July 27, 2011 Newsletter

Dear Friends,

Tangents:

I picked up a couple of CDs at a record store in Healdsburg last week for listening as we drove through the valley. One of them which I’d recommend is Robbie Robertson’s latest (came out a few months ago) How to become Clairvoyant. Eric Clapton is featured on a couple of tunes.

More on travel…. Last Sunday, The New York Times had a piece on The Van Dusens of New Amsterdam: Fifteen generations spread outward from one of the earliest settlers of Manhattan. It featured stories on different members of this family from many generations, thanks to the fact that for some in the family, genealogy has become an obsession, even a calling. I thought this piece was insightful:

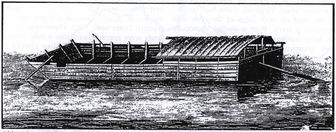

A rendering of an Ohio River flat-boat, similar to the one Abraham Van Dusen used when he went west.

A rendering of an Ohio River flat boat, similar to the one Abraham Van Dusen used when he went West.

A rendering of an Ohio River flat boat, similar to the one Abraham Van Dusen used when he went West.

ABRAHAM VAN DUSEN

(1755-1836)

Flat-boater

THEY called 1816 “The Year Without a Summer.”

New York had snow in June. Intense fog, now thought to be the residue of volcanic action in Indonesia, made it hard for sunlight to penetrate the atmosphere for months on end. Crops froze on several continents, spreading famine.

Abraham, a 60-year-old grandson of Abraham Pieterszen’s grandson Abraham, had moved in 1806 or 1807 to Jerusalem Township, N.Y., paying $250 for a piece of farmland where Keuka College sits today. He found work as an “overseer of highways.”

But with the extreme weather threatening starvation, he was among many upstate residents who decided they could not afford to stay put. In April 1817, he found a buyer for the land, packed up the family — 11 children, in addition to uncountable numbers of cousins, in-laws and grandchildren — and headed west.

Their journey was as audacious as it was innovative. First, they traveled 100 miles overland to meet the Allegheny River in Olean, N.Y. There, they built flat-bottomed boats that resembled oversize rafts with roofs and piled on their belongings: horses, cattle and children. Using the current, they floated 325 miles downstream to Pittsburgh, where they met the Ohio River, then continued 475 miles on to Covington, Ky., according to Herbert D. Simons.

“The children of Israel could scarcely have presented a more motley array of men and women, with their ‘kneading troughs’ on their backs, and their ‘little ones,’ than were assembled on their way to the new land of promise,” one observer wrote of the flat-boaters in a compilation the Carnegie Library did for Pittsburgh’s centennial.

Two of Abraham’s sons, Robert and Isaac, were entitled to land in Indiana for having fought in the War of 1812, according to Mr. Simons. Like many others, the family stripped the lumber from their boats to build cabins on the land.

At least 100 of Abraham’s kin from 22 related households accompanied him or completed similar voyages by 1820, judging from census records. By 1830, many of these same families coalesced in or around Sand Creek, Ind.

Photos of the day

July 27, 2011

A reporter leans over the edge of the catwalk during the media preview for the ‘EdgeWalk’ on the CN Tower in Toronto. Participants are strapped into a harness that is attached to a guard rail while walking around the catwalk on the structure 1,168 feet off the ground.Mark Blinch/Reuters

The Olympic Stadium with the figure 1 mowed into the grass marks one year to go until the start of the London 2012 Olympic Games in this undated photo released today. LOCOG/Handout/Reuters

Market Commentary:

Canada

By Matt Walcoff and Victoria Taylor

July 27 (Bloomberg) — Canadian stocks fell the most in 11 months, led by oil and raw material producers, as the U.S. stalemate on raising the debt limit persisted.

Suncor Energy Inc., Canada’s largest oil and gas company, declined 2.7 percent as oil fell after an unexpected increase in U.S. supplies. Barrick Gold Corp., the world’s biggest producer of the metal, dropped 2.1 percent as bullion futures fluctuated after three days of gains. Toronto-Dominion Bank, Canada’s second-largest lender by assets, decreased 2.1 percent as investors including BlackRock Inc. and Franklin Templeton Investments said the U.S. faces losing its top-level debt rating from Standard & Poor’s or Moody’s Investors Service.

The Standard & Poor’s/TSX Composite Index retreated 267.89 points, or 2.0 percent, to 13,032.67 at 4 p.m. in Toronto, the biggest decline since Aug. 11.

“It’s a reflection of the jitteriness we’re seeing,” Laura Wallace, a money manager in the private client division at Scotia Asset Management, said in a telephone interview. Scotia oversees C$10 billion ($10.5 billion). “We don’t have a resolution to the debt and there is concern about what the impact of an S&P downgrade would be.”

The S&P/TSX slipped less than 1 point this month through yesterday as gold producers rose and financial companies dropped while U.S. politicians debated rival plans to raise the country’s debt ceiling. U.S. Treasury Secretary Timothy F. Geithner has said the U.S. will run out of options to prevent a default on Aug. 2. Seventy-five percent of Canadian exports went to the U.S. last year, according to Statistics Canada.

Crude oil lost 2.2 percent in New York after the U.S.

Energy Department said inventories increased last week. Eleven of 13 analysts in a Bloomberg survey had forecast a drop in supplies.

Canadian Natural Resources Ltd., the country’s second- largest energy company by market value, fell 2.8 percent to C$39.48. Canadian Oil Sands Ltd., the largest owner of the Syncrude project, declined 3.7 percent to C$26.55. Talisman Energy Inc., which operates in North America, the North Sea and Indonesia, lost 2.3 percent to C$18.75. Suncor declined 2.7 percent to C$38.14. Uranium One Inc., an explorer for the metal, sank 6.8 percent to C$3.43.

The S&P/TSX index that measures utilities fell 1.9 percent, the most since June 2010. Fortis Inc., Canada’s largest publicly traded utility, dropped 2.4 percent, the most since November 2010, to C$31.69. The S&P/TSX index of consumer discretionary stocks declined 2.2 percent, the most since August 2010. Magna International Inc., Canada’s largest auto-parts maker, lost 4.1 percent to C$45.61 for its biggest drop since February.

Gold futures fell 0.2 percent after advancing to a record earlier, while the U.S. Dollar Index rebounded from a two-month low.

Barrick lost 2.1 percent to C$46. Goldcorp Inc., the world’s second-largest producer of the metal by market value, decreased 3.4 percent to C$48.23. Silver Wheaton Corp. fell 4.9 percent to C$35.35. Avalon Rare Metals Inc. tumbled 10 percent to C$5.78 after pricing a $43.7 million offering of stock. Orvana Minerals Corp. slumped 12 percent, the most since March 2009, to $2.06 after saying it plans a $17 million stock offering.

Copper, lead and zinc fell on the London Metal Exchange after the U.S. Commerce Department reported a drop in durable goods orders in June. Teck Resources Ltd., Canada’s biggest base metals producer, lost 4.8 percent to $47.29. Ivanhoe Mines Ltd. slipped 2 percent to C$25.23.

Sino-Forest Corp. rose 8 percent to C$7.69, gaining for a seventh day after New Zealand billionaire Richard Chandler said he raised his stake in the Chinese tree-farm operator to 15 percent to become the largest shareholder.

An index of financial shares in the S&P/TSX declined to a seven-month low. Toronto-Dominion fell 2.1 percent to C$77.00. Royal Bank of Canada dropped 1.4 percent to C$51.33. Bank of Nova Scotia lost 2 percent to C$54.82.

Fertilizer producers slumped along with corn futures after meteorologists forecast rain for the U.S. Midwest. Potash Corp. of Saskatchewan Inc., the world’s largest maker of the crop nutrient by market value, declined 2.3 percent to C$56.28. Rival producer Agrium Inc. lost 1.8 percent to C$84.33.

Research In Motion Ltd., which makes BlackBerry smartphones, dropped 5.6 percent to C$24.37, its lowest price since August 2006, after UBS lowered its price target to $30 from $41, saying that the company is losing ground to competitors.

US

By Nikolaj Gammeltoft

July 27 (Bloomberg) — U.S. stocks fell, dragging the Standard & Poor’s 500 Index down the most in almost two months, as lawmakers indicated they were no closer to reaching a compromise on the federal debt limit.

Technology and industrial stocks led declines among 10 S&P 500 groups. Caterpillar Inc. and General Electric Co. decreased more than 2.4 percent after a government report showed orders for durable goods unexpectedly decreased. Corning Inc. dropped 7.2 percent after reducing its forecast for glass demand amid lower television-sales projections. Amazon.com Inc. rallied 3.9 percent after its Kindle e-reader and digital-media services helped second-quarter results beat analysts’ estimates.

The S&P 500 slipped 2 percent, its biggest decline since June 1, to 1,304.89 at 4 p.m. in New York. The Dow Jones Industrial Average retreated 198.75 points, or 1.6 percent, to 12,302.55. Treasury yields, which dropped yesterday on speculation lawmakers would reach an accord on the nation’s debt ceiling, rose today as the political stalemate continued.

“The macro events are clearly driving the market,” Sarah Hunt, portfolio manager at Alpine Mutual Funds in Purchase, New York, said in a telephone interview. Alpine oversees about $6.5 billion. “Beyond the fact that we have this political squabble, which never makes people feel better, you also have an underlying potential softening in the economic data.”

The S&P 500 has fallen 3 percent this week, its biggest three-day decline since June 3, as Republicans and Democrats sparred over separate plans to raise the federal debt limit and avoid a default by Aug. 2. S&P, Moody’s Investors Service and Fitch Ratings have said they may downgrade the U.S.’s top AAA rating if lawmakers fail to resolve the stalemate. Stocks rallied 2.2 percent last week as corporate profits topped analysts’ estimates.

Equities declined today as an agreement remained elusive.

House Speaker John Boehner’s reworked deficit-cutting plan was gaining support among Republicans, while Senate Majority Leader Harry Reid said his competing proposal to avert a potential U.S. default is the only “true compromise.”

The non-partisan Congressional Budget Office said Reid’s plan would cut $2.2 trillion over 10 years, shy of its $2.7 trillion target. The savings also fall below the $2.4 trillion needed to meet Republican demands that a debt-limit extension be accompanied by an equal amount of savings. President Barack Obama is insisting on a debt-limit increase large enough to last through the 2012 elections.

CBO said Boehner’s plan would save just $850 billion rather than its advertised $3 trillion, forcing him to make revisions and round up backing among fiscal conservatives after Republican leaders postponed a vote scheduled for today.

Rates on six-month Treasury bills due Aug. 4 climbed 10 basis points to 0.15 percent, the highest since February, according to Bloomberg Bond Trader data, a signal investors are growing more concerned that lawmakers will fail to reach an agreement on the nation’s debt. The bills are the first government debt securities to mature after the deadline to increase the $14.3 trillion borrowing limit passes on Aug. 2.

Benchmark Treasury 10-year note yields increased two basis points to 2.98 percent.

Stock futures retreated earlier as the U.S. Commerce Department said bookings for goods meant to last at least three years fell 2.1 percent in June after a 1.9 percent gain the prior month that was smaller than last reported. The median forecast of 76 economists surveyed by Bloomberg News projected a 0.3 percent increase.

Stocks lost further ground in the afternoon after the Federal Reserve said the U.S. economy grew at a slower pace in more parts of the country since the beginning of June as shoppers restrained spending and factory production eased.

