Dear Friends,

It was a subdued day today with the news of the earthquake in Japan; a potent reminder of how fragile this existence is, and how we have to cherish every moment we have. Tomorrow is the birthday of Jack Kerouac, who was born on March 12th, 1922. This passage is from his iconic On the Road:

…the only people for me are the mad ones, the ones who are mad to live, mad to talk, and to be saved, desirous of everything at the same time, the ones who never yawn or say a common-place thing, but burn, burn, burn, like fabulous yellow roman candles exploding like spiders across the stars and in the middle you see the blue center-light pop and everybody goes “Awww!”

-from Motivation:

What is the feeling when you’re driving away from people, and they recede on the plain till you see their specks dispersing? It’s the too huge world vaulting us, and it’s good-bye. But we lean forward to the next crazy adventure beneath the skies.

We’re off to Seattle tomorrow to the opera – hard to believe it’s the second to last one of the season. It’s Don Quixote and it has been getting excellent reviews so I’m so looking forward to it. When I called the float plane dispatch this morning to confirm our flight times, I was reminded to change the time Saturday night so we wouldn’t miss our flight back on Sunday – yes, we “spring ahead” one hour this weekend. I don’t know about you, but I just wish they would just leave the time alone, so away with daylight savings.

Japan’s 8.9 earthquake

March 11, 2011

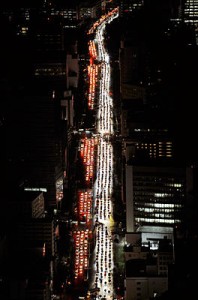

Traffic is jammed on a road in Sendai city, Japan, after a powerful earthquake –

the largest in Japan’s recorded history – slammed the eastern coast on March 11.

Kyodo News/AP

Houses burn in Natori, Japan, on March 11 after Japan was struck by a strong earthquake off its northeastern coast earlier in the day.

Kyodo News/AP

With a tsunami warning in effect for northern California, two men watch the waves at San Francisco’s Ocean Beach on March 11. The tsunami warnings came after a 8.9-magnitude earthquake struck Japan.

Noah Berger/AP/File

Market Commentary:

Canada

By Jennifer A. Johnson

March 11 (Bloomberg) — Canadian stocks rose for the first time in five days, as gains by Teck Resources Ltd. and Barrick Gold Corp. helped the market pare its worst weekly decline in eight months.

Teck, Canada’s biggest base-metals and coal producer, advanced 2.5 percent as copper advanced 0.2 percent. Barrick added 0.6 percent as gold climbed. Insurer Manulife Financial Corp. slipped 1.1 percent on concern the 8.9-magnitude earthquake that struck Japan will boost claims. Pacific Rubiales Energy Corp. fell 9.1 percent after reporting earnings that missed the average analyst estimate.

The Standard & Poor’s/TSX Composite Index advanced 35.67 points, or 0.3 percent, to close at 13,674.25 in Toronto. The Canadian equity benchmark fell 4.1 percent in the week after oil prices surged on unrest in northern Africa and the Middle East, spurring concern the economy will falter. Copper fell 6.2 percent during the same period. Energy and material producers make up 49 percent of Canadian stocks by market value.

“The volatility has picked up a great deal,” said Danielle Park, a partner at Venable Park Investment Counsel Inc.

in Barrie, Ontario, which manages at least C$1 million ($1.02

million) each for more than 250 families. “The trend has certainly been down. Canada as a market is correcting with the commodities story.”

Potash Corp. has declined 11 percent this week, even after today’s 0.3 percent advance to C$52.65. Barrick Gold gained 0.5 percent to C$49.40, paring its weekly loss to 3.9 percent. Teck Resources Ltd., the country’s biggest base metals producer, fell

5.9 percent for the week, after rising 2.5 percent today to C$50.93.

Manulife dropped 1.1 percent to C$17.35, after the seven- meter-high tsunami hit Japan. Sun Life Financial Inc. fell 0.8 percent to C$30.30. Great-West Lifeco Inc. dropped 0.5 percent to C$25.84.

Pacific Rubiales declined 9.1 percent to C$28.54, the biggest decline in the S&P/TSX Index. The energy producer reported fourth-quarter earnings of 44 cents a share on an adjusted basis, missing the average analyst estimate by 3.1 percent, Bloomberg data show.

West Fraser Timber Co. advanced 6.7 percent to C$50.83, after Dundee Securities said North American lumber producers may benefit as Japan recovers from a tsunami and its strongest earthquake on record. International Forest Products Ltd. soared

15 percent to C$6.00.

US

By Lu Wang and Rita Nazareth

March 11 (Bloomberg) — U.S. stocks advanced, trimming the weekly loss in the Standard & Poor’s 500 Index, as gains in fuel, metal and industrial companies helped the market overcome a global slump following Japan’s worst earthquake on record.

Steel Dynamics Inc. climbed 3.9 percent after forecasting more profit than analysts estimated. Valero Energy Corp. surged

6.3 percent as the largest U.S. oil refiner agreed to buy Chevron Corp.’s U.K. refinery and 1,000 retail stores. Pall Corp. drove industrial stocks higher as the supplier of filters for drugmakers boosted its earnings forecast. The iShares MSCI Japan Index Fund, an exchange-traded fund, fell 1.7 percent.

