October 15, 2015 Newsletter

Dear Friends,

Tangents:

This day in 1990, Soviet leader Mikhail Gorbachev won the Nobel Peace Prize for his work in ending Cold War tensions.

1990 Soviet President Mikhail S. Gorbachev was named the winner of the Nobel Peace Prize.

1993 Nelson Mandela and F.W. de Klerk were named winners of the Nobel Peace Prize for their efforts to end apartheid in South Africa.

2002 ImClone Systems founder Sam Waksal pleaded guilty in New York in the biotech company’s insider trading scandal.

2007 The New York Yankees and third baseman Alex Rodriguez agreed on a record 10-year, $275 million contract, the richest in sports history.

-from The Book of Days:

Edward Gibbon, Autobiography:

It was Rome, on the 15th of October 1764, as I sat musing amidst the ruins of the Capitol, while the barefooted friars were singing vespers in the temple of Jupiter, that the idea of writing the decline and fall of the city first started to my mind. But my original plan was circumscribed to the decay of the city rather than of the empire; and though my reading and reflections began to point towards that object, some years elapsed, and several avocations intervened, before I was seriously engaged in the execution of that laborious work.

The friars were actually singing in Santa Maria in Aracoeli, on the site of the temple of Juno.

PHOTOS OF THE DAY

The sun rises behind a beach installation of the Black Pearl pirate ship made of driftwood on New Brighton beach, Liverpool, northwest England, Thursday. The installation was created by artists Frank Lund and Major Mace. Peter Byrne/PA/AP

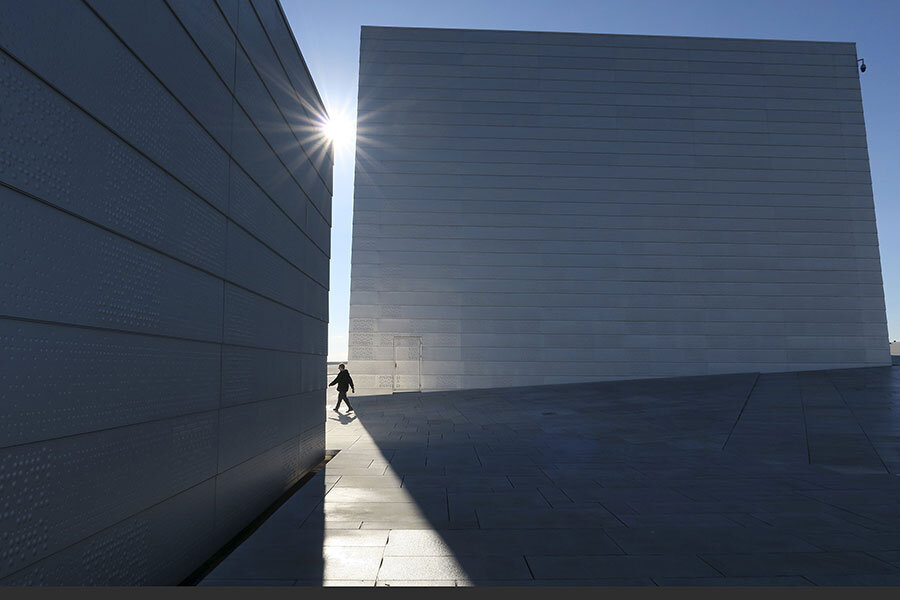

A man walks between two structures that form part of the roof of the Oslo Opera House in Norway Thursday. Russell Boyce/Reuters

Market Closes for October 15th, 2015

| Market

Index |

Close | Change |

| Dow

Jones |

17141.75 | +217.00

+1.28% |

| S&P 500 | 2023.86 | +29.62

+1.49% |

| NASDAQ | 4870.102 | +87.253

+1.82% |

| TSX | 13828.97 | -46.36

|

| -0.33%

|

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 18096.90 | +205.90

|

| +1.15%

|

||

| HANG

SENG |

22888.17 | +448.26

|

| +2.00%

|

||

| SENSEX | 27010.14 | +230.48

|

| +0.86%

|

||

| FTSE 100 | 6338.67 | +69.06

|

| +1.10%

|

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.442 | 1.392 |

| CND.

30 Year Bond |

2.245 | 2.214 |

| U.S.

10 Year Bond |

2.0192 | 1.9788

|

| U.S.

30 Year Bond |

2.8655 | 2.8382

|

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.77764 | 0.77308

|

| US

$ |

1.28595 | 1.29352 |

| Euro Rate

1 Euro= |

Inverse | |

| Canadian $ | 1.46345 | 0.68332

|

| US

$ |

1.13799 | 0.87874 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1184.25 | 1173.90 |

| Oil | Close | Previous |

| WTI Crude Future | 46.38 | 46.64

|

Treasury Bills Sold at Zero Percent Interest Top $1 Trillion: Investors are handing the federal government a lot of free money. The pile of Treasury bills sold at an interest rate of zero since the financial crisis topped $1 trillion this summer and grew further this week, with auctions for three-month bills on Tuesday and one-month bills on Wednesday that each carried no yield.

Market Commentary:

Canada

By Eric Lam

(Bloomberg) — Valeant Pharmaceuticals International Inc., at one point this year the largest stock in Canada, has come down a few pegs as the drugmaker’s pricing decisions face the scrutiny of U.S. lawmakers.

Valeant dropped 5.4 percent on Thursday, touching a February low and extending its loss from an August peak to about 37 percent. The Laval, Quebec-based company led declines in the benchmark Canadian equities index after disclosing it had received subpoenas from the U.S. Attorney’s Office in Massachusetts and the Manhattan U.S. Attorney’s Office seeking information on its patient assistance programs, drug distribution and pricing decisions.

The Standard & Poor’s/TSX Composite Index fell 46.36 points, or 0.3 percent, to 13,828.97 at 4 p.m. in Toronto, for the third decline in four days. The benchmark Canadian equity gauge is down 5.5 percent for the year, the poorest showing among 24 countries except for Singapore and Greece.

“Given the recent political and media scrutiny of pharmaceutical pricing practices and the impact this has had on the specialty pharmaceutical sector, we will be focused on any additional disclosure that management provides related to price versus volume growth,” said Alan Ridgeway, analyst at Scotia Capital in a note to clients.

Ridgeway lowered his price target for the stock to C$250 from C$295 due to the general declines in the pharmaceutical industry ahead of Valeant’s third-quarter earnings results expected Oct. 19. He maintained a sector outperform rating, the equivalent of a buy.

Biotechnology companies, one of the best-performing groups in the S&P 500 this year, plunged into a bear market after Democratic U.S. presidential candidate Hillary Clinton raised concern about possible “price gouging” of prescription drugs in a tweet Sept. 21. Valeant slumped 22 percent in September, the biggest monthly decline since 2007.

The drugmaker had reached a record C$346.32 on Aug. 5 and, along with smaller peer Concordia Healthcare Corp., were the two best-performing stocks in the S&P/TSX as late as Sept. 20. The two companies competed with global peers in an acquisition frenzy in the first half of the year, pursuing a growth-by- acquisition strategy.

Valeant, with a market cap of more than $70 billion, is now jockeying with Bank of Nova Scotia for the title of third- largest stock in the benchmark index, behind Royal Bank of Canada and Toronto-Dominion Bank.

Health-care stocks remain the best-performing industry in the broader S&P/TSX this year with a 22 percent advance, after paring a gain of as much as 94 percent earlier in the year.

Prices for Canadian stocks remain expensive relative to global peers. The MSCI All-Country World Index, a measure of developed and developing markets, currently trades at about 17.3 times earnings. The index’s valuation dropped to as low as about 16 at the end of September, the lowest since October 2014. By contrast, the price-to-earnings ratio of the S&P/TSX sits at 20.1, after falling to as low as 18.9 in September.

US

By Kate Garber

(Bloomberg) — U.S. stocks advanced for the first time in three days as bank shares rebounded amid Citigroup Inc.’s better-than-estimated results, touching off a rally that sent the Standard & Poor’s 500 Index to an eight-week high.

The mood toward bank stocks had an about-face since yesterday, lifting equity market sentiment as Citigroup’s 4.4 percent climb paced banks’ best gain in more than a month. Biotechnology shares continued a rebound from Tuesday’s selloff, while energy jumped without help from oil prices. Netflix Inc. slumped after its U.S. subscriber growthmissed analysts’ forecasts, while Wal-Mart Stores Inc. fell again after its worst drop since 1988.

The S&P 500 Index gained 1.5 percent to 2,023.86 at 4 p.m. in New York, closing at its highest level since Aug. 20. The Dow Jones Industrial Average added 217 points, or 1.3 percent, to 17,141.75. The Nasdaq Composite Index climbed 1.8 percent, with Apple Inc. and Amazon.com Inc. up more than 1.5 percent. About 7.1 billion shares traded hands on U.S. exchanges, 3.7 percent below the three-month average.

“The best way to describe the bank earnings is they didn’t rock the boat,” said Michael Antonelli, an institutional equity sales trader and managing director at Robert W. Baird & Co. in Milwaukee. “Expectations around timing of the Fed action is really the prime driver of sentiment and the market right now. The Fed is the 800-pound gorilla.”

Equities are rebounding from their worst quarter in four years, with investor sentiment weaving from worries that a slowdown in China will spread, to reassurance that the Federal Reserve will be slow to raise interest rates until policy makers are more confident that overseas turbulence won’t derail U.S. growth and inflation will reach their 2 percent target. The S&P 500 is up 5.4 percent this month, and has rallied 8.4 percent from the low during an August selloff.

A report today showed consumer prices excluding food and fuel rose more than forecast in September, propelled by rising rents. Plunging energy expenses caused total costs to decrease by the most since January. A separate report showed the number of Americans submitting applications for jobless benefits unexpectedly declined last week to match the fewest in four decades, bringing the monthly average to its lowest level since December 1973.

A worse-than-forecast U.S. retail sales report yesterday compounded pessimism from disappointing data on China’s economy, sending the probability of the Federal Reserve raising interest rates by January to 39 percent, from 47 percent last week. March resumed as the first month for which traders are pricing in at least even odds of a liftoff, after those bets had been pushed to April before today’s data.

Fed Bank of New York President William C. Dudley said today that he favors raising interest rates later this year if his forecast is met. Debate among policy makers has gone increasingly public in recent days, with cautious comments by Fed governors Lael Brainard and Daniel Tarullo that argued for patience on liftoff.

Earnings season is beginning to compete more aggressively against the Fed for investors’ attention. Analysts forecast profits for S&P 500 members dropped 7.2 percent in the third quarter. Disappointing results from JPMorgan Chase & Co. and Wal-Mart’s shock forecast that next year’s profit will slump dragged equities lower yesterday. General Electric Co. and Honeywell International Inc. are due to report results tomorrow.

The Chicago Board Options Exchange Volatility Index fell 11 percent Thursday to 16.05, its lowest since Aug. 19. The measure of market turbulence known as the VIX is down 34 percent this month, the most since February.

Bank stocks in the S&P 500 had their strongest gain in almost two months amid today’s earnings results. KeyCorp rose 4.7 percent, the most in seven weeks, after matching profit estimates while net interest margins were better than expected. JPMorgan, the biggest U.S. bank, rebounded 3.2 percent to wipe out Wednesday’s drop when its quarterly results disappointed. Bank of America Corp. added 3.5 percent.

Even Goldman Sachs Group Inc. joined the financial sector rally, rising 3 percent despite third-quarter results falling short of analysts’ estimates for the first time in four years. Net income fell 36 percent from a year earlier, while net revenue was below $7 billion for the first time in two years.

Biotechnology shares climbed for a second day, erasing a selloff on Tuesday to lead health-care higher. Amgen Inc., Biogen Inc. and Gilead Sciences Inc. all increased at least 3.2 percent. Pfizer Inc. and Merck & Co. gained more than 2.3 percent. The Nasdaq Biotechnology Index climbed for a second day, adding 4.4 percent.

Energy companies in the benchmark index rose 1.6 percent, despite crude oil slipping for a fourth day amid the biggest increase in stockpiles in six months. Exxon Mobil Corp. gained 1.7 percent. Valero Energy Corp. and Southwestern Energy Co. increased more than 3.1 percent.

Seagate Technology Plc was among the leading losers in the benchmark with a 13 percent tumble, the most since 2011. The hard-drive maker’s preliminary quarterly revenue fell short of analysts’ estimates. Consumer electronics company Garmin Ltd. dropped nearly 13 percent to a four-year low after cutting its earnings outlook.

Netflix fell 8.3 percent, the most in a year after falling short on two important measures: subscriber growth and programming expenses. Blaming the slump on new credit and debit card technology, the online video service still expects to finish 2015 with net additions of about 6 million subscribers in the U.S., the fourth straight year of such gains.

Valeant Pharmaceuticals International Inc. fell 4.8 percent, as the company faces subpoenas seeking information on drug pricing. The subpoenas renew concerns that Valeant and other drugmakers will face continued political scrutiny over drug prices.

Have a wonderful evening everyone.

Be magnificent!

If this individuality is wiped away, the creative joy that crystallized it disappears,

even if no material was lost, even if no atom was destroyed.

And if it is lost, it is also a loss for the entire world. It is particularly precious because it is not universal.

Rabindranath Tagore

As ever,

Carolann

If you rest, you rust.

-Helen Hayes, 1900-1993

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Portfolio Manager &

Senior Vice-President

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7