January 31, 2013 Newsletter

Dear Friends,

Tangents:

Seems Super Bowl weekend coming up is a really big deal this year. Even all the financial news that streams across my screens features stories intermittently on it throughout the day.

Here’s an article that might interest you by Ross Atkin:

Super Bowl XLVII: 15 pregame facts

San Francisco 49ers (13-4-1 ) versus Baltimore Ravens (13-6 ).

By ROSS ATKIN

Anybody worth their Super Bowl guacamole

dip already knows the megawatt story line of

this Sunday’s game: the coaching civil war

between Jim Harbaugh of the San Francisco

49ers and older brother John, who patrols

the Baltimore Ravens’ sideline. There’s much

more to know beyond this, however. Here’s a

Super Bowl snack-fact sampler:

1 – Kickoff on CBS is at 6:30 p.m., ET.

2 – San Francisco is 5-0 in previous Super Bowl

appearances. If the 49ers’ Quest for Six succeeds,

they will tie the Pittsburgh Steelers for

the most SB wins. Baltimore won in its only

previous trip to the Super Bowl in 2001.

3 – In some way, both teams pay tribute to

American culture, the 49ers to the California

Gold Rush of 1849, the Ravens to

the famous poem, “The Raven,”

penned by Baltimore resident

Edgar Allan Poe.

4 – The 49ers began their existence

in 1946 in the old All America

Football Conference. The Ravens

were relocated from Cleveland in

1996, a move that placated fans

after their beloved Colts bolted to

Indianapolis in 1984.

5 – The average margin of victory

in the last nine Super Bowls is 6.6

points.

6 – Sunday’s game will be played

in the Superdome in New Orleans.

That ties the Big Easy with Miami

for hosting of the most Super

Bowls: 10. Greater Los Angeles is

next with seven.

7 – The headliner for the 30-minute halftime

show will be pop diva Beyoncé.

8 – The only other time the Harbaugh brothers

matched coaching wits was last season, when

the Ravens beat the 49ers, 16-6.

9 – San Francisco quarterback Colin Kaepernick’s

skills as both a passer and runner, plus his

uncommon coolness under pressure, have

taken the league by storm as he prepares to

start only his 10th National Football League

game. As a virtually unknown rookie out of

the University of Nevada, he threw only three

passes, but was pressed into service this season

after starter Alex Smith was injured.

10 – “Kaepernicking,” a new football buzz word,

has become so popular that the 49ers’ signal

caller has filed for a trademark on the word,

which was coined to describe his habit of kissing

a bicep after he scores a touchdown.

11 – Ray Lewis, the Ravens’ surefire Hall of Fame

middle linebacker and the only holdover from

Baltimore’s 2000 season championship team,

will retire after the Super Bowl.

12 – The Ravens lost four of their last five regular-

season games, but turned things around

when several injured players returned and the

team replaced its offensive coordinator.

13 – Baltimore’s rookie placekicker Justin

Tucker has been sensational, making 30 of 33

field goal attempts, including four of 50 yards

or more. His San Francisco counterpart, veteran

David Akers, has gone from being one of

the league’s best to one of its shakiest kickers,

making only 30 of 44 tries.

14 – The 49ers haven’t won more than two

games in a row this season. They did enjoy a

run of five nonlosing games in midseason, but

a 24-24 tie with the St. Louis Rams in Week 10

kept them from a five-game winning streak.

15 – Baltimore QB Joe Flacco has thrown eight

touchdown passes without an interception during

three playoff games. That places him on the

postseason gold standard of Joe Montana, who

threw 11 touchdown passes without a “pick” in

the 1989 postseason in leading the 49ers to an

NFL title.

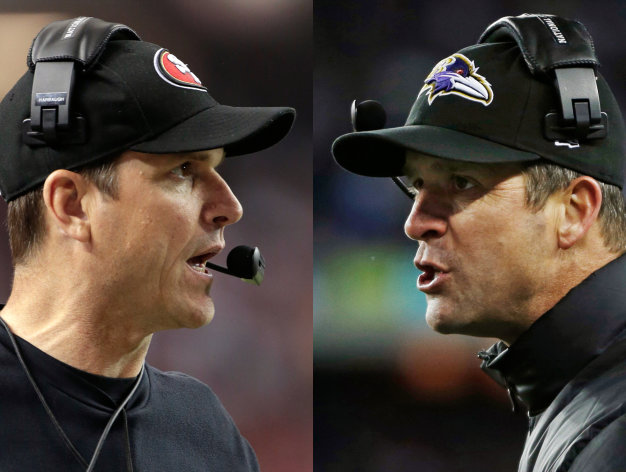

face-off: Coaching brothers Jim Harbaugh (l.) of the San Francisco 49ers

and John of the Baltimore Ravens will match wits Sunday in New Orleans

Courage is being scared to death, but saddling up anyway. -John Wayne

Market Closes for January 31st, 2013

| Market

Index |

Close | Change |

| Dow

Jones |

13860.58 | -49.84

-0.36% |

| S&P 500 | 1498.11 | -3.85

-0.26% |

| NASDAQ | 3142.132 | -0.176

-0.01% |

| TSX | 12685.24 | -109.20

|

| -0.85%

|

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 11138.66 | +24.71

|

| +0.22%

|

||

| HANG

SENG |

23729.53 | -92.53

|

| -0.39%

|

||

| SENSEX | 19894.98 | -110.02

|

| -0.55

|

||

| FTSE 100 | 6276.88 | -46.23

|

| -0.73

|

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.990 | 1.995 |

| CND.

30 Year Bond |

2.570 | 2.572 |

| U.S.

10 Year Bond |

1.9849 | 1.9920 |

| U.S.

30 Year Bond |

3.1719 | 3.1822 |

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.99734 | 1.00228

|

| US

$ |

1.00266 | 0.99773 |

| Euro Rate

1 Euro= |

Inverse

|

|

| Canadian

$

|

1.35532 | 0.73783 |

| US

$

|

1.35878 | 0.73595 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1663.60 | 1677.15 |

| Oil | Close | Previous

|

| WTI Crude Future | 97.49 | 97.94 |

| BRENT | 117.58 | 117.05

|

Market Commentary:

Canada

By Leslie Picker

Jan. 31 (Bloomberg) — Canadian stocks slumped the most in three months as raw-material producers fell amid disappointing earnings and a drop in commodity prices, overshadowing faster- than-estimated expansion in the nation’s economy.

Potash Corp. of Saskatchewan Inc., the world’s largest fertilizer producer, fell 1.9 percent after forecasting first- quarter profit that trailed analysts’ estimates. BlackBerry, formerly known as Research in Motion Ltd., dropped 6.8 percent after Credit Suisse downgraded it to underperform. Goldcorp Inc. and Barrick Gold Corp. fell at least 2.2 percent after the metal slid the most in almost four weeks.

The Standard & Poor’s/TSX Composite Index retreated 109.20 points, or 0.9 percent, to 12,685.24 at 4 p.m. in Toronto. The S&P/TSX has risen 2 percent this year, the fourth-worst performance among the world’s 24 developed markets, according to data compiled by Bloomberg. The main equity benchmark for stocks in Israel has fallen 0.7 percent, Belgium’s equities rose 1.8 percent and Austrian shares added 1.9 percent.

“Everyone’s focused on earnings,” Anil Tahiliani, fund manager at Calgary-based McLean & Partners Wealth Management Ltd., which has C$900 million in assets, said in a phone interview. “We’re getting mixed signals from companies regarding forward guidance. Having a pullback is not surprising.”

About 81 percent of the 16 companies in the S&P/TSX that have released results so far in this reporting season have exceeded profit projections. Forty percent have surpassed sales estimates, according to data compiled by Bloomberg.

Canada’s gross domestic product grew at the fastest pace in seven months in November on gains in manufacturing, mining and energy. Output grew 0.3 percent to an annualized C$1.56 trillion ($1.56 trillion), following a prior gain of 0.1 percent, Statistics Canada said today in Ottawa. The median forecast in a Bloomberg economist survey was for a 0.2 percent expansion in the month.

Potash fell 1.9 percent to C$42.37. First-quarter earnings will be 50 cents to 65 cents a share, the Saskatoon, Saskatchewan-based company said today in a statement. The average of 17 estimates compiled by Bloomberg was for 69 cents.

The company said taxes will be higher in 2013 because of reduced capital spending. Fourth-quarter earnings and revenue also trailed analyst projections.

Gildan Activewear Inc., the top-performing company in the S&P/TSX last year, fell 3.1 percent to C$36.71. Tal Woolley, an analyst with RBC Capital Markets, lowered his recommendation for the clothing supplier to sector perform, or hold, from outperform.

“Strong price appreciation is the primary reason for our downgrade,” Woolley said in a note to clients today. Gildan now trades more expensively than its peers based on his 2014 earnings forecast of $3 a share, he said.

Barrick Gold fell 2.2 percent to C$31.76 and Goldcorp dropped 2.5 percent to C$35.13. After the close of trading, Barrick Gold confirmed in an e-mail that it was considering the sale of its Barrick Energy unit and other non-core assets.

Gold futures for April delivery dropped 1.2 percent to settle at $1,662 an ounce on the Comex in New York. Raw- materials producers in the S&P/TSX slipped 1.5 percent to the lowest closing level in five months.

BlackBerry lost 6.8 percent to C$12.92, extending its decline for the week to 27 percent. BlackBerry stumbled in its introduction of the BlackBerry 10 lineup yesterday, disappointing shareholders with the lack of a firm U.S. release date and setting a price that may be too high to lure away customers from Apple Inc. and Google Inc.’s Android.

Kulbinder Garcha, of Credit Suisse, is the latest analyst to downgrade the smartphone maker. In all, five analysts recommend buying the stock, 20 have a hold rating, and 20 advise selling, according to data compiled by Bloomberg.

US

By Lu Wang and Sarah Pringle

Jan. 31 (Bloomberg) — U.S. stocks fell, trimming the best January rally for the Dow Jones Industrial Average since 1994, on disappointing earnings as investors weighed economic data ahead of tomorrow’s jobs report.

United Parcel Service Inc. fell 2.4 percent after it forecast profit that trailed estimates as a weak global economy weighs on demand for package shipments. Dow Chemical Co. slid 7 percent after earnings missed forecasts as sales fell in Europe.

ConocoPhillips slipped 5.1 percent after saying oil and natural gas production will hit a low point this year. Qualcomm Inc. and JDS Uniphase Corp. rallied 3.9 percent and 17 percent, respectively, amid better-than-anticipated earnings.

The Standard & Poor’s 500 Index fell 0.3 percent to 1,498.11 at 4 p.m. in New York. The Dow lost 49.84 points, or 0.4 percent, to 13,860.58. About 7.1 billion shares traded hands on U.S. exchanges today, or 16 percent above the three-month average.

“The market’s due for a breather, so unless the economic news was significantly above expectations or significantly below, you’re probably going to get a trading down market,” Eric Green, director of research at Penn Capital, which oversees about $7 billion in Philadelphia, said in a phone interview.

“The mixed data give some reason to take some profits potentially.”

The S&P 500 rose 5 percent this month, its best January performance since 1997, as lawmakers agreed on a budget compromise and companies reported better-than-estimated earnings. The Dow rallied 5.8 percent, the biggest January gain since 1994.

The benchmark index is about 4.3 percent below its record of 1,565.15 set in October 2007, while the Dow is about 2.2 percent from its all-time high. The S&P 500 has more than doubled from a 12-year low in 2009 as the Federal Reserve increased its bond purchases to keep interest rates low and spur growth.

U.S. benchmark indexes fell from five-year highs yesterday as the economy unexpectedly shrank in the fourth quarter.

Economic reports today showed that consumer spending in the U.S. climbed in December as incomes grew by the most in eight years, while claims for unemployment benefits increased more than forecast last week.

Data tomorrow may show employers added 165,000 workers this month, according to economists’ projections in a Bloomberg survey. The unemployment rate probably held at 7.8 percent.

“The outlook is fairly benign right now,” Brian Gendreau, a market strategist at Los Angeles-based Cetera Financial Group Inc., said by phone. The firm has about $20 billion in assets under management. “We are looking at moderate growth. Earnings picture is good. No one is talking about double-dip recession.”

Dow Chemical and UPS are among 37 companies in the S&P 500 scheduled to report earnings today. About 74 percent of the 237 companies that have released results so far exceeded profit projections, and 66 percent have surpassed sales estimates, according to data compiled by Bloomberg.

Seven out of the 10 groups in the S&P 500 fell as consumer- discretionary, energy and raw-material shares declined the most, sinking at least 0.5 percent. Utilities, technology and phone companies rose the most.

UPS slid 2.4 percent to $79.29. Earnings per share for this year will be $4.80 to $5.06, the Atlanta-based company said.

Analysts projected $5.13, the average of estimates in a Bloomberg survey.

The company’s growth is constrained by a sluggish worldwide economy and disputes over the U.S. debt ceiling that erode shipping demand and confidence, Chief Executive Officer Scott Davis said. Investors and analysts use the company as an economic gauge because it handles goods as varied as auto parts and pharmaceuticals.

Dow Chemical tumbled 7 percent, the most since September 2011, to $32.20. The largest U.S. chemical maker by sales reported a net loss of 61 cents a share. Profit excluding one- time items was 33 cents a share, trailing the 34-cent average of estimates compiled by Bloomberg.

ConocoPhillips slipped 5.1 percent, the biggest drop since August 2011, to $58. Daily output from continuing operations may decline to as little as 1.475 million barrels of oil equivalent in 2013 because of asset sales that are part of its restructuring, the company said.

Time Warner Cable Inc. tumbled 11 percent to $89.34. The second-largest U.S. cable-television operator forecast full-year profits short of analyst estimates.

Harman International Industries Inc. slumped 9.1 percent to $44.78. The maker of audio equipment for cars and homes forecast 2013 operating profit of $2.90 a share at most. That missed the average analyst estimate of $3.36.

Constellation Brands Inc., which has agreed to buy out partner Grupo Modelo SAB from its U.S. beer importing business, sank 17 percent to $32.36. The U.S. sued to block Anheuser-Busch InBev NV’s proposed $20.1 billion purchase of the half of Grupo Modelo it doesn’t already own, saying the deal would hurt competition and raise prices. Constellation’s agreement was struck in part to help make InBev’s acquisition more palatable to U.S. regulators, people familiar with the discussions said in June.

Qualcomm rose 3.9 percent to $66.02. The largest seller of semiconductors for mobile phones gave a second-quarter sales and profit forecast that exceeded analysts’ estimates, helped by strong sales of smartphones that run on its technology.

JDS Uniphase rallied 17 percent to $14.51. The maker of fiber-optic testing equipment reported second-quarter profit excluding some items of 18 cents a share, beating the average analyst estimate of 14 cents. Needham & Co. raised the stock’s rating to buy from hold.

Mead Johnson Nutrition Co. climbed 12 percent to $76. The world’s largest baby formula maker reported fourth-quarter earnings that exceeded analysts’ estimates.

Citrix Systems Inc. rallied 9.2 percent to $73.16. The software maker projected first-quarter revenue in the range of $670 million to $680 million. The average analyst estimate in a Bloomberg survey called for $669.2 million.

WMS Industries Inc. surged 51 percent to $24.75. Scientific Games Corp. agreed to buy WMS for $1.5 billion, the biggest deal in the leisure and recreational-products industry in almost two years, to create a global supplier of lottery equipment and slot machines.

Whirlpool Corp. added 6.1 percent to $115.38. The world’s largest appliance maker reported better-than-estimated profits for the fourth quarter and forecast full-year earnings of $9.25 to $9.75 a share, exceeding the average analyst estimate of $9.09.

Investors should consider buying stocks related to homebuilding, including Whirlpool, according to Laszlo Birinyi, president of Birinyi Associates Inc. The company’s shares will rally this year, even after they more than doubled in 2012, he said during a Bloomberg Television interview today.

Have a wonderful evening everyone.

Be magnificent!

Until a radical change takes place and we wipe out all nationalities,

all ideologies, all religious division, and establish a global relationship – psychologically and

inwardly first, then organized in the outside world – we shall go on with war.

Krishnamurti, 1895-1986

As ever,

Carolann

Try not to become a man of success, but rather try

to become a man of value.

-Albert Einstein, 1879-1955

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor

Queensbury Securities Inc.,

St. Andrew’s Square

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7