data compiled by Bloomberg. That compared with the 6.61 percent average yield on junk bonds, data from Barclays Plc show. It was the first time the spread, a way of comparing debt and equity values, has shown stocks with a higher yield, according to Bloomberg data going back to 1987.

Technology shares led the gains in the S&P 500 among 10 industries, rising 1.6 percent.

Apple rallied 3.1 percent to $347.83. CEO Jobs will make a public appearance June 6 to introduce a cloud-computing product and a new version of the operating system that powers its iPad and iPhone touch devices. Jobs, in the midst of his third medical leave since 2004 as he battles a rare form of cancer, will deliver a keynote address at Apple’s Worldwide Developers Conference, the Cupertino, California-based company said in a statement today.

Intel gained 1.4 percent to $22.51. The world’s largest chipmaker is seeking to help the personal-computer industry fend off a challenge from Apple’s iPad and other tablets. Intel’s new machines will be less than an inch thick, have days of battery life on standby, start up in just seconds and retail for less than $1,000, according to Intel Executive Vice President Sean Maloney. Intel aims to convert 40 percent of consumer laptops to the new category by the end of 2012.

General Dynamics advanced 4.2 percent to $74.22. The second-largest U.S. shipbuilder received a $744 million contract from the U.S. Navy to construct two mobile landing platform ships. The contract comes with an option for the construction of a third ship, which would increase its size to $1.3 billion.

BlackRock Inc.’s Chief Executive Officer Laurence D. Fink said he’s more bullish on U.S. equities than bonds because companies are benefiting from the weak dollar and have surplus cash to invest for growth.

“We love equities, we love dividend stocks,” Fink said in a Bloomberg Television interview today in Hong Kong. “You own Treasuries because you’re worried about the world and the future, but if you believe the world is a good place to invest for the long cycle, you have to be in equities.”

Fink, one of the co-founders of BlackRock in 1988, built what is now the world’s biggest asset manager through acquisitions including the purchase in December 2009 of Barclays Global Investors. He said in a March 3 interview that he’s a “big buyer” of the U.S. dollar, doesn’t see a “bear market” in bonds and would buy Treasuries if yields rise above 4 percent.

Have a wonderful evening everyone.

Be magnificent!

Chitragupta, who is supposed to be writing out our deeds in an account book is no other than the conscious and unconscious parts of our mind.The Lord of Law, to whom we have to render the account, is the Soul within us.

-Gopal Singh, 1911-1963

As ever,

Carolann

The clock indicates the moment,

but what does eternity indicate?

-Walt Whitman, 1819-1892

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor