March 3, 2011 Newsletter

Dear Friends,

Carolann is at a course today at UBC so I am writing in her absence ~ Chelsey

Yesterday was Dr. Seuss’s birthday. He would have been 107. Some of my favourite Dr. Seuss quotes are:

“Today you are You, that is truer than true. There is no one alive who is Youer than You.”

“You know you’re in love when you can’t fall asleep because reality is finally better than your dreams.”

“Be who you are and say what you feel because those who mind don’t matter and those who matter don’t mind.”

“The more that you read, the more things you will know. The more that you learn, the more places you’ll go.”

~Dr. Seuss (March 2, 1904 – September 24, 1991)

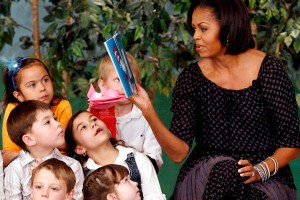

First Lady Michelle Obama reads ‘The Cat in the Hat’ to students during a visit to the Oyster Adams Bilingual School, with Mexico’s first lady Margarita Zavala, in Washington. Jose Luis Magana/AP

Market Commentary

Canada

Canadian stocks rose for a second day after Royal Bank of Canada and Toronto-Dominion Bank (TD) reported earnings that beat analyst estimates as a rebounding economy boosted fees from consumer lending.

Royal Bank of Canada, the country’s largest lender by assets, advanced 5.2 percent after it reported first-quarter profit on an adjusted basis that beat the average analyst estimate by 25 percent. Toronto-Dominion rose 3.9 percent after reporting first-quarter profit excluding some items that beat the average analyst estimate by 13 percent. Barrick Gold Corp. (ABX) declined 2.6 percent as the metal dropped.

The Standard & Poor’s/TSX Composite Index gained 70.70 points, or 0.5 percent, to close at 14,214.72 in Toronto, the highest level since June 2008.

“Toronto-Dominion and other Canadian banks don’t have subprime worries,” said Paul Ma, who oversees C$500 million ($512.82 million) as a money manager at McLean & Partners in Calgary. “If you look at income and lending, they are doing really, really well and beating estimates. The only thing you worry about is valuation.”

Fifty-four percent of the companies in the S&P/TSX that have reported earnings since Jan. 10, have surpassed the average analyst estimate. All six Canadian banks that posted results have beaten forecasts as loan losses fell and consumer lending climbed after Canada’s economy grew more than economists forecast.

Royal Bank of Canada (RY) added 5.2 percent to C$59.92, the highest price since May 19. Toronto-Dominion advanced 3.9 percent to C$83.60, the highest price since at least January 1983.

Barrick slumped 2.6 percent to C$51.10. Gold declined the most in six weeks after Venezuelan President Hugo Chavez offered to mediate a resolution to the crisis in Libya. The Arab League said it’s weighing the offer.

Gold futures for April delivery declined 1.5 percent to settle at $1,416.40 in New York. The precious metal had gained 9 percent from Jan. 27 through yesterday as unrest in northern Africa and the Middle East spurred demand for a haven.

Oil declined for the first time in three days in New York, as crude for April delivery slid 0.3 percent to settle at $101.91 a barrel. Canadian Natural Resources Ltd. (CNQ) slumped 3.2 percent to C$48.12, the biggest drop since Jan. 7. The nation’s second-largest energy company reported fourth-quarter earnings of 57 Canadian cents a share on an adjusted basis, missing the average analyst estimate by 13 percent, Bloomberg data show.

US

(Bloomberg) U.S. stocks rallied, giving benchmark indexes their biggest advances in three months, as a decrease in jobless claims and growth in service industries bolstered confidence in the economic recovery.

DuPont Co. and Caterpillar Inc. (CAT) advanced at least 2.8 percent, pacing gains in industrial companies. A gauge of retailers in the Standard & Poor’s 500 Index added 1.2 percent as Retail Metrics said industry sales rose 4.3 percent in February, topping analyst estimates. Big Lots Inc. (BIG) jumped 3.6 percent after reporting earnings that beat forecasts. Valero Energy Corp. (VLO) rose 7.7 percent as the refiner projected a profit.

The S&P 500 added 1.7 percent to 1,330.97 at 4 p.m. in New York. The Dow Jones Industrial Average increased 191.40 points, or 1.6 percent, to 12,258.20. Both gauges gained the most since Dec. 1. Crude oil declined as Venezuela offered to mediate a resolution to the Libyan crisis. The Chicago Board Options Exchange Volatility Index, which measures the cost of using options as insurance against declines in the S&P 500, tumbled 10 percent, the most since November, to 18.60.

“It’s a relief rally,” said Michael Nasto, senior trader at U.S. Global Investors Inc., which manages about $3 billion in San Antonio. “We got strong economic data across the board. Oil is down, which is also a positive, reflecting what I like to call a controlled chaos in the Middle East. Traders are happy about the fact that the market has been hanging in there despite all the recent turmoil.”

The S&P 500 has risen 5.8 percent this year as government stimulus measures, improving profits and increased takeovers bolstered confidence in equities. Per-share profit topped analysts’ estimates at 71 percent of the 470 companies in the gauge that have reported results since Jan. 10, according to data compiled by Bloomberg.

Earlier today, equity-index futures extended gains before the open of exchanges as the Labor Department report said applications for unemployment benefits fell by 20,000 to 368,000 in the week ended Feb. 26. Economists forecast claims would rise to 395,000, according to the median estimate in a Bloomberg News survey. The total number of people receiving unemployment insurance fell to the lowest level since October 2008.

A separate report today showed that the Institute for Supply Management’s index of non-manufacturing businesses rose to 59.7, the highest level since August 2005, from 59.4 in January. Economists forecast the gauge would fall to 59.3, according to the median estimate in a Bloomberg News survey. A reading above 50 signals growth.

U.S. consumer confidence last week held close to the highest level in almost three years as more Americans said their finances were in good shape. The Bloomberg Consumer Comfort Index, formerly the ABC News U.S. Weekly Consumer Comfort Index, was minus 39.3 in the period to Feb. 27, compared with minus 39.2 the prior week. Respondents’ view of their financial situation climbed to an almost two-year high.

“All the economic data today was strong and pointed to a self-sustaining U.S. recovery,” said Richard Campagna, chief executive officer of 300 North Capital LLC, which manages $500 million in Pasadena, California. “You had two big picture things that came out. There’s possibly less uncertainty in the Middle East. At the same time, jobless claims dipped below expectations. These things added together are driving everything higher except the safe havens.”

Bridgewater Associates LP Chief Investment Officer Ray Dalio told financial-news channel CNBC that a “pretty good environment” exists for some investments in U.S. equities. Dalio said investors in U.S. stocks should consider diversification in underrated assets, adding that 2011 “should be a good year for equities, by and large.”

Shares of industrial companies, among the stocks most dependent on economic growth, led the gains in the S&P 500, rallying 2.4 percent as a group. The Morgan Stanley Cyclical Index added 2.1 percent as 28 of its 30 stocks advanced.

The Dow Jones Transportation Average of 20 shipping, airline, railroad and trucking companies increased 2.5 percent as the drop in oil prices eased concern about rising fuel costs.

DuPont, the third-biggest U.S. chemical maker, rose 2.8 percent to $54.55. Caterpillar, the world’s largest maker of construction equipment, advanced 3.3 percent to $104.25.

The S&P 500 Retailing Index (S5RETL) gained 1.2 percent as same- store sales in February surpassed analysts’ estimates, driven by department stores as more confident shoppers embraced the arrival of warm-weather goods.

Same-store sales rose 4.3 percent last month, beating an overall compilation of analysts’ estimates for a gain of 3.8 percent at the 27 chains tracked by Retail Metrics, based in Swampscott, Massachusetts. That marked the 18th straight monthly gain from September 2009 and the fifth time in the past seven months that sales have beaten projections.

Big Lots advanced 3.6 percent to $41.33. The Columbus, Ohio-based discount retailer reported fourth-quarter profit of $1.46 a share excluding some items. Analysts surveyed by Bloomberg had estimated profit of $1.38 on average.

Valero climbed 7.7 percent, the biggest gain in the S&P 500, to $28.98. The independent U.S. refiner said it expects to earn as much as 30 cents a share in the first quarter, after recording a loss of $348 million on forward sales of refined products. The company removed a “negative” by closing out the positions, Credit Suisse Group AG said in a note.

Coventry Health Care Inc. (CVH) advanced 5.7 percent to $32.30, the highest price since September 2008. Stifel Nicolaus & Co. raised its recommendation for the managed health-care company to “buy” from “hold”.

Motorola Mobility Holdings Inc. fell 5.6 percent, the biggest decline in the S&P 500, to $26.78. The mobile-phone maker was cut to “neutral” from “outperform” by Cowen & Co., which cited competition for the company’s XOOM tablet from Apple Inc.’s iPad 2, being introduced next week.

Warmest regards,

Chelsey for Carolann

“It is better to offer no excuse than a bad one.” ~George Washington (1732-1799)