The S&P 500 gained 0.7 percent to 1,304.28 at 4 p.m. in New York, paring its weekly decline to 1.3 percent. The Dow Jones Industrial Average rose 59.79 points, or 0.5 percent, to 12,044.40. Oil slid 1.5 percent as refineries were shut in Japan, cutting demand in the third-largest oil-consuming nation.

“The good U.S. economic signals are winning over external shocks,” said Alan Gayle, senior investment strategist at RidgeWorth Capital Management in Richmond, Virginia, which oversees $52.5 billion. “Companies are reporting strong earnings, M&A activity is moving forward, the economy is in decent shape. We had a recent selloff triggered by all sorts of external uncertainties. It may be time for investors to look at the internal strength.”

The benchmark gauge for American equities had fallen 2 percent over the prior two days as oil surged amid unrest in Libya and the Middle East. Energy and raw-materials companies in the S&P 500 posted declines of at least 3.6 percent in the period, the most within 10 industries, according to data compiled by Bloomberg.

U.S. stocks fell earlier today, following a global equity slump, after Japan’s earthquake. The 8.9-magnitude quake unleashed a tsunami as high as 10 meters, engulfing towns along the northern coast and killed hundreds. The temblor hit 130 kilometers off the coast of Sendai, north of Tokyo, at a depth of 24 kilometers, the U.S. Geological Survey said. A 7.1- magnitude aftershock followed, it said.

Stock-index futures pared declines before the open of exchanges as a report showed that U.S. retail sales increased in February by the most in four months as Americans took advantage of more seasonable weather to buy cars, clothes and electronics.

Purchases climbed 1 percent after a revised 0.7 percent rise in January that was more than double the previous estimate, Commerce Department figures showed. February sales matched the median forecast in a Bloomberg News survey.

“The outlook is pretty decent,” said Madelynn Matlock, who helps oversee $14.5 billion at Huntington Asset Advisors in Cincinnati. “The valuation isn’t ridiculous and earnings look like they will continue to grow. The question would be how much these risk factors influence the overall valuation on these earnings. Right now, we think it’s pretty balanced.”

The S&P 500 has rallied 3.7 percent this year, building on a 13 percent advance in 2010, amid government stimulus measures and as corporate profits beat estimates for eight straight quarters. The benchmark gauge is trading at 15.3 times reported earnings, compared with the average ratio of 19.7 at bull-market peaks, according to data compiled by Bloomberg.

Gauges of raw-materials and energy producers had the two biggest gains in the S&P 500 within 10 industries, adding at least 1.3 percent.

Steel Dynamics rose 3.9 percent to $18.55. The Fort Wayne, Indiana-based producer of the metal forecast first-quarter earnings may be as high as 42 cents a share, compared with the 38-cent average of analyst estimates compiled by Bloomberg.

AK Steel Holding Corp. advanced 5.8 percent to $15.46. U.S.

Steel Corp. gained 4.5 percent to $55.14.

Valero advanced 6.3 percent to $27.98. The largest U.S. oil refiner agreed to buy Chevron Corp.’s U.K. refinery and 1,000 retail outlets for about $1.73 billion in cash, gaining its first European plant. The Pembroke refinery will add 26 cents a share to annual profit based on 2010 market prices, Valero said.

Industrial companies had the third-biggest gain in the S&P 500 among 10 industries, rallying 1.2 percent.

Pall gained 6.2 percent to $57.02. The supplier of filters for drugmakers and refineries increased its full-year forecast, saying it expects to earn $2.80 a share at least, excluding some items. Analysts, on average, estimated $2.62, according to a Bloomberg survey.

Caterpillar Inc. climbed 1.7 percent to $100.02. The world’s largest maker of construction equipment will outperform the industry over the next 30 days, Morgan Stanley said in a note, picking the stock as a “research tactical idea.”

“The recent selloff created an opportunity to buy beaten-up companies,” said Mark Bronzo, who helps manage over $25 billion at Irvington, New York-based Security Global Investors. “There had been so much fear lately. Obviously, the news out of Japan is very bad. However, we have a couple of things to support the market. We’ve got good earnings reports. Oil is down. There’s not much too say about the Middle East crisis today. Overall, people do believe the global economy is getting better.”

U.S. shares of Toyota Motor Corp., which halted auto production at its plant in Miyagi, northern Japan, after the earthquake, dropped 2.1 percent to $85.65. Sony Corp., which was forced to suspend operations at six factories, declined 2.4 percent to $33.45.

Starbucks Corp. dropped 3.7 percent, the biggest decline in the S&P 500, to $36.56. Shares of the Seattle-based coffee chain already “fully reflected” the company’s global growth potential from an agreement to put its coffee in Green Mountain Coffee Roasters Inc. single serve brewing systems, BMO Capital Markets wrote in a note. Starbucks surged 9.9 percent yesterday.

Have a wonderful weekend everyone.

Be magnificent!

The whole universe is bound by the law of causation. There cannot be anything, any fact – either in the internal or in the external world – that does not have a cause; and every cause must produce an effect.

-Swami Vivekananda, 1863-1902

As ever,

Carolann

Mistakes are the portals of discovery. -James Joyce, 1882-1941