“Economic activity continued to grow,” the Fed said in its Beige Book survey released today in Washington. “However, the pace has moderated in many districts.” Growth slowed in eight of the Fed’s 12 regions, compared with four in the last survey, the central bank said.

The S&P 500 Industrials Index lost 2.7 percent, the second- most among 10 groups in the benchmark gauge for U.S. equities.

Caterpillar, the world’s largest maker of construction and mining equipment, slipped 3.7 percent to $101.34. General Electric decreased 2.4 percent to $18.11.

Boeing Co. rose the most in the Dow, adding 0.7 percent to $70.63, as the airplane maker lifted its forecast for full-year earnings. Net income rose 20 percent to $941 million, or $1.25 a share, buoyed by higher commercial sales. The average estimate of 22 analysts surveyed by Bloomberg was for 97 cents. Full-year profit will be $3.90 to $4.10 a share, Boeing said, a jump of 10 cents at each end of its previous range.

“It’s a tug of war between the headline risk of the debt ceiling issue and earnings,” Matthew DiFilippo, who helps manage $1 billion as director of research at Stewart Capital Advisors LLC in Indiana, Pennsylvania, said in telephone interview. “The volatility may create buying opportunities because corporate earnings are coming in strong, and the market does appear to be cheap compared to the underlying earnings power.”

Since July 11, about 81 percent of S&P 500 companies that have released quarterly results beat estimates for earnings per share, according to data compiled by Bloomberg.

Technology companies lost 3 percent, the most among 10 groups in the S&P 500 today.

Corning slumped 7.2 percent to $16.04. The maker of glass for flat-panel televisions lowered its outlook for the global glass market and slashed its full-year sales forecast for its Gorilla Glass by 20 percent to $800 million.

Juniper Networks Inc. plunged 21 percent to $24.66. The second-largest maker of Internet networking equipment posted second-quarter profit excluding certain costs of 31 cents a share. Analysts on average projected profit of 33 cents a share, according to data compiled by Bloomberg.

Cisco Systems Inc., the largest maker of networking equipment, declined 3.7 percent to $15.69.Amazon.com gained 3.9 percent to $222.52. The world’s largest online retailer reported second-quarter net income of $191 million, or 41 cents a share, topping the 34-cent average analyst estimate. Net sales rose to $9.91 billion, compared with the average prediction for $9.38 billion.

Total System Services Inc. had the biggest gain in the S&P 500, adding 5.3 percent to $19.13. The credit-card processor said it earned 28 cents a share from continuing operations in the second quarter. That’s 1 cent more than the average analyst estimate in a Bloomberg survey. Barclays Plc raised the stock’s rating to “overweight” from “equal weight.”

Delta Air Lines Inc. fell 5.1 percent to $7.61. The world’s second-largest airline plans further seating-capacity cuts after higher fuel and maintenance costs pulled second-quarter profit below analysts’ estimates.

Dunkin’ Brands Group Inc. surged 47 percent to $27.85 on the first day of trading. The operator of Dunkin’ Donuts coffee shops sold 22.3 million shares at $19 each in an initial public offering.

“It’s a very mixed market environment,” Michael C. Aronstein, who manages $1.1 billion as president of New York- based Marketfield Asset Management LLC, said in a telephone interview. “There are sectors, companies and countries that are doing really well, while there are others that are very distressed.”

Have a wonderful evening everyone.

Be magnificent!

The word duty indicates compulsion.

The word responsibility indicates freedom.

Duties lead one to demand rightfully.

Responsibilities lead one to command respectfully.

Sense of duty is out of attachment.

Sense of responsibility is out of love.

Duties can be thrust upon others.

Responsibilities are taken up by oneself.

There can be unwillingness in performing one’s duty.

Responsibility is always taken up willingly.

-Maa Purnananda

As ever,

Carolann

When everything seems to be going against you,

remember that the airplane takes off against

the wind, not with it.

-Henry Ford, 1863-1947