Dear Friends,

Tangents:

Enjoy the last day of summer 2015 today – the autumn equinox occurs at 4:21 AM tomorrow, rendering it the first day of fall.

Significant Numbers:

63 years, 216 days: length of Queen Victoria’s reign in Britain (1876-1901) a record surpassed by Queen Elizabeth ll on September 9th.

29,000: People in Japan who turned 100 in 2015. So many are reaching their centenary that the government may drop the traditional 100th birthday gift, and engraved silver bowl, because it’s gotten so expensive.

Good News:

Seattle: sustainable seafood may be easier to find. A pilot program called Smart Catch, supported by philanthropist Paul Allen, will certify restaurants that offer 90 percent sustainably harvested or raised fish, based on abundance, bycatch, and fishery-management practices. Details of the offerings and their origins will be featured on menus.

London: There’s new life in the Thames. Finally – owing largely to 1990s-era changes in waste-treatment legislation – the river, which had been pronounced “biologically dead” more than 50 years ago, now harbors marine mammals from seals and porpoises to the occasional wayward whale, as noted in a 10-year survey of public sightings compiled by the Zoological Society of London.

London: There’s new life in the Thames. Finally,

PHOTOS OF THE DAY

Workers travel on a speed boat past an inflatable Rubber Duck installation, by Dutch artist Florentijn Hofman, on a lake at a botanic garden in Changsha, Hunan province, China, Monday. The 18-meter-high duck will be on display from Sept. 21 to Nov. 22. Reuters

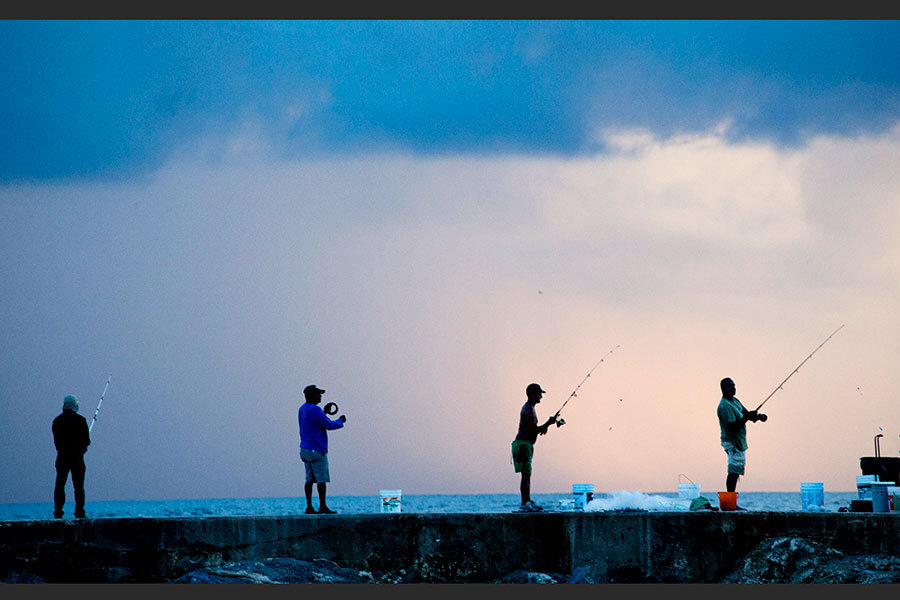

Fishermen cast their lines from a jetty as storm clouds loom in the distance in Bal Harbour, Fla., Tuesday. Wilfredo Lee/AP

Market Closes for September 22nd, 2015

| Market

Index |

Close | Change |

| Dow

Jones |

16330.47 | -179.72

-1.09% |

| S&P 500 | 1941.64 | -25.33

-1.29% |

| NASDAQ | 4576.723 | -72.232

-1.50% |

| TSX | 13489.57 | -289.87

|

| -2.10% |

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 18070.21 | -362.06

|

| -1.96% |

||

| HANG

SENG |

21796.58 | +39.65 |

| +0.18% |

||

| SENSEX | 25651.84 | -541.14 |

| -2.07% |

||

| FTSE 100 | 5935.84 | -172.87 |

| -2.83% |

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.482 | 1.541 |

| CND.

30 Year Bond |

2.234 | 2.293 |

| U.S.

10 Year Bond |

2.1372 | 2.1958 |

| U.S.

30 Year Bond |

2.9468 | 3.0168 |

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.75350 | 0.75454

|

| US

$ |

1.32714 | 1.32532 |

| Euro Rate

1 Euro= |

Inverse | |

| Canadian $ | 1.47637 | 0.67734 |

| US

$ |

1.11244 | 0.89892 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1122.90 | 1133.25 |

| Oil | Close | Previous |

| WTI Crude Future | 45.83 | 46.68 |

Market Commentary:

Canada

By Eric Lam

(Bloomberg) — Canada stocks tumbled the most in three weeks, joining a rout in global markets as commodities prices slumped amid escalating concern China’s growth is slowing.

Raw-materials producers plunged 4.4 percent to the lowest level since November 2008 as copper led losses in industrial metals and zinc fell to a five-year low. Health-care shares slid a second day, while industrial stocks tumbled.

The S&P/TSX Composite Index fell 288.35 points, or 2.1 percent, to 13,491.09 at 4 p.m. in Toronto, the biggest drop since Sept. 1. The benchmark Canadian equity gauge has lost 2.7 percent in September, which would be a fifth straight monthly drop.

A volatility gauge for 60 of the largest, most liquid Canadian stocks jumped 9.8 percent, the most in three weeks, to 23.95. The measure has surged 17 percent in two days.

The Asian Development Bank cut its forecast for China’s economic growth to 6.8 percent in 2015 and 6.7 percent in 2016, the second such reduction in just over two months. In July, it estimated a 7 percent expansion for this year and 6.8 percent for next.

Global stocks slumped, with a gauge of developed and developing markets falling 1.7 percent to a two-week low. The Standard & Poor’s 500 Index sank 1.2 percent in New York while the Stoxx Europe 600 Index slumped 3.1 percent.

In Canada, First Quantum Minerals Ltd. and Teck Resources Ltd. sank at least 7.7 percent as copper futures for December delivery tumbled 3.8 percent in New York. Canadian Natural Resources Ltd. fell 2.4 percent and Canadian Oil Sands Ltd. declined 4.9 percent as energy stocks retreated.

The Bloomberg Commodity Index, a basket of prices for natural resources from copper to oil and gold, dropped 1 percent. The gauge has slumped 16 percent this year.

Auto parts makers slumped to lead consumer discretionary stocks lower after German automaker Volkswagen AG said 11 million vehicles were equipped with diesel engines at the center of a widening scandal over faked pollution controls. Magna International Inc. retreated 4.9 percent, the biggest decline since January, and Linamar Corp. lost 1.8 percent.

Valeant Pharmaceuticals International Inc. dropped 5.4 percent to a July low. The drugmaker has stumbled 10 percent in two days, joining losses among U.S. health-care stocks after Democratic presidential candidate Hillary Clinton said Monday some “price gouging” in the specialty drug market was “outrageous” in a tweet.

Toronto-Dominion Bank lost 1.9 percent and Bank of Nova Scotia fell 1.7 percent. A gauge of the nation’s largest lenders has dropped 2.1 percent in September, headed for a fifth straight month of losses, the worst stretch since February 2009.

US

By Dani Burger and Anna-Louise Jackson

(Bloomberg) — U.S. stocks fell, with raw-material shares dragged lower as commodities retreated, a selloff in biotechnology shares deepened and Volkswagen AG’s diesel- emissions cheating scandal continued to rattle global auto stocks.

Fiat Chrysler Automobiles NV fell 5.7 percent, while Ford Motor Co. and General Motors Co. lost at least 1.9 percent with investors wary of industry fallout. Monsanto Co. and Alcoa Inc. dropped more than 1.3 percent amid sliding commodity prices. The Nasdaq Biotechnology Index sank 1.7 percent after losing 4.4 percent Monday. Apple Inc., Google Inc. and Facebook Inc. declined at least 1.5 percent.

The Standard & Poor’s 500 Index lost 1.2 percent to 1,942.74 at 4 p.m. in New York, trimming a decline in the final hour after falling as much as 1.9 percent. It’s the third drop in four days, sending the gauge to a two-week low. The Dow Jones Industrial Average slid 179.72 points, or 1.1 percent, to 16,330.47. The Nasdaq Composite Index slumped 1.5 percent. About 7.3 billion shares traded hands on U.S. exchanges, in line with the three-month average.

“With macro uncertainty and very little fundamentals overall, when you see a rise in volatility it leads to investor uncertainty and any bad news has the opportunity to shake things up,” said Joseph Betlej, who helps oversee $33 billion as vice president of Advantus Capital Management. “It’s a hangover from last week’s Fed move. Yesterday was just a little bounce.”

Equities got a boost Monday after a quartet of Fed officials talked up prospects for higher interest rates in 2015, just days after the central bank jolted investors by citing global market turmoil and a slowdown in China as reasons for standing pat. Their remarks suggested continued improvement in the domestic economy may overshadow concerns about global conditions.

The central bank’s bid for greater transparency about its criteria for a rate increase has left markets on edge amid an expanding Fed checklist and conflicting U.S. data. Fed Chair Yellen said last week that policy makers would scrutinize slowing growth in China and emerging markets for risks that could spill over to the U.S.

