Dear Friends, I had a client bring me some fresh salmon yesterday that he caught in the morning which I’m soon on my way home to cook. He had caught two large salmon in no time at all he said, fishing off Beecher Bay. Salmon is brain food so consume lots of it now that salmon fishing season is here. A recipe a devised a few years ago is really simple and is wonderfully Canadian. I put the oven on broil, with the grate about 5 inches below the element; I rub the salmon very lightly with olive oil, and drizzle 100% Canadian maple syrup over it; squeeze a few lemon drops over it, and surround it with vegetable broth (or white wine). It takes about 7 minutes, but keep watching it – every oven is different and it may be more or less time, depending on your oven.

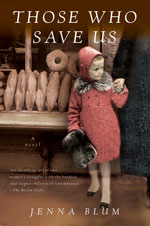

I wanted to tell you about an interesting book I read last weekend entitled Those Who Save Us, by Jenna Blum. This was Blum’s first novel; and even more remarkable because of that fact. The story takes place in Weimar, Germany during the second World War; it is the story of a young German Christian civilian girl named Anna Schlemmer who hides her Jewish lover in 1939 and has his child while he is incarcerated in the Buchenwald camp. It gives a glimpse of what the war was like for ordinary civilians living in Germany at that time. The story is written with somewhat of a covert empathy which is extraordinary given that Blum is a descendant of German Jewish Holocaust survivors and worked for the Steven Spielberg Shoah Foundation interviewing Holocaust survivors for four years.

Eventually, Weimar is liberated by the Americans and Anna and her daughter move with an American soldier to New Heidelberg, Minnesota. Anna’s experience in New Heidelberg reminds me of the stories my husband has told me about growing up in Kitchener (originally New Berlin), Ontario – how most of the Germans repressed, stifled, their heritage and language, something I could never understand ….anyway, it is worth the read.

photos of the day

May 6, 2011

As many as 768 Croats in Zagreb, Croatia, broke the Guinness World Record for the world’s biggest human smiley. The previous record had 551 participants and was reached in the Latvian capital of Riga.

Nikola Solic/Reuters

Villagers take part in a ritual celebrating the pagan god Yurya in the village of Pogost, Belarus. People believe that Yurya protects their harvest.

Vasily Fedosenko/Reuters

Melida Horn watches one of the races before the 137th running of the Kentucky Oaks horse race at Churchill Downs in Louisville, Ky.

Darron Cummings/AP

Market Commentary:

Canada

By Matt Walcoff

May 6 (Bloomberg) — Canadian stocks rose, trimming a second straight weekly decline, after the nation added three times more jobs than economists estimated and U.S. employment also topped projections.

Suncor Energy Inc., Canada’s largest oil and gas producer, gained 1.7 percent after the U.S. added the most jobs in five years. Manulife Financial Corp., North America’s fourth-largest insurer, advanced 5.1 percent after at least three analysts raised their ratings on the shares. Teck Resources Ltd., Canada’s largest base-metals and coal producer, increased 2.1 percent.

The Standard & Poor’s/TSX Composite Index gained 111.22 points, or 0.8 percent, to 13,566.60.

“The key driver is the economic data we’re getting both out of the U.S. and Canada,” said Jennifer Dowty, the Toronto- based co-manager of the C$873.1 million ($909.3 million) Manulife Growth Opportunities Fund. “The payrolls out of the U.S. was a lot stronger than expected, and in Canada it was a similar story.”

The S&P/TSX lost 2.7 percent this week to decline for consecutive weeks for the first time since July. The benchmark stock index retreated as crude oil tumbled 15 percent and silver plunged 27 percent, the most for a week since at least 1975.

Energy and raw-materials companies make up 48 percent of Canadian stocks by market value, according to Bloomberg data.

Canadian employment increased by 58,300 in April, Statistics Canada said today. Forecasts among 25 economists in a Bloomberg survey had ranged from 5,000 to 40,000. The U.S. added 244,000 jobs last month, surpassing the median economist forecast of 185,000 in a Bloomberg survey.

The S&P/TSX Energy Index advanced from a three-month low as natural gas gained in electronic trading.

Suncor increased 1.7 percent to C$40.26 after falling 10 percent, the most since July 2009, in the previous three days.

Canadian Natural Resources Ltd., the country’s second-largest energy company by market value, climbed 2.5 percent to C$42.30.

Oilfield-services provider Pason Systems Inc. gained for the first time in eight days, surging 5.4 percent to C$15.33.

Penn West Petroleum Ltd., a western Canadian oil and gas producer, jumped 5.9 percent to C$24.17 after Fergal Kelly, an analyst at Royal Bank of Canada, boosted his rating on the company to “outperform” from “sector perform.” Yesterday, the Calgary-based company reported a first-quarter profit more than four times as large as the average analyst estimate.

Gold narrowed its biggest weekly slide since May 2010.

Kinross Gold Corp., Canada’s third-largest producer of the metal, increased 1.5 percent to C$14.54. China Gold International Resources Corp., which explores in China, climbed 6.5 percent to C$4.58. First Majestic Silver Corp., which mines in Mexico, rallied 7.4 percent to C$17.60.

Minefinders Corp., which explores for gold in Mexico, slumped 5.3 percent to C$12.78 to extend its weekly plunge to 20 percent, the biggest since 2008. Brian Christie, an analyst at Desjardins Securities Inc., and Steven J. Green, an analyst at Toronto-Dominion Bank, cut their ratings on the shares.

Romarco Minerals Inc., which is developing a gold mine in South Carolina, rallied 13 percent, the most in eight months, to C$1.88. Shares of the Toronto-based company had fallen 28 percent this year, nearly twice as much as an index of gold explorers.

Industrial-metals and coal companies rose as zinc and copper gained in London. Teck advanced 2.1 percent to CS48.80.

First Quantum Minerals Ltd., Canada’s second-largest publicly traded copper producer, increased 2.1 percent to C$123.72.

Potash Corp. of Saskatchewan Inc., the world’s largest fertilizer producer by market value, rose 2.1 percent from a 2011 low to C$51.80. Earnings at CF Industries Holdings Inc., the second-biggest maker of nitrogen fertilizer, surpassed the average of 12 analyst estimates by 27 percent, excluding certain items.

Manulife surged 5.1 percent to C$17.47 a day after reporting first-quarter profit that fell less than analysts expected as higher premiums in the U.S. and Canada countered claims from the earthquake in Japan. Analysts at Royal Bank of Canada, Bank of Nova Scotia and National Bank of Canada raised their ratings on the insurer.

“The risk premium that the market currently applies to Manulife’s stock has not adjusted to the company’s reduced risk position and improved fundamentals,” Peter Routledge, a National Bank analyst, wrote in a note to clients.

Magna International Inc., Canada’s largest auto-parts maker, advanced 3.8 percent to C$50.51. The company said it earned $1.34 a share in the first quarter, excluding certain items, beating the average of 15 analyst estimates by 18 percent as vehicle production rebounded.

BlackBerry maker Research In Motion Ltd. retreated 2.6 percent to a four-year low of C$44.56. Market-research firm ComScore Inc. said smartphones using Google Inc.’s Android operating system surpassed BlackBerry in U.S. market share in the first quarter.

RIM now trades at a record-low 7.2 times its past four quarters of earnings.

US

By Rita Nazareth

May 6 (Bloomberg) — U.S. stocks advanced, paring the biggest weekly decline for the Standard & Poor’s 500 Index since March, as stronger-than-forecast growth in jobs bolstered confidence in the world’s largest economy.

DuPont Co. and Boeing Co. rose at least 1.1 percent to help lead gains in the Dow Jones Industrial Average. Kraft Foods Inc., the world’s second-largest food company, and Fluor Corp., the biggest publicly traded U.S. construction company, climbed more than 2 percent after beating analysts’ earnings estimates.

Stocks trimmed gains after two people familiar with the situation said European finance officials are meeting in Luxembourg to discuss restructuring Greek debt.

The S&P 500 advanced 0.4 percent to 1,340.20 at 4 p.m. in New York, after earlier rallying as much as 1.4 percent. The benchmark gauge for American equities dropped 1.7 percent this week as commodities slumped the most since 2008. The Dow gained 54.57 points, or 0.4 percent, to 12,638.74 today.

“The jobs report was pretty solid,” said Russ Koesterich, the San Francisco-based global chief investment strategist for the IShares unit of BlackRock Inc., which oversees $3.65 trillion as the world’s largest asset manager. “It gave people more conviction that the economic recovery is still on pace.

Investors started to doubt the sustainability of the rebound and commodities naturally took the hit. The rally is a partial reversal of that sentiment. There’s more room for stocks to move higher during the course of the year.”

Gauges of energy and raw-material companies fell more than

4.4 percent through yesterday to lead the S&P 500’s retreat from an almost three-year high reached on April 29. The plunge in commodity shares led the index to a 2.1 percent retreat over the first four days of this week. Including today’s rebound, the index is up 6.6 percent this year amid higher-than-forecast profits and government stimulus efforts.

