Dear Friends,

Tangents:

Birthday: John Locke, philosopher, born August 29th, 1632.

The actions of men are the best interpreters of their thoughts.

-John Locke, 1632-1704

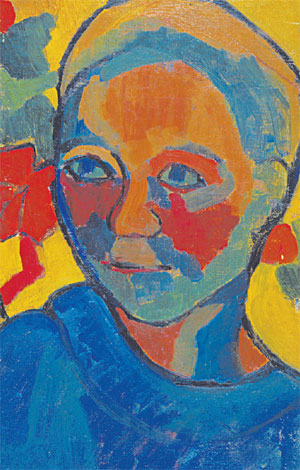

Yesterday, we went to the exhibit at the Vancouver Art Gallery, The Colour of My Dreams, The Surrealist Revolution in Art. It is on until September 25th, 2011. There are some important pieces from surrealists such as Salvador Darli, Joan Miró, Alberto Giacometti, Max Ernst, Man Ray, René Magritte, André Bretton and others. It is being billed as the most comprehensive exhibition of surrealist art ever presented in Canada. Worth seeing if you have a chance.

We were at the Santana concert on Saturday night and it was just an amazing concert …I know many people from Victoria were there and I’d love to hear your comments. Almost everyone was standing for the full concert – it was impossible to sit down. The opening act was Michael Franti & Spearhead. Gary and I hadn’t heard them before but one of our friends who was with us had heard them in San Francisco where they hail from and assured us we’d be impressed – we were.

The CEO of Starbucks said that President Obama shouldn’t be vacationing during a crisis, and that he

should be getting Americans back to work, so they can afford a $9 cup of coffee.

– Conan O’Brien

Photos of the day

August 29, 2011

Boys run their horse through the streets during the Ould Lammas Fair in Ballycastle in the Glens of Antrim, Northern Ireland. The event is one of the oldest fairs in Ireland and has been held without interruption for more than three centuries. Cathal McNaughton/Reuters

A performer dances in the street parade at the annual Notting Hill Carnival in central London. The annual carnival is a celebration of Caribbean culture that usually draws about 1 million people for a colorful procession of musicians and performers. Olivia Harris/Reuters.

Market Commentary:

Canada

By Matt Walcoff

Aug. 29 (Bloomberg) — Canadian stocks rose for a second day, led by energy and financial companies, after the U.S. reported a bigger increase in consumer spending then most economists had forecast.

Canadian Natural Resources Ltd., Canada’s second-largest energy company by market value, gained 3.5 percent as crude futures advanced 2.2 percent. Bank of Nova Scotia, the country’s third-biggest lender by assets, climbed 2 percent after the U.S. consumer-spending figure for July surpassed 73 of 74 economist forecasts in a Bloomberg survey. Northgate Minerals Corp., which mines gold in Australia, soared 28 percent after agreeing to be bought by AuRico Gold Inc.

The Standard & Poor’s/TSX Composite Index rose 177.34 points, or 1.4 percent, to 12,504.85.

“The market is figuring in a 40 percent chance of a double-dip recession,” Sebastian van Berkom, a money manager at Van Berkom & Associates in Montreal, said in a telephone interview. The firm oversees C$1.6 billion ($1.6 billion). “Any kind of clues that maybe that’s not going to happen is going to help.”

The stock benchmark has slipped 3.4 percent this month and is heading for its sixth-straight monthly decline. Energy stocks have led the retreat as oil futures have tumbled 8.6 percent with economic data signaling a slowing recovery. The industry accounts for 26 percent of Canadian stocks by market value, according to Bloomberg data.

U.S. consumer purchases increased 0.8 percent last month, the Commerce Department said today in Washington. Economists had forecast a gain of 0.5 percent, according to the median estimate in a Bloomberg survey.

Oil futures advanced to the highest settlement since Aug.17. Suncor Energy Inc., Canada’s largest oil and gas producer, climbed 2.6 percent to C$30.56. Canadian Natural rose 3.5 percent to C$36.05. Bankers Petroleum Ltd., which operates in Albania, surged 8 percent to C$5.02, a sixth-straight gain.

All S&P/TSX banks and insurers advanced. Scotiabank increased 2 percent to C$52.35. Toronto-Dominion Bank, Canada’s second-largest lender by assets, climbed 1.3 percent to C$74.88.

Manulife Financial Corp., North America’s fourth-biggest insurer, rallied 4.6 percent to C$13.29 after Hurricane Irene did less damage than Kinetic Analysis Corp., a firm that predicts the effects of disasters, had forecast.

Potash Corp. of Saskatchewan Inc., the world’s largest fertilizer producer by market value, rose 2.2 percent to C$57.37 as corn reached an 11-week high. Agricultural futures have advanced as hot weather threatened yields in the U.S. Midwest.

Northgate jumped 28 percent, the most since December 2008, to C$3.98 after agreeing to be bought by AuRico for C$1.46 billion.

AuRico, the gold producer formerly known as Gammon Gold Inc., slumped 19 percent, the most since January 2002, to C$11.05. Precious-metals producer Primero Mining Corp. sank 16 percent to C$3.47 as Northgate scrapped its C$370 million deal to buy the company.

Other precious-metals stocks fell as gold futures dropped 0.3 percent. Barrick Gold Corp., the world’s largest producer of the metal, decreased 1.9 percent to C$49. Goldcorp Inc., the world’s second-biggest company in the industry by market value, declined 1.3 percent to C$50.30. Silver Wheaton Corp., Canada’s fourth-largest precious-metals company by market value, lost 2.3 percent to C$37.91.

Base-metals and coal producers climbed. Teck Resources Ltd., Canada’s largest company in the industry, increased 2.6 percent to C$41.65. Lundin Mining Corp., which produces base metals in Europe, surged 9.9 percent to C$5.66. First Quantum Minerals Ltd., Canada’s second-biggest publicly traded copper producer, gained 5.5 percent to C$22.49.

An index of S&P/TSX consumer-discretionary stocks rallied 2.1 percent. Magna International Inc., Canada’s largest auto- parts maker, advanced 4.4 percent to C$37.20 after the U.S. consumer-spending data reflected gains in vehicle sales. Imax Corp., the maker of giant-screen movie-projection systems, jumped 8.8 percent to C$17.24. Yoga-wear retailer Lululemon Athletica Inc. rose 5 percent to C$53.96.

Uranium producer Denison Mines Corp. soared 10 percent to C$1.64, extending its two-day gain to 19 percent. Cameco Corp., the world’s largest producer of the nuclear fuel, offered to buy Hathor Exploration Ltd. for C$520 million on Aug. 26.

BlackBerry maker Research In Motion Ltd. rallied 4.6 percent to C$29.98 to extend its surge since Aug. 8 to 37 percent. Kevin Smithen, an analyst at Macquarie Group Ltd., raised his 12-month price estimate on RIM’s U.S.-traded shares to $42 from $40, citing international growth and new smartphones in a note to clients.

US

By Rita Nazareth

Aug. 29 (Bloomberg) — U.S. stocks rose, sending the Standard & Poor’s 500 Index to the highest level in almost a month, amid optimism the economy will recover and after Hurricane Irene failed to shut financial markets.

Only three stocks in the benchmark gauge declined today as all of its 10 groups advanced. The S&P 500 Insurance Index of 22 stocks rallied 4.8 percent as Hurricane Irene’s estimated cost declined with the storm losing strength en route to New York.

Bank of America Corp. rose 8.1 percent after agreeing to sell about half its stake in China Construction Bank Corp. in a deal generating $8.3 billion in cash proceeds.

The S&P 500 rose 2.8 percent to 1,210.08 at 4 p.m. in New York, the highest level since Aug. 3. The Dow Jones Industrial Average gained 254.71 points, or 2.3 percent, to 11,539.25, paring this year’s drop to 0.3 percent. About 6.6 billion shares changed hands on U.S. exchanges at 4:10 p.m., 21 percent below the three-month average, data compiled by Bloomberg show.

“I still do not buy into the recession,” Jeffrey Saut, chief investment strategist at Raymond James & Associates in St. Petersburg, Florida, said in a telephone interview. His firm manages $278 billion. “There’s no way the U.S. is going into a recession. Pessimism can’t get much worse than it’s been. Is growth going to be slow? Yes. But if we avoid a recession, stocks are pretty attractive.”

The S&P 500 has fallen as much as 18 percent from a three- year high on April 29 amid concern about a global economic slowdown. Gauges of financial, industrial and energy shares, which are most-tied to the economy, led the declines in the index, slumping at least 22 percent over that period.

Equities climbed today after Americans’ spending increased more than economists forecast while incomes grew at the projected pace. Benchmark gauges also rose as two Greek banks, EFG Eurobank Ergasias SA and Alpha Bank SA, discussed merging. Equities in Greece rallied the most in more than 20 years.

Stocks rose even after a report showed that the number of contracts to purchase previously owned U.S. homes fell in July for the first time in three months, a sign that lower prices and borrowing costs aren’t luring in buyers.

Investors are paying less for equities than they have during every recession since Ronald Reagan was president amid growing concern that the economy is on the edge of another recession. The S&P 500 has lost 13 percent in the past five weeks, sending its price-earnings ratio down to 12.9. That’s 3.5 percent less than the average multiple during the 10 contractions since 1949 and a level last reached in 1982, according to data compiled by Bloomberg.

Stocks dropped and then rebounded on Aug. 26 after Federal Reserve Chairman Ben S. Bernanke ‘s speech in Jackson Hole, Wyoming, in which he said the central bank still has tools to stimulate the economy without signaling he will use them. He echoed comments from dissenting members of the Federal Open Market Committee who said data aren’t pointing to a recession.

“Some positive thinking here has some value — to at least making investors think twice before they dump stocks,” Madelynn Matlock, who helps oversee $14.8 billion at Huntington Asset Advisors in Cincinnati, said in a telephone interview. “Central bankers don’t think there’s any really immediate screaming problem to deal with and have taken that more positively. Plus, there’s the fact that valuation is a whole lot better than it was a couple of months ago. In addition, the absence of any bad news in Europe is good news.”

All 10 groups in the S&P 500 rose between 1.2 percent and 4.2 percent, with gains being led by financial and industrial stocks. The Morgan Stanley Cyclical Index of companies most- dependent on economic growth added 4.3 percent.

Insurers jumped. Hartford Financial Services Group Inc. added 13 percent to $19.42, while Travelers Cos. increased 5.1 percent to $50.75.

Hurricane Irene’s estimated cost to insurers fell to about $2.6 billion, according to Kinetic Analysis Corp. That compares with a projection last week from the Silver Spring, Maryland- based company of as much as $14 billion when Irene was forecast to make landfall in New York as a Category 2 hurricane. Total economic losses, including those that aren’t insured, may be about $7 billion.

Bank of America gained 8.1 percent to $8.39. The bank will sell 13.1 billion shares in a private transaction with a group of investors, the Charlotte, North Carolina-based company said today in a statement.

The KBW Bank Index added 4.5 percent as all of its 24 stocks gained. JPMorgan Chase & Co. advanced 4 percent to $37.64. Citigroup Inc. added 4.9 percent to $31.29.

Pfizer Inc. added 3.7 percent to $18.88. The drugmaker won U.S. approval to sell a drug to treat lung cancer. The treatment, crizotinib, is the leading candidate among more than 20 tumor-fighting medicines the company is developing to help replace sales expected to be lost to generic drugs.

Monsanto Co. slumped 1.3 percent to $69.78. The world’s biggest seed company said 100,000 acres of corn in Iowa and Nebraska may harbor rootworms that developed resistance to the company’s insect-killing biotechnology.

Newmont Mining Corp., the largest U.S. gold producer, and Home Depot Inc., the largest U.S. home improvement retailer, fell less than 0.1 percent.

Have a wonderful evening everyone.

Be magnificent!

I believe in the absolute oneness of God, and therefore, humanity.

What though we have many bodies? We have but one soul.

The rays of sun are many through refraction.

But they have the same source.

I cannot, therefore, detach myself from the wickedest soul

nor may I be denied identity with the most virtuous.

-Mahatma Gandhi, 1869-1948

As ever,

Carolann

The past is not dead. In fact,

it’s not even past.

-William Faulkner, 1897-1962