Dear Friends,

Another thought on spring…

Now the green blade riseth, from the buried grain,

Wheat that in dark earth many days has lain;

Love lives again, that with the dead has been:

Love is come again, like wheat that springeth green.

– J.M.C. Crum

photos of the day

March 24, 2011

People cross Tai Ping Bridge as they participate in the ‘bridge-treading’ event in

Jushui town of Mianyang, Sichuan province, China. Participants throw old clothes and coins from the 200-year-old bridge into the water during the traditional annual event to seek happiness and health. Reuters

With the Washington Monument in the background, cherry blossom trees began to bloom despite cold temperatures in Washington.

Jacquelyn Martin/AP

Members of The Household Cavalry Mounted Regiment ride along The Mall in central London. Toby Melville/Reuters

Market Commentary:

Canada

By Matt Walcoff

March 24 (Bloomberg) — Canadian stocks dropped as energy shares fell on a U.K. plan to raise oil-extraction taxes and a smaller decline in U.S. natural gas inventories than most analysts had forecast, while gold retreated from a record high.

Canadian Natural Resources Ltd., the country’s second- largest energy company by market value, slipped 1.2 percent.

Goldcorp Inc., the world’s second-biggest gold producer by market value, lost 2.4 percent. Imax Corp., the maker of giant- screen movie-projection systems, advanced 12 percent on plans to open 75 more theaters in China.

The Standard & Poor’s/TSX Composite Index decreased 57.81 points, or 0.4 percent, to 14,029.37.

“Why it’s put a little bit of pressure on energy companies is you can see some government copycat legislation,” said Youssef Zohny, who helps oversee about C$50 million ($51 million) as a money manager at Van Arbor Asset Management Ltd. in Vancouver. “Governments around the world are essentially looking to raise revenue. There’s some concern globally that commodity producers are being targeted.”

The S&P/TSX gained 4.2 percent from March 16 to yesterday, narrowing its monthly decline to 0.4 percent, as oil and precious-metal prices rebounded. The equity benchmark gauge has not had a monthly drop since June.

Oil and gas producers dropped a day after U.K. Chancellor of the Exchequer George Osborne raised the supplementary charge on North Sea oil profits to 32 percent from 20 percent. Greg Pardy, an analyst at Royal Bank of Canada, cut his share-price estimates for Canadian Natural and Nexen Inc., citing the U.K. tax in a note to clients.

Today, the U.S. Energy Department said natural gas inventories fell by 6 billion cubic feet, compared with the median analyst forecast of 8 billion cubic feet. The fuel slid as much as 2.8 percent.

Canadian Natural declined 1.2 percent to C$47.76. Nexen lost 1.2 percent to C$23.89 after plunging 7.9 percent yesterday. Imperial Oil Ltd., the country’s second-largest oil and gas producer by revenue, decreased 1.4 percent to C$49.28.

Emerge Oil & Gas Inc., which produces oil in western Canada, slumped 9.4 percent to C$3.08 after reporting a 2010 loss that exceeded the average of six analyst estimates by 29 percent, excluding certain items. The shares’ tumble was their biggest in a day since the company began trading in January 2010.

Gold futures retreated for the first time in seven days as technical indicators led traders to sell the precious metal.

Technical analysts study charts of trading patterns and prices to predict changes in a security, commodity, currency or index.

Goldcorp fell 2.4 percent to C$47.65. Barrick Gold Corp., the world’s largest gold producer, dropped 1.4 percent to C$50.32. Silver reseller Silver Wheaton Corp. declined 3.6 percent to C$42.45, ending a five-day streak of gains.

Diamond producer Harry Winston Diamond Corp. lost 4.2 percent in Toronto Stock Exchange trading to C$14.05 after Kinross Gold Corp. said it sold its 7.1 million Harry Winston shares for about C$100 million ($102 million). Harry Winston had gained 27 percent this year through yesterday.

Imax jumped 12 percent to a 10-year high of C$29.21 after saying it will open 75 more cinemas in China with Wanda Cinema Line Corp. by the end of 2014. In an interview, Imax Chief Executive Officer Richard Gelfond said China will replace the U.S. as its biggest market.

BlackBerry maker Research In Motion Ltd. advanced 2.6 percent to C$62.49 before the release of its fourth-quarter financial results.

“We expect another very solid quarter, with guidance that is much higher than Street estimates,” Tim Long, an analyst at Bank of Montreal, wrote in a note to clients. “Our checks indicate that RIMM is seeing strength in all regions outside North America, despite a lack of new products.”

Teck Resources Ltd., Canada’s largest base-metals and coal producer, climbed for the first time in five days, increasing 2.9 percent to C$53.39.

Vector Aerospace Corp., which repairs aircraft engines, soared 11 percent to a record C$11.13 after European Aeronautic Defence & Space Co. said it is in acquisition talks with the Toronto-based company.

US

By Rita Nazareth and Jennifer A. Johnson

March 24 (Bloomberg) — U.S. stocks advanced, sending the Standard & Poor’s 500 Index higher for a second day, after corporate profit topped analysts’ estimates and a government report showed a decline in jobless claims.

Micron Technology Inc., the biggest U.S. producer of computer-memory chips, rose 8.4 percent and Linux-software maker Red Hat Inc. surged 18 percent after earnings beat analysts’ estimates. GameStop Corp. jumped 2.9 percent as the largest video-game retailer forecast profit above analyst’s projections.

Amazon.com Inc. gained 3.5 percent after William Blair & Co. raised its rating for the world’s biggest online retailer.

The S&P 500 advanced 0.9 percent to 1,309.66 at 4 p.m. in New York, the highest level in two weeks. The Dow Jones Industrial Average advanced 84.54 points, or 0.7 percent, to 12,170.56. The benchmark measure of U.S. stock options completed its biggest six-day drop since November 2008.

“There’s no shortage of cheap stocks,” Leon Cooperman, chairman of hedge fund Omega Advisors Inc. said in an interview today with Bloomberg Television at the Strategas Global Macro Conference in New York. “You have good profits and good economic growth. You have good valuations and conservative posture.”

The S&P 500 has advanced 4.1 percent in 2011, extending last year’s 13 percent rally, amid government stimulus measures and as companies reported earnings that topped analysts’ estimates for the eighth straight quarter. The benchmark index is trading at 15.4 times reported earnings, compared with the average ratio of 19.7 at bull-market peaks.

Fewer Americans filed applications for unemployment benefits last week, signaling the labor market is mending.

Jobless claims declined by 5,000 to 382,000, Labor Department figures showed, in line with the median forecast of economists surveyed by Bloomberg News. The total number of people receiving benefits dropped to the lowest level in almost three years.

“The economy is improving and this is a good environment for corporate profits,” said David Kelly, who helps oversee $450 billion as chief market strategist at JPMorgan Funds in New York. “The latest numbers suggest an advance in the U.S. economy. Investors are buying the idea that even though there are many headwinds, if you believe the economy will grow, then stocks are cheap.”

Global stocks rose for a sixth day, the longest rally for the MSCI World Index since September, amid speculation the need for European Union bailouts may end with Portugal. European leaders meet in Brussels today after Portugal’s parliament rejected budget-cutting measures, pushing the country closer to needing an EU rescue.

The VIX, as the Chicago Board Options Exchange Volatility Index is known, fell 6.1 percent to 18, extending its drop since March 16 to 39 percent. That’s the biggest drop over the same number of days in 28 months. The VIX needed to fall below 17.53 to beat the six-day record set two months after Lehman Brothers Holdings Inc.’s September 2008 bankruptcy sent stocks plunging.

Micron Technology jumped 8.4 percent to $11.50. Second- quarter sales and profit beat analysts’ estimates on increasing demand for chips used to store data on mobile phones and tablets. Revenue climbed 15 percent to $2.26 billion in the period that ended March 3. That compared with $2.1 billion, the average of predictions compiled by Bloomberg.

Red Hat gained 18 percent, the most in the S&P 500, to $47.26. The largest seller of the Linux operating system posted a profit of 26 cents a share excluding some items, beating the 22 cent average of 22 estimates in a Bloomberg survey, as customers updating data centers to take advantage of cloud computing boosted billings.

GameStop rose 2.9 percent to $21.73. The world’s largest video-game retailer forecast first-quarter profit excluding some items of at least 53 cents a share, beating the average analyst estimate of 52 cents in a Bloomberg survey.

Amazon.com added 3.5 percent to $171.10 after being raised to “outperform” from “market perform” at William Blair by equity analyst Mark Miller.

Bank of America Corp. sank 1.3 percent to $13.48. The biggest U.S. lender was cut to “market perform” from “outperform” at FBR Capital Markets. The bank may not have the earnings power to be in compliance with the new capital requirements, analyst Paul Miller said in a note.

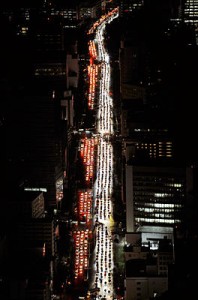

Trading in U.S. stocks, which fell to the slowest pace this year, is poised to contract because Citigroup Inc.’s reverse stock split may take out about one-tenth of the volume, according to Birinyi Associates Inc. New York Stock Exchange volume declined to 3.75 billion shares on March 22 and 3.97 billion shares yesterday, the second and the sixth-slowest trading days this year, respectively, Bloomberg data show.

“We won’t be surprised when we read in a few weeks that volume is declining and how this is a negative signal for equities,” Jeffrey Yale Rubin, Birinyi’s director of research, wrote in a note yesterday. “Just be aware that it’s because of a structural change and not a ‘real’ decline in volume.”

Have a wonderful evening everyone. Be magnificent!

To live completely, fully, in the moment is to live with what is, the actual, without any sense of condemnation or justification – then you understand it so totally that you are finished with it. When you see clearly the problem is solved. -Krishnamurti, 1895-1986

As ever,

Carolann

Discretion in speech is more than eloquence. -Sir Francis Bacon, 1561-1626