June 2nd 2011, Newsletter

Dear Friends,

ANNIVERSARY today: June 2, 1953 The Coronation of Queen Elizabeth II. Louis St. Laurent attended and footage was flown across the Atlantic by RAF jets so that Canadians could see it the same day. A lot has changed in the world of communication in the intervening 58 years.

In his diary, A Mingled Measure, James Lees-Milne describes the coronation:

The weather was damnable. It rained all day. The moment the procession started it positively poured, and the troops were soaked. Yet the procession was magnificent. The colour and pageantry cannot be described. Uniforms superb and resplendent. The most popular figure Queen Salote of Tonga, a vast, brown, smiling bundle with a tall red knitting needle in her hat: knitting needle having begun as a plume of feathers. Despite the rain she refused to have the hood of her open carriage drawn, and people were delighted. They roared applause. Extraordinary how the public will take someone to its bosom, especially someone not very exalted who is putting up a good show. All along the route they adored her. Beside her squatted a little man in black and a top hat – her husband. Noël Coward, when asked who he was, said, ‘Her dinner.’

56

photos of the day

June 2, 2011

A trader works on the floor at the New York Stock Exchange in New York.

Seth Wenig/AP

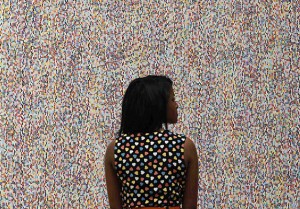

A visitor poses with artist James Hugonin’s ‘Binary Rhythm (I)’ at the press view of the Summer Exhibition 2011 at the Royal Academy of Arts in London.

Luke MacGregor /Reuters

Market Commentary:

Canada

By Matt Walcoff

June 2 (Bloomberg) — Canadian stocks fell for a third day, led by raw-materials producers, as gold and silver dropped after the euro gained, eroding demand for precious metals as a haven.

Barrick Gold Corp., the world’s largest producer of the metal, declined 2.2 percent as gold lost 0.7 percent. Sino- Forest Corp., a forestry company with operations in China, plunged 21 percent after a short seller said it overstated timberland holdings and production. Potash Corp. of Saskatchewan Inc., the world’s biggest fertilizer producer by market value, rose 1.5 percent as corn and wheat gained.

The Standard & Poor’s/TSX Composite Index slipped 8.38 points, or 0.1 percent, to 13,519.50.

“People have been going to gold not for investment purposes but more as a currency,” said Robert “Hap” Sneddon, president of Oakville, Ontario, money manager CastleMoore Inc. and vice president of the Canadian Society of Technical Analysts. “You get the euro strengthening a little bit, and it’s probably going to come at the expense of gold.”

The S&P/TSX slumped 2 percent yesterday, the most since August, after private reports indicated slowing employment and manufacturing growth in the U.S. Seventy-five percent of Canadian exports went to the U.S. last year, according to Statistics Canada.

An index of S&P/TSX gold stocks fell the most in three weeks as demand for a safe haven weakened. The metal advanced 8.6 percent this year through yesterday as investors speculated European countries will have difficulty managing their debt crisis.

Barrick dropped 2.2 percent to C$45.06. Goldcorp Inc., the world’s second-largest gold producer by market value, declined 1.2 percent to C$47.58. Silver Wheaton Corp., Canada’s fourth- biggest precious-metals company by market value, lost 2.1 percent to C$34.36 as silver sank 4 percent.

Sino-Forest tumbled 21 percent, the most since 1995, to C$14.46 before being halted. Carson C. Block, a Hong Kong-based analyst who has bet against Sino-Forest shares, said in a report that the amount of land the company reported buying from Lincang City in Yunnan province doesn’t match city records.

Dave Horsley, chief financial officer at Sino-Forest, didn’t immediately return calls to his mobile phone and the company’s Mississauga, Ontario office. No one immediately replied to voicemail messages left at Sino-Forest’s Hong Kong and Mississauga offices.

Fertilizer producers climbed as wheat futures rose on speculation Russian exports won’t be enough to help meet higher global demand and corn gained. Potash Corp. increased 1.5 percent to C$54.19. Agrium Inc., Canada’s second-largset fertilizer producer, advanced 1.8 percent to C$84.81.

Oilfield-services company Trinidad Drilling Ltd. plunged 5.3 percent to C$9.74 a day after sinking 6 percent. Yesterday, the company reported earnings that missed the average analyst estimate by 7.2 percent, excluding certain items. At least three analysts cut their ratings on the shares today.

Transat A.T. Inc., the owner of airline Air Transat, slumped 7.9 percent to C$11.78 after Claude Proulx, an analyst at Bank of Montreal, reduced his rating on the shares to “market perform” from “outperform.” In a note to clients, Proulx wrote that second-quarter earnings may decline in the second half of the fiscal year due to excess capacity and competition from Air Canada.

Valeant Pharmaceuticals International Inc., Canada’s largest drugmaker, rallied 4.1 percent to C$51.29 as company executives met with potential investors in New York.

US

By Rita Nazareth

June 2 (Bloomberg) — U.S. stocks retreated, a day after the biggest slump for the Standard & Poor’s 500 Index since August, as investors awaited the Labor Department’s monthly report on employment in the world’s largest economy.

Limited Brands Inc. and Gap Inc. paced losses among chain stores, falling at least 2.1 percent. Goldman Sachs Group Inc. retreated 1.3 percent after two people familiar with the matter said it received a subpoena from the Manhattan District Attorney regarding the bank’s activity leading into the credit crisis.

Joy Global Inc. gained 5.4 percent, spurring a rally in industrial companies, after the mining-equipment maker reported profit that beat analysts’ estimates.

The S&P 500 fell 0.1 percent to 1,312.94 at 4 p.m. in New York. It slumped 2.3 percent yesterday, the most since August, after data showing slower-than-forecast job growth spurred concern that tomorrow’s Labor Department report will trail estimates. The Dow Jones Industrial Average dropped 41.59 points, or 0.3 percent, to 12,248.55 today.

“Nobody is going to jump in with strong conviction before the jobs report,” said Peter Jankovskis, who helps manage about $2.7 billion at Oakbrook Investments in Lisle, Illinois. “We’ve been experiencing fairly weak economic figures. Investors need more evidence that this is a temporary slowdown.”

The S&P 500 tumbled to a six-week low yesterday following ADP Employer Services’ jobs report and separate data from the Institute for Supply Management that showed manufacturing expanded at the slowest pace in more than a year. Citigroup Inc.’s U.S. Economic Surprise Index, which tracks the rate at which data are beating or missing estimates, turned negative in May and has since fallen to the lowest level since January 2009.

Stocks fell today as data showed the economic recovery is slowing. Orders placed with U.S. factories fell in April by the most in nearly a year as demand for aircraft waned and Japan’s earthquake restrained auto-related supplies. A separate report showed that more Americans than forecast filed applications for unemployment benefits last week, signaling the job market is weakening as employers trim staff to cut costs.

“There are so many worries that hit the screen that investors don’t know where to focus on first,” said Bruce McCain, who oversees $22 billion as chief investment strategist at the private-banking unit of KeyCorp in Cleveland. “There’s sluggish growth, the European crisis, fiscal issues, high commodity prices. It’s not like we’ll suddenly go over the edge and into an abyss. Still, those are uncertain times. That is reflected in global markets.”

Moody’s Investors Service said that if there is no progress on increasing the statutory debt limit in coming weeks, it expects to place the U.S. government’s rating under review for possible downgrade, due to the very small but rising risk of a short-lived default. Moody’s said if the debt limit is raised and default avoided, the Aaa rating will be maintained. Lack of an agreement could prompt Moody’s to change its outlook to negative on the Aaa rating.

Limited Brands, Gap and other U.S. retailers reported May sales that trailed analysts’ projections as increasing prices and surging gasoline costs deterred budget-conscious shoppers.

Limited, operator of the Victoria’s Secret chain, posted a gain of 6 percent in same-store sales, missing the 7.4 percent average of analysts’ estimates compiled by Retail Metrics Inc.

Sales at Gap, the largest U.S. apparel chain, fell 4 percent, more than five times the rate analysts projected.

Surging costs for cotton, oil and labor in Asia have forced some apparel chains to pass costs on to consumers, with several saying hikes will accelerate this year. Some shoppers are scrimping on trips to stores because they can’t keep up with the price of fuel.

Limited Brands slumped 2.2 percent to $37.87. Gap dropped 4.1 percent to $18.12.

Goldman Sachs Group Inc. slid 1.3 percent to $134.38. The fifth-biggest U.S. bank by assets received a subpoena from the Manhattan District Attorney’s office seeking information related to a Senate subcommittee report on Wall Street’s role in the housing market collapse, according to two people familiar with the matter.

Joy Global gained 5.4 percent to $90.51. The mining- equipment maker reported second-quarter profit of $1.52 a share.

Analysts surveyed by Bloomberg had estimated earnings of $1.35 a share on average.

For-profit colleges rallied as the U.S. Education Department gave the industry more time to comply with rules that will cut off federal aid to institutions whose students struggle the most to repay their government loans.

Corinthian Colleges Inc. gained 27 percent to $5.06. Apollo Group Inc. advanced 11 percent to $46.90.

More than $578 billion has been erased from U.S. equity markets since the S&P 500 peaked at 1,363.61 on April 29, pushing the index’s valuation to 13.3 times estimated profit for 2011 from 13.8 times. The drop is creating a buying opportunity for investors willing to withstand declines that may reach 10 percent, according to Blackstone Group LP’s Byron Wien. Wien, who estimates earnings for companies in the gauge will climb about 12 percent in 2011, says shares will prove a bargain and the index will rally.

“Investors should be looking for buying opportunities,” said Wien, the vice chairman of Blackstone Advisory Partners, whose parent, New York-based Blackstone Group LP, is the world’s largest private-equity firm. “The economy is not as bad as it looks right now. Corporate profits will be good, very good.

People are asking me, ‘Do you still think the market can get to 1,500 by the end of the year?’ I do.”

Have a wonderful evening everyone.

Be magnificent!

Man lives in confusion and fear until he discovers the uniformity of the law in nature; until then the world is a stranger to him.

And yet, the law discovered is only the perception of the harmony between reason, which is the soul of man, and the play of nature.

It is the bond that unites man to the world he lives in.

When he discovers it, man feels an intense joy, because he realizes himself in his environment.

To understand this is to find something to which we belong,

and it is the discovery of ourselves outside ourselves that gives us joy.

-Rabindranath Tagore, 1861-1901

As ever,

Carolann

Life is not always a matter of holding

good cards, but sometimes of playing

a poor hand well.

-Robert Louis Stevenson, 1850-1894

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor