May 27, 2016 Newsletter

Dear Friends,

Tangents: Memorial Day on Monday, so US markets are closed.

May 27, 1937 : Golden Gate Bridge opens in San Francisco.

Rachel Carson’s birthday, born May 27, 1907.

Rachel Carson is celebrated the world over as the catalyst of the ecology movement and savior of countless endangered species. She began her career writing pamphlets for the United States Fish and Wildlife Service. Educated as a marine biologist, Carson wrote her first book, Under the Sea Wind, from the viewpoint of the main character, the sea. She addressed the sea again in The Sea Around Us, which spent 81 weeks on the New York Times bestseller list and earned her the National Book Award in 1951 for best nonfiction book.

Her most famous work, Silent Spring, appeared in The New Yorker in three installments beginning June 1962. It presented the scientific evidence that everything is connected to everything else, and documented the demise of songbirds due to DDT poisoning. After reading it, President John F. Kennedy appointed a council to examine the use of pesticides. The chemical industry, unable to discredit her scientific work, attacked Carson personally as a hysterical middle-aged kook, a faddist, and a threat to Americans who needed pesticides to have a quality life. Though weakened from cancer, she defended her ideas. The president’s advisory report, issued finally on May 15, 1963, agreed with Carson. She died the following spring, April 14, 1964. Time magazine named her among the most 100 influential people of the 20th century.

Those who dwell, as scientists or laymen,

among the beauties and mysteries of the

earth are never alone or weary of life. –Rachel Carson

PHOTOS OF THE DAY

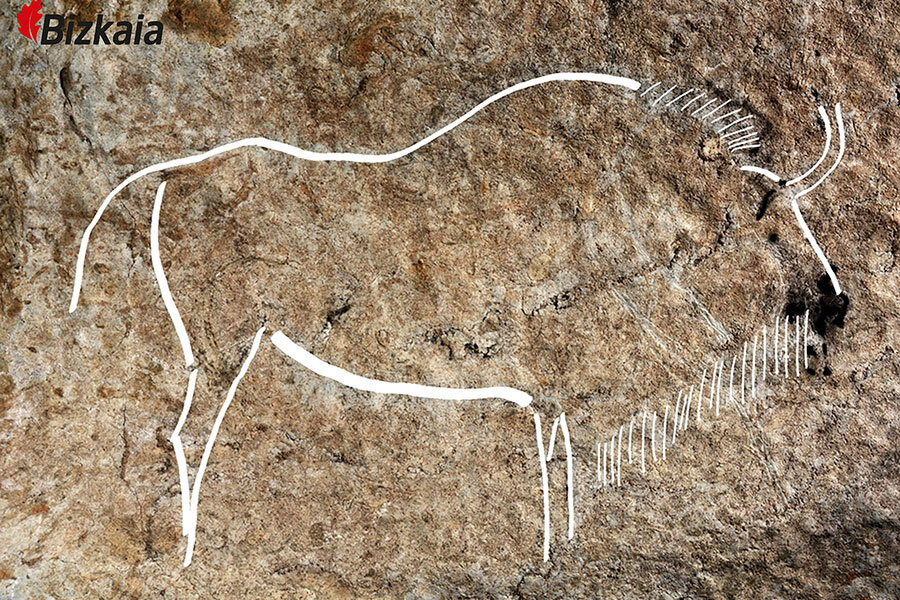

This cave drawing was discovered by Spanish archaeologists. They say they have discovered an exceptional set of Paleolithic-era cave drawings that could rank among the best in a country that already boasts some of the world’s most important cave art. Chief site archaeologist Diego Garate said Friday that an estimated 70 drawings were found on ledges 300 meters (1,000 feet) underground in the Atxurra cave, Berriatua, in the northern Basque region. Diputacion Floral de Bizkaia/AP

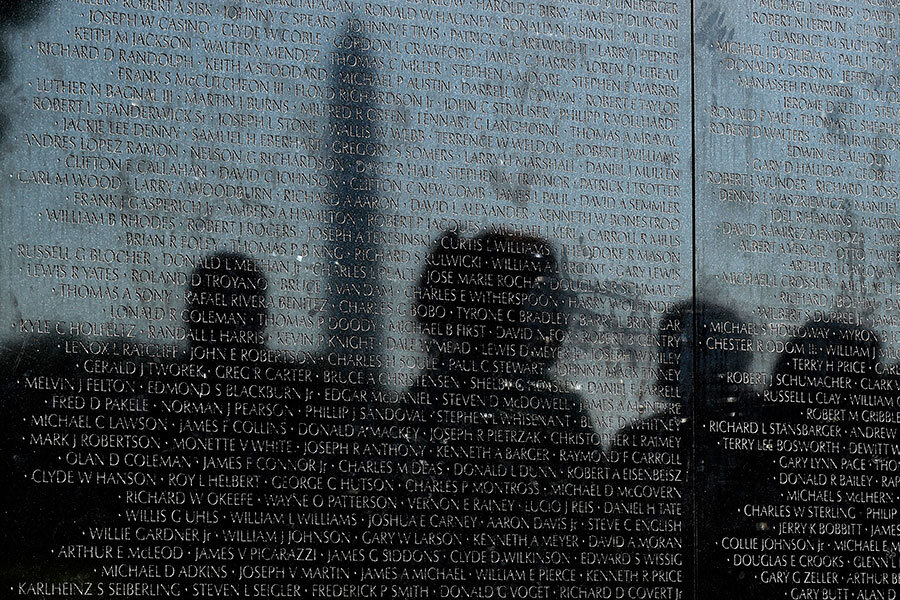

People visit the Vietnam Memorial in Washington on Friday at the start of the Memorial Day weekend. Susan Walsh/AP

Market Closes for May 27th, 2016

| Market

Index |

Close | Change |

| Dow

Jones |

17873.22 | +44.93

+0.25% |

| S&P 500 | 2099.06 | +8.96

+0.43% |

| NASDAQ | 4933.504 | +31.738

+0.65% |

| TSX | 14105.23 | +56.03

|

| +0.40%

|

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 16834.84 | +62.38

|

| +0.37%

|

||

| HANG

SENG |

20576.77 | +179.66

|

| +0.88%

|

||

| SENSEX | 26653.60 | +286.92

|

| +1.09%

|

||

| FTSE 100 | 6270.79 | +5.14

|

| +0.08%

|

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.351 | 1.332

|

| CND.

30 Year Bond |

1.985 | 1.983 |

| U.S.

10 Year Bond |

1.8510 | 1.8282

|

| U.S.

30 Year Bond |

2.6464 | 2.6402

|

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.76753 | 0.77107

|

| US

$ |

1.30288 | 1.29689 |

| Euro Rate

1 Euro= |

Inverse | |

| Canadian $ | 1.44777 | 0.69072

|

| US

$ |

1.11120 | 0.89992 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1216.25 | 1223.85 |

| Oil | Close | Previous |

| WTI Crude Future | 49.33 | 49.48

|

Market Commentary:

Canada

By Eric Lam

(Bloomberg) — Canadian stocks capped a third straight weekly advance, rising to the highest level since August, as the nation’s largest lenders extended a rally to a fifth day amid quarterly results and the prospect for higher interest rates in the U.S.

The S&P/TSX Composite Index rose 0.4 percent to 14,105.23 at 4 p.m. in Toronto, posting a 1.3 percent weekly gain that’s the best in five weeks. The index has surged 19 percent since reaching a two-year low on Jan. 20 and is up more than 8 percent this year, the second most after New Zealand among developed- market nations tracked by Bloomberg.

The surge has made Canadian shares expensive relative to their U.S. peers. The S&P/TSX now trades at 21.4 times earnings, about 10 percent higher than the 19.4 times valuation of the S&P 500.

Global stocks rose a fourth day, for the highest close in three weeks. The continued recovery of the U.S. economy would warrant another interest rate increase “in the coming months,” Federal Reserve Chair Janet Yellen said at an event in Massachusetts today. Traders have now priced in a 34 percent chance of an interest rate increase in June, and better-than- even odds for July, according to data compiled by Bloomberg. U.S. markets will be closed on Monday for a holiday.

In Canada, Royal Bank of Canada and Toronto-Dominion Bank rose at least 0.6 percent as financial services stocks rose with eight of 10 industries in the Canadian equity benchmark. A gauge of the nation’s largest lenders is on a five-day rally, the longest in six weeks, trading at its highest level in more than a year. Toronto-Dominion, Royal Bank of Canada and Canadian Imperial Bank of Commerce reported second-quarter results ahead of expectations Thursday, while Bank of Nova Scotia is scheduled to post its earnings on May 31.

Valeant Pharmaceuticals International Inc. added 6.3 percent as health-care stocks jumped the most in the S&P/TSX. The drugmaker rejected a takeover bid from Takeda Pharmaceutical Co. and investment firm TPG about six weeks ago, according to a report. The approach was rejected and no talks are currently ongoing, according to people familiar with the situation.

Cenovus Energy Inc. rose 1.4 percent as energy producers ended the day higher, erasing an earlier loss. Oil trimmed its third weekly advance as futures pared losses to 0.3 percent in New York. Cenovus is considering using some of its C$3.9 billion in cash to buy back debt and expand, according to CEO Brian Ferguson in an interview with David Scanlan on Bloomberg TV Canada.

Commodities producers, which make up about a third of the S&P/TSX by market capitalization, have fueled the rally in Canadian stocks this year. Resource prices came under pressure last week as the Fed’s April meeting minutes increased speculation an interest-rate hike could come as soon as June, driving the dollar higher.

US

By Anna-Louise Jackson and Oliver Renick

(Bloomberg) — U.S. stocks climbed in light, pre-holiday trading, with the S&P 500 posting the biggest weekly gain since March, amid growing confidence that the economy is strengthening enough to handle higher borrowing costs as early as this summer.

Equities resumed an advance after barely budging Thursday, lifted by gains in banks and technology companies, which marked their best week since February. Federal Reserve Chair Janet Yellen said in remarks at Harvard University an improving economy would probably warrant another rate increase “in the coming months,” sending the dollar higher and damping commodity producers.

The S&P 500 rose 0.4 percent to 2,099.06 at 4 p.m. in New York, the highest since April 20. The Dow Jones Industrial Average added 44.93 points, or 0.3 percent, to 17,873.22, while the Nasdaq Composite Index increased 0.7 percent to a five-week high. About 5.6 billion shares traded on U.S. exchanges, the second-lowest this year and 23 percent below the three-month average. U.S. markets will be closed Monday in observance of Memorial Day.

“Yellen had sent out her crew to telegraph this before today,” said Michael Antonelli, an institutional equity sales trader and managing director at Robert W. Baird & Co. in Milwaukee. “It’s confirmation more than anything — we had all heard from various speakers for a week now that the tone of the FOMC members was not particularly dovish. Yellen comes out today and the writing was on the wall and she etched it in with a pen.”

A series of speeches by Fed officials and the release of the minutes to their April policy meeting have heightened investor expectations for another tightening move either next month or in July.

The S&P 500 gained 2.3 percent this week, with stronger- than-forecast housing data helping to boost optimism on the economy. Traders are pricing in a 34 percent chance the Fed will increase rates in June, up from 30 percent before Yellen’s remarks today, and 4 percent early last week. July shows a 58 percent probability of higher borrowing costs, up from 51 percent earlier Friday.

Leading gains today, Ulta Salon Cosmetics & Fragrance Inc. jumped 9.1 percent to a record after quarterly results beat estimates and the company raised its outlook. Alphabet Inc. rose 1.5 percent to a five-week high after Google won a jury verdict that kills Oracle Corp.’s claim to a $9 billion slice of the search giant’s Android phone business. Verizon Communications Inc. rose on a deal to end a 44-day strike by landline workers.

After slipping as much as 3 percent from a four-month high on April 20, the S&P 500 is back within 0.2 percent of that level, boosted by gains this week in technology shares, with Apple Inc. climbing 5.4 percent and Microsoft Corp. adding 3.4 percent. That’s rejuvenated a rally that pushed the benchmark up as much as 15 percent from a February low before stalling last month amid mixed corporate earnings — including disappointing results from those two tech giants — and lukewarm signs of an economic pickup.

A report today showed the economy expanded at a slightly faster pace in the first quarter than previously estimated, though the figures do little to alter views of the third consecutive sluggish start to the year. A separate gauge showed consumer confidence climbed less than forecast in May as Americans were a little less ebullient about the economy’s prospects in the run up to the presidential election.

“It feels like deja vu to me,” Katie Nixon, chief investment officer of wealth management at Northern Trust Corp., said in an interview with Bloomberg TV. “Last year, we had a weak first quarter followed by a great second quarter, and then we saw weakness into the summer, and there’s no reason to expect anything necessarily different this year.”

With the reporting season almost at an end, analysts estimate first-quarter earnings declined 7.1 percent, compared with calls for a 10 percent drop as recently as April. They forecast second-quarter income will slide 4.9 percent, while growth is expected to return in the third quarter with a 3 percent increase.

In Friday’s trading, all of the S&P 500’s 10 main industries rose, with financial shares rising 0.7 percent while technology and health-care companies increased more than 0.5 percent. All 10 groups marked weekly gains for the first time since March. The CBOE Volatility Index fell 2.3 percent to 13.12, an eight-week low. The measure of market turbulence known as the VIX also posted the first weekly decline in three.

“It’s a long weekend so there’s not a lot of trading, plus the end of the month is coming up here quick,” Jim Davis, regional investment manager for The Private Client Group of U.S. Bank, said by phone. “The employment number next week is the next big step in the path.”

Ulta Salon Cosmetics best gain in two months boosted consumer discretionary companies in the benchmark, which rose to a two-week high. Viacom Inc. climbed 4 percent, extending its longest rally since November, as controlling shareholder Sumner Redstone may be laying the groundwork to replace the company’s board and Chief Executive Officer Philippe Dauman. Royal Caribbean Cruises Ltd. and Carnival Corp. added at least 2.1 percent, recovering after a two-day selloff in the cruise-line operators.

Energy producers were little changed as oil prices retreated for a second day after briefly rising above $50 a barrel on Thursday. The commodity trimmed its third weekly advance as Canadian energy producers moved to resume operations after wildfires eased. Chesapeake Energy Corp. and Marathon Oil Corp. lost more than 1.6 percent.

Among shares moving on corporate news, FEI Co. jumped 14 percent, the steepest since 2011 after agreeing to be bought by Thermo Fisher Scientific Inc. for about $4.2 billion. FEI produces electron microscopes which are used to analyze proteins.

GameStop Corp. sank 3.9 percent, after losing as much as 7.8 percent. The video-game retailer’s forecast for the current quarter fell short of analysts’ projections, a period that’s typically the slowest for new video-game releases, according to the company.

Have a wonderful weekend everyone.

Be magnificent!

Until a radical change takes place and we wipe out all nationalities,

all ideologies, all religious division, and establish a global relationship – psychologically and

inwardly first, then organized in the outside world – we shall go on with war.

Krishnamurti

As ever,

Carolann

There is nothing like music to relieve the soul and uplift it.

-Mickey Hart, 1943

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Portfolio Manager &

Senior Vice-President

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7