One year ago today the Dow average had the biggest slide since 1987, as a mutual fund’s hedging strategy set off a chain reaction. Almost 1.3 billion shares traded on U.S. markets in a 10-minute span starting at 2:40 p.m. New York time on May 6, 2010, six times the average, sending prices lower on trading venues from New York to New Jersey and Chicago. The Dow slumped almost 1,000 points intraday before paring losses.

Stock futures extended gains before the start of regular trading today after a government report showed that the U.S. economy added more jobs than forecast in April, easing concern that higher fuel prices are slowing the economic recovery.

Payrolls increased by 244,000 workers last month, the biggest gain since May 2010, after a revised 221,000 increase the prior month, the Labor Department said. Economists projected an April rise of 185,000, according to the median estimate in a Bloomberg News survey. Employment excluding government jobs jumped the most in five years. The jobless rate rose to 9 percent, the first increase since November.

“The very positive jobs report was just what we needed after all the bad news of the last few days,” said Paul Zemsky, the New York-based head of asset allocation for ING Investment Management, which oversees $550 billion. “The market is going to focus on the change in private payrolls which was excellent.

That will more than offset a slight increase in the unemployment rate. If oil continues to fall, we’ll see higher consumer spending and a very good environment for stocks.”

Bill Gross, who runs the world’s biggest mutual fund at Pacific Investment Management Co., said U.S. growth isn’t sufficient to support asset and labor markets nor enough to compensate for the nation’s growing debt level.

“The private economy is moving ahead as evidenced by today’s number but at a measured pace,” Gross said in a radio interview on “Bloomberg Surveillance” with Tom Keene. “Year- over-year real gross domestic product is holding at 2 percent, while nominal GDP is only 3.9 percent. That’s hardly sufficient to support both asset and labor markets in combination, nor is it sufficient to grow our way out of a steadily increasing debt to GDP ratio. It’s not enough.”

While employment growth will probably be strong the next few months, investors will need to see whether that is sustainable once the Federal Reserve’s policy of quantitative easing ends in June, according to Gross. The S&P 500 has rallied 28 percent since Fed Chairman Ben S. Bernanke suggested on Aug. 27 that he would pursue a second round of asset purchases to stimulate the economy.

The euro extended losses versus the dollar as European finance officials held an unscheduled meeting in Luxembourg where they may discuss proposals for restructuring Greek debt, according to two European officials familiar with the situation.

A German official said the discussions would include a German paper on options for confronting Greece’s growing debt load, which has spurred speculation by investors that a restructuring was a likely outcome.

Earlier, Der Spiegel magazine reported that ministers are convening an emergency meeting after Greece threatened to withdraw from the euro region. Greece rejected the report, according to a finance ministry statement, and German Chancellor Angela Merkel’s chief spokesman “categorically” denied that any discussions on a Greek exit were under way. He declined to comment when asked whether officials are meeting tonight.

“We’re seeing some knee-jerk reaction in the currency market,” said Kevin Caron, a market strategist in Florham Park, New Jersey, at Stifel Nicolaus & Co. “The dollar gets a bid as a haven when there’s concern about risks. As investors bid the dollar, they sell other things, like commodities and stocks.”

A gauge of industrial companies in the S&P 500 rose 0.8 percent, the most within 10 groups. DuPont, the third-biggest U.S. chemical maker, added 1.4 to $54.63. Boeing gained 1.1 percent to $79.31.

Kraft rose 2.1 percent, the most in the Dow, to $34.08.

Food and beverage companies such as Kraft, Sara Lee Corp. and Kellogg Co. have raised prices on many products to cope with rising costs for commodities such as wheat, corn, and coffee.

Kraft, led by Chief Executive Officer Irene Rosenfeld, said yesterday that price increases helped make up for rising costs.

Fluor jumped 7.9 percent to $70.87. The largest publicly traded U.S. construction company said first-quarter profit rose 2.3 percent as higher metal prices spurred mining projects. A rebound in commodity demand and higher oil prices have boosted mining and energy contracts, helping Fluor reach record backlog of $37.2 billion.

Earnings per share beat estimates at 73 percent of the 416 companies in the S&P 500 that reported quarterly results since April 11, according to data compiled by Bloomberg.

Have a wonderful weekend everyone.

Be magnificent!

To go from opinion to perception,

from imagination to fact, from illusion to reality,

from something that is not there,

to something that is;

that is the way forward.

-Swami Prajnanpad, 1891-1974

As ever,

Carolann

Three o’clock is always too late

or too early for anything you

want to do.

-Jean-Paul Sartre, 1905-1980

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor