July 25, 2016 Newsletter

Dear Friends,

Tangents:

Carolann is out of the office, I will be writing the newsletter on her behalf.

PHOTOS OF THE DAY

On Monday, painters work on a mural created by Brazilian artist Eduardo Kobra that will cover nearly 3,000 square meters of wall space and depict indigenous faces from five continents as a welcome to visitors attending the Rio 2016 Olympic Games in Rio de Janeiro, Brazil. Stoyan Nenov/Reuters

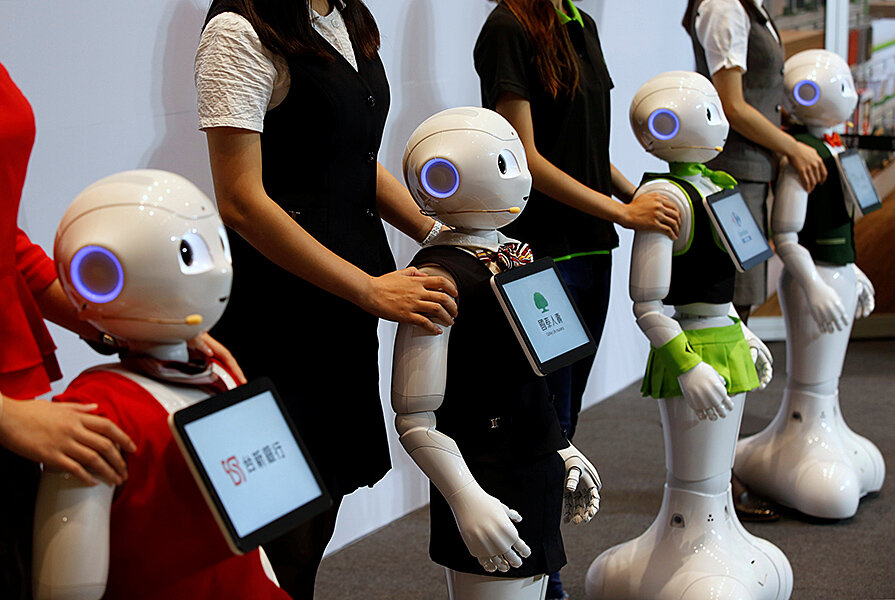

SoftBank’s ‘pepper’ robots, dressed in different bank uniforms, are displayed during a news conference in Taipei, Taiwan, on Monday. Tyron Siu/Reuters

Market Closes for July 25th, 2016

| Market

Index |

Close | Change |

| Dow

Jones |

18493.06 | -77.79

-0.42% |

| S&P 500 | 2168.48 | -6.55

-0.30% |

| NASDAQ | 5097.628 | -2.534

-0.05% |

| TSX | 14498.10 | -102.56

|

| -0.70%

|

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 16620.29 | -6.96 |

| -0.04% |

||

| HANG

SENG |

21993.44 | +29.17 |

| +0.13% |

||

| SENSEX | 28095.34 | +292.10 |

| +1.05% |

||

| FTSE 100 | 6710.13 | -20.35 |

| -0.30% |

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.107 | 1.097 |

| CND.

30 Year Bond |

1.727 | 1.731 |

| U.S.

10 Year Bond |

1.5731 | 1.5645 |

| U.S.

30 Year Bond |

2.2872 | 2.2809 |

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.75658 | 0.76417

|

| US

$ |

1.32173 | 1.30861 |

| Euro Rate

1 Euro= |

Inverse | |

| Canadian $ | 1.45292 | 0.68827 |

| US

$ |

1.09926 | 0.90970 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1313.15 | 1320.75 |

| Oil | Close | Previous |

| WTI Crude Future | 42.38 | 43.49

|

Market Commentary:

Canada

By Eric Lam

(Bloomberg) — Canada stocks fell the most in a month, dropping from the highest level in a year to halt a three-day advance as commodities producers retreated with crude and gold.

The S&P/TSX Composite Index lost 0.7 percent to 14,498.10 at 4 p.m. in Toronto. The benchmark is up 11 percent in 2016, making Canadian stocks more expensive than their U.S. peers, with a price-earnings ratio of 22.3 for the S&P/TSX, about 11 percent higher than the S&P 500 Index.

Raw-materials and energy producers tumbled at least 1.9 percent, the two biggest laggards among 10 industries in the S&P/TSX. They account for about one-third of the benchmark by weighting. Suncor Energy Inc. and Barrick Gold Corp. fell at least 3 percent.

Oil dropped to the lowest level in three months, down 2.4 percent in New York to extend losses after a weekly decline last week. U.S. producers increased drilling for a fourth week, even as government data points to U.S. supplies remaining ample as the summer driving season comes to a close. The S&P/TSX Energy Index dropped to the lowest in a month.

Gold prices also fell, extending the first back-to-back weekly loss since May. Global markets have rallied following a brief swoon after the U.K. voted to leave the European Union, while strengthening U.S. economic data has prompted traders to increase bets of a rate increase.

Today’s decline in raw-material shares pares the rally this year to 53 percent, which remains the best such performance for the group in at least 30 years, according to data compiled by Bloomberg. Mining and energy stocks have propelled Canada to the second-best performance among developed markets, trailing only New Zealand. It’s a far cry from last year, when the S&P/TSX was one of the worst-performing markets in the world, slumping the most since the 2008 Financial Crisis.

Valeant Pharmaceuticals International Inc. added 0.6 percent, rebounding from a two-day slide. The struggling drugmaker said Friday it had received a letter from the Food and Drug Administration over its application for an eye drop medication due to some deficiencies at a manufacturing facility.

US

By Jeremy Herron and Bailey Lipschultz

(Bloomberg) — U.S. stocks declined as crude oil slid to a three-month low, while a stronger dollar weighed on metals ahead of central bank meetings in the U.S. and Japan this week.

The S&P 500 Index slipped from a record as energy shares paced declines, with U.S. oil down 2.4 percent to below $44 a barrel. Nine of 10 main groups in the gauge retreated amid trading volumes that were 18 percent below average. The Treasury’s auction of two-year notes lured the weakest demand since 2008 on speculation the Federal Reserve will acknowledge signs of economic strength on Wednesday. Gold extended its first back-to-back weekly drop since May as the dollar gained against high-yielding currencies.

Global equities edged lower before the central-bank policy meetings and as investors awaited a slew of corporate results. The pullback came after the S&P 500 advanced to a fresh record Friday, as strong U.S. economic data spurred traders to boost bets on the Fed raising interest rates by the end of 2016. While the Fed will probably keep borrowing costs on hold this week, economists predict the Bank of Japan will bolster stimulus. The European Central Bank last week said it would be ready and able to act if needed.

“This is a small drop off from the record climb after recovering those losses from Brexit,” said Todd Lowenstein, director of research at Highmark Capital Management Inc. in Montecito, California. “There’s euphoria from the potential of more central bank easing. Along with higher-than-expected earnings, that led markets higher and now we’ve had a chance to digest those gains and we’re seeing a slight selloff.”

The S&P 500 lost 0.3 percent to 2,168.48 as of 4 p.m. in New York, with energy companies down 2 percent as a group and industrial shares falling 0.6 percent. Yahoo! Inc. fell 2.7 percent after agreeing to sell its main web businesses to Verizon Communications Inc., while Verizon fell 0.4 percent.

Roper Technologies Inc. dropped 5.8 percent, the most in the S&P 500, after missing profit estimates. Micron Technology Inc. jumped 6 percent after the company adopted a so-called poison pill, a rights issue that can make a takeover more difficult to achieve.

In Europe, the Stoxx 600gauge pared gains to close 0.2 percent higher, with the drop in oil prices weighing on energy producers. The benchmark came within 1 percent of erasing losses incurred after the Brexit vote, after figures showed a measure of German business sentiment slipped less than expected in July. The gains were short-lived, however, with the rebound stalling for a third day after the index hit a one-month high last week.

In Asia, Nintendo Co. shares plunged by the most since 1990 after the company said late Friday that the financial benefits from the worldwide hit Pokemon Go will be limited. The stock sank 18 percent to 23,220 yen at the close in Tokyo, the maximum one-day move allowed by the exchange, wiping out 708 billion yen ($6.7 billion) in market value.

Futures on Asian equity indexes mostly signaled losses for Tuesday, with contracts on Japan’s Nikkei 225 Stock Average down at least 0.2 percent in both Osaka and Chicago. Futures on stock gauges in South Korea and Hong Kong dropped more than 0.1 percent, while those on Australia’s S&P/ASX 200 Index were little changed.

The dollar advanced against about eight of its 16 major peers, climbing at least 0.7 percent against Mexico’s peso and the Canadian dollar. The Bloomberg Dollar Spot Index, which tracks the greenback against 10 key currencies, added 0.1 percent to its highest point since May 31.

“Crude is under pressure so that’s a big factor,” said Bipan Rai, senior foreign-exchange and macro strategist at Canadian Imperial Bank of Commerce in Toronto. “But we’re also starting to see the market become more cognizant of the fact that the Fed could be more hawkish than expected, which is leading to a firmer dollar.”

Brazil’s real joined a retreat in emerging-market currencies Monday as policy makers intervened and economists cut forecasts for the Latin American nation’s economy amid uncertainty over budget plans. Turkey’s lira climbed 1 percent, the most among 31 major currencies.

The yen reversed an earlier retreat to end Monday up 0.3 percent at 105.81 per dollar.

Oil dropped to its lowest point since April after U.S. producers increased drilling for a fourth week, even as the market contends with abundant stockpiles. West Texas Intermediate crude futures slipped to $43.13 a barrel after sliding 1.3 percent on Friday to its lowest settlement since May 9.

Rigs targeting oil in the U.S. rose to 371, capping the longest run of gains since August, according to data from Baker Hughes Inc. Money managers also added the most bets in a year on falling WTI prices during the week ended July 19, according to Commodity Futures Trading Commission figures.

Zinc paced gains in industrial metals, trading near the highest level in more than a year on prospects for a supply deficit and as central banks pledge to back economic stability, boosting the metal’s demand outlook.

Precious metals declined, with gold futures losing 0.7 percent to settle at $1,322.90 an ounce as the buoyant equity markets and revived expectations for a potential U.S. rate hike this year hurt demand. Silver futures retreated 0.4 percent.

Benchmark two-year bond yields jumped to a one-month high as the Treasury sold $26 billion of the maturity at steeper yields than indicated in pre-auction trading. Yields on Treasuries maturing in a decade were little changed at 1.58 percent. The Treasury has $103 billion of planned offerings of coupon-bearing securities this week.

Two-year German notes held onto their longest slide since August as data indicated that Europe’s biggest economy may be weathering the fallout from last month’s Brexit vote.

A month after British voters opted to leave the European Union, U.K. bonds are yielding the least in 16 years relative to their U.S. counterparts, reflecting speculation that the Bank of England will loosen policy to mitigate the economic impact of the vote. The extra yield, or spread, that investors get for holding U.S. two-year notes instead of similar-maturity gilts was 58 basis points, the most since May 2000, based on closing Bloomberg generic prices.

Have a wonderful evening everyone.

Be magnificent!

“The best preparation for tomorrow is doing your best today.” H. Jackson Brown, Jr.

As ever,

Karen

“Integrity is doing the right thing, even when no one is watching.” C. S. Lewis

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Portfolio Manager &

Senior Vice-President

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7