Meanwhile, the market remains unconvinced a liftoff will take place this year after the Fed’s decision and its dovish statement. Traders are pricing in a roughly 41 percent probability of a rate increase by the Federal Open Market Committee’s December meeting, compared with 64 percent on Sept. 16 before the policy decision.

Equities have been particularly volatile amid anxiety over the impact of China’s slowdown on global growth and the Fed’s intentions. The Chicago Board Options Exchange Volatility Index has closed above 20 for 22 straight sessions, the longest stretch since June 2012. The measure of market turbulence known as the VIX jumped 11 percent Tuesday, the most in a month, to 22.44.

Several technical charts are also sounding warning signals that the worst of equities turmoil may not be over. A downward sloping neckline in a head-and-shoulders pattern have formed in the Dow. The index and the Dow Jones Transportation Average also breached the low from last October, flashing a so-called Dow Theory sell signal.

“On days when there’s not much economic data, that can lead to bigger moves,” said Brent Schutte, senior investment strategist at BMO Global Asset Management in Chicago, which manages $250 billion. “People are selling or buying off things that aren’t grounded in fundamentals.”

The S&P 500 had climbed 6.8 percent from its August low before the Fed unveiled its decision last Thursday to leave interest rates near zero. The benchmark has slumped 2.6 percent since the FOMC meeting concluded, and is down 8.8 percent from its all-time high in May.

All of the S&P 500’s 10 main groups declined Tuesday, with raw-materials and technology companies falling more than 1.5 percent. Leading the drop in materials, Mosaic Co. fell 7 percent to its lowest level since January 2009. The largest U.S. producer of potash fertilizer said it plans to reduce output as low crop prices continue to erode farmer demand for agricultural products.

Renewed worries about slower growth in China pressured commodity prices, sending Alcoa down 4 percent, and steel company Nucor Corp. sliding 2.9 percent. The Asian Development Bank reduced its China growth forecasts for the second time in just over two months. Newmont Mining Co. lost 6.3 percent as gold prices fell.

Semiconductors fell for a fourth straight session, the longest losing streak in a month. Applied Materials Inc., Micron Technology Inc. and Qorvo Inc. slumped more than 2.7 percent, while Intel Corp. fell 1.7 percent.

Biotech shares extended declines sparked yesterday after Democratic presidential candidate Hillary Clinton criticized high drug prices. Today she said she’d implement programs to force the industry to concede tens of billions of dollars a year in tax breaks, lower prices and increase research spending. Celgene Corp. and Mylan NV paced the slide in the Nasdaq Biotech Index, falling more than 1.2 percent.

Among consumer discretionary shares, the influence of the Volkswagen scandal was visible. Parts supplier BorgWarner Inc. dropped 7.6 percent, the most in four years, and Delphi Automotive Plc fell 3.6 percent. CarMax Inc. lost 4.7 percent, its biggest drop in a year, even after the used-car retailer’s quarterly profit exceeded analysts’ estimates.

Weakness in homebuilders also weighed on consumer stocks. An S&P gauge of builder shares fell 2.7 percent, the most since Aug. 25. Lennar Corp., PulteGroup Inc. and Toll Brothers Inc. slid at least 2.2 percent.

Goldman Sachs Group Inc. lost 2 percent, ranking as the second-worst performer in the Dow. Chief Executive Lloyd Blankfein said he has a “highly curable” form of lymphoma and will undergo chemotherapy over the next several months. Among financial stocks in the S&P 500, Morgan Stanley and BlackRock Inc. were among the biggest losers, down more than 2.5 percent.

The KBW Bank Index sank 1.3 percent on its way to a four-week low.

The Dow Jones Transportation Average fell 2.5 percent, its biggest slide since Aug. 24. Kirby Corp., which operates a fleet of inland tank barges that transport commodities such as industrial chemicals, fell 4.1 percent. Railroads Kansas City Southern and Norfolk Southern Corp. lost more than 2.7 percent. A Bloomberg gauge of U.S. airlines slid 3.1 percent, the most in a month.

Staples Inc. and Office Depot Inc. both tumbled at least 4.1 percent, hurt by renewed concerns that the Federal Trade Commission will block the companies’ merger plan.

Weatherford International Plc jumped 11 percent after the oil-services company scrapped a proposed $1 billion sale of shares and convertible debt. The sale was announced yesterday, and Weatherford’s share price tumbled 17 percent in response.

Have a wonderful evening everyone!

Be magnificent!

The outward freedom that we shall attain will only be in exact proportion

to the inward freedom to which we may have grown at any given moment.

Mahatma Gandhi

As ever,

Carolann

We tend to think of meditation in only one way. But life itself is a meditation.

-Raul Julia, 1940-1994

Carolann Steinhoff, B.Sc., CFP®, CIM, CIWM

Portfolio Manager &

Senior Vice-President

Queensbury Securities Inc.,

St. Andrew’s Square,

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7