Tangents:

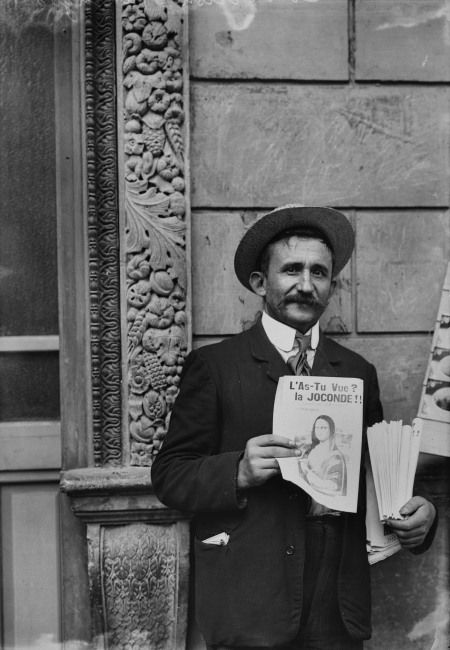

The theft of the most famous painting in the world on August 22nd, 1911, created a sensation.

Leonardo da Vinci’s Mona Lisa, also known as La Gioconda, is the most famous painting in the world. Quantities of effort and ink have been spent over the years on identifying who she was and deciding what her enigmatic smile signifies, what she says about femininity, if anything, and why she has no eyebrows. Leonardo took the painting with him when he was invited to France by Francis I in 1516. The king bought it and at the French Revolution it was placed in the Louvre. Napoleon took it away to hang in his bedroom, but it was returned to the Louvre afterwards.

The theft of this fabulous object in 1911 created a media sensation. The police were as baffled as everyone else. It was thought that modernist enemies of traditional art must be involved and the avant-garde poet and playwright Guillaume Apollinaire was arrested in September and questioned for a week before being released. Pablo Picasso was the next prominent suspect, but there was no evidence against him either.

Two years went by before the true culprit was discovered, an Italian petty criminal called Vincenzo Perugia who had moved to Paris in 1908 and worked at the Louvre for a time. He went to the gallery in the white smock that all the employees there wore and hid until it closed for the night when he removed the Mona Lisa from its frame. When the gallery reopened he walked unobtrusively out with the painting under his smock, attracting no attention, and took it to his lodgings in Paris.

It was not until November 1913, calling himself Leonardo Vincenzo, that Perugia wrote to an art dealer in Florence named Alfredo Geri offering to bring the painting to Italy for a reward of 500,000 lire. He travelled to Florence by train the following month, taking the Mona Lisa in a trunk, hidden beneath a false bottom. After booking into a hotel, which subsequently shrewdly changed its name to the Hotel La Gioconda, he took the painting to Geri’s gallery. Geri persuaded him to leave it for expert examination and the police arrested Perugia later that day.

Perugia apparently believed, entirely mistakenly, that the Mona Lisa had been stolen from Florence by Napoleon and that he deserved a reward for doing his patriotic duty and returning it to its true home in Italy. That was what he said, at least. Many Italians welcomed the masterpiece home; people flocked to see it for a time at the Uffizi Gallery, some of them weeping with joy, and Perugia served only a brief prison sentence. The great painting was duly returned to the Louvre and has hung there safely and enigmatically ever since.

And also on this day in…

1849 – The Portuguese governor of Macao, China, is assassinated because of his anti-Chinese policies.

1862 – Claude Debussy was born.

1893 – Dorothy Parker is born.

1908 – Henri Cartier-Bresson is born.

1911 – The Mona Lisa, the famous painting by Leonardo da Vinci, is stolen from the Louvre in Paris, where it had hung for more than 100 years. It is recovered in 1913.

1915 – John Lee Hooker is born.

1922 – Michael Collins, Irish politician, is killed in an ambush.

1942 – Battle of Stalingrad.

1942 – Brazil declares war on the Axis powers. She is the only South American country to send combat troops into Europe.

1945 – Conflict in Vietnam begins when a group of Free French parachute into southern Indochina, in response to a successful coup by communist guerilla Ho Chi Minh.

1983 – Benigno Aquino, the only real opposition on Ferdinand Marcos’ reign as president of the Philippines, is gunned down at Manila Airport.

The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man. – George Bernard Shaw

photos of the day August 22, 2012

A butterfly flies over a flower in the village of Trstenica, Serbia.

Darko Vojinovic/AP

Beach visitors of different sorts watch the sunset on Dauphin Island, Ala.

Dave Martin/AP

Market Closes for August 22, 2012:

North American Markets

| Market

Index |

Close | Change |

| Dow

Jones |

13172.76 | -30.82

|

| -0.23%

|

||

| S&P 500 | 1413.52 | +0.35

|

| +0.02%

|

||

| NASDAQ | 3073.67 | +6.41

|

| +0.21%

|

||

| TSX | 12116.90 | -0.02

|

| —-

|

International Markets

| Market

Index |

Close | Change |

| NIKKEI | 9131.74 | -25.18

|

| -0.27%

|

||

| HANG

SENG |

19887.78 | -212.31

|

| -1.06%

|

||

| SENSEX | 17846.86 | -38.40

|

| -0.21%

|

||

| FTSE 100 | 5774.20 | -83.32

|

| -1.42%

|

Bonds

| Bonds | % Yield | Previous % Yield |

| CND.

10 Year Bond |

1.851 | 1.933 |

| CND.

30 Year Bond |

2.418 | 2.484 |

| U.S.

10 Year Bond |

1.7002 | 1.8002 |

| U.S.

30 Year Bond |

2.8127 | 2.9005 |

Currencies

| BOC Close | Today | Previous |

| Canadian $ | 0.99138 | 0.98922

|

| US

$ |

1.00870 | 1.01090 |

| Euro Rate

1 Euro= |

Inverse

|

|

| Canadian

$

|

1.24157 | 0.80543 |

| US

$

|

1.25237 | 0.79843 |

Commodities

| Gold | Close | Previous |

| London Gold

Fix |

1654.30 | 1637.55 |

| Oil | Close | Previous

|

| WTI Crude Future | 96.98 | 96.40 |

| BRENT | 117.09 | 116.95

|

Market Commentary:

Canada

By Eric Lam

Aug. 22 (Bloomberg) — Canadian stocks erased losses as gold rallied after minutes of the U.S. Federal Reserve’s last meeting showed many policy makers backed more monetary easing soon to stimulate the economy.

Barrick Gold Corp., Goldcorp Inc., Eldorado Gold Corp. and Yamana Gold Inc. advanced at least 2.3 percent as the price of the metal jumped to a 16-week high. Rona Inc., Canada’s largest home improvement retailer, plunged 5.1 percent, the biggest percentage drop since May 2011.

The Standard & Poor’s/TSX Composite Index rose 2.07 points, or less than 0.1 percent, to 12,118.99 in Toronto, after declining by as much as 0.7 percent earlier in the session. The equity benchmark has gained 3.9 percent this month.

“They hinted way more than expectations, and that is obvious in the reaction; they’re prepared to do QE3,” Bruce Campbell, president of Campbell & Lee Investment Management in Oakville, Ontario, said in a phone interview, referring to a third round of so-called quantitative easing through asset purchases. “Most of it is gold. Money printing, bond printing, however you want to call it, it is a perceived positive for gold because it’s inflationary.”

Many Federal Reserve policy makers said additional stimulus would probably be needed soon unless the economy shows signs of a durable pickup, according to the record of the Federal Open Market Committee’s July 31-Aug. 1 gathering released today in Washington.

Chairman Ben S. Bernanke will have an opportunity to clarify his views in an Aug. 31 speech at a forum for central bankers in Jackson Hole, Wyoming. Fed officials next meet on Sept. 12 13.

The S&P/TSX Composite Gold Industry subindex rallied, adding 2.7 percent. Barrick Gold advanced 2.4 percent to C$37.34, Goldcorp rose 2.8 percent to C$39.96 and Eldorado Gold surged 4.7 percent to C$13.01. Gold futures for December delivery reached $1,655.90 an ounce on the Comex after the minutes were released at 2 p.m. New York time, the highest for a most-active contract since May 2.

Yamana Gold gained 4 percent to C$16.42 after posting an update on its Corpo Sul project in Brazil and closing its acquisition of Extorre Gold Mines Ltd. Shares of the gold producer have risen 9.3 percent so far this year.

Uranium One Inc. climbed 3.6 percent to C$2.56 and Cameco Corp. rose 0.9 percent to C$22.74 after BHP Billiton Ltd. put on hold approvals on $68 billion worth of projects including its Olympic Dam expansion, which would have created the world’s largest uranium mine.

Rona lost 5.1 percent to C$12.45 after a group of independent Rona store owners sent a letter to Lowe’s opposing the U.S.-based retailer’s C$14.50 a share offer, which Rona rejected. Rona shares have plunged 9.8 percent so far this week, on its way to its worst weekly decline since March 2009.

US

By Inyoung Hwang and Rita Nazareth

Aug. 22 (Bloomberg) — U.S. stocks and commodities reversed declines, while the dollar slid and Treasuries extended gains, as Federal Reserve meeting minutes showed many policy makers backed more monetary easing soon.

The Standard & Poor’s 500 Index added less than 0.1 percent to 1,413.49 at 4 p.m. in New York after falling as much as 0.5 percent before the minutes. The S&P GSCI Index of commodities rose 0.2 percent, recovering from a 0.6 percent decline, as natural gas and nickel led gains. The Dollar Index, a gauge of the currency against six major peers, lost 0.4 percent to 81.6. Ten-year Treasury note yields slipped 10 basis points to 1.70 percent.

The record of the Federal Open Market Committee’s July 31- Aug. 1 gathering showed that “many members” believed more monetary accommodation would be needed fairly soon unless the pace of the economic recovery picks up. Earlier declines in stocks today were triggered after a slump in Japan’s exports spurred concern about global demand.

“It’s similar to what the Fed governors have been talking about in recent speeches, but it’s positive and that’s why you’ve seen some market reaction,” said Christopher Orndorff, who helps oversee $450 billion as senior portfolio manager at Western Asset Management Co. in Pasadena, California. “It’s still a wait-and-see. The next GDP print will be important, the next employment numbers will be important.”

The S&P 500 has rebounded as much as 12 percent from a five-month low in June and yesterday climbed to its highest level in four years before erasing gains and ending the session lower. The rally has been driven by Europe’s efforts to fight its debt crisis, better-than-forecast economic data and speculation that central banks will provide more stimulus if needed to safeguard the global recovery.

Chairman Ben S. Bernanke will have an opportunity to clarify his views in an Aug. 31 speech at a forum for central bankers in Jackson Hole, Wyoming, where he signaled a second round of bond buying by the Fed in 2010. Fed officials next meet on Sept. 12-13.

“The Fed is ready, willing and able to be responsive to weak economic conditions,” Eric Teal, chief investment officer at First Citizens Bancshares Inc., which manages $4.5 billion in Raleigh, North Carolina, said in a telephone interview.

“There’s a perception that officials want to be ahead of the curve rather than risk a further slowdown as we go through the rest of the year.”

Consumer, commodity and technology shares led gains among the 10 main groups in the S&P 500 today.

PulteGroup Inc. and D.R. Horton Inc. climbed more than 3.9 percent for the biggest gains in the index. Sales of existing homes climbed 2.3 percent to a 4.47 million annual rate in July, rebounding from an eight-month low and adding to signs U.S. housing may pick up in the second half. Toll Brothers Inc. advanced 3.8 percent, climbing to a five-year high, after the luxury home builder’s profit beat estimates.

Discover Financial Services climbed 3.9 percent to a record $38.43 and EBay Inc. rallied 2.5 percent. The two companies announced a payment-processing agreement in which customers of EBay’s PayPal unit can use their accounts at more than 7 million merchant locations that accept Discover.

Dell Inc. sank 5.4 percent after cutting its fiscal 2013 earnings forecast as sales of personal computers weaken, triggering losses in other technology shares. Lenovo Group Ltd., the second-biggest maker of personal computers, sank 2.7 percent in Hong Kong. Samsung Electronics Co., the largest semiconductor manufacturer, lost 1.4 percent in Seoul.

The Stoxx Europe 600 Index retreated the most in almost three weeks, losing 1.2 percent. Mining companies led losses, with BHP Billiton Ltd. falling 1.7 percent in London after the world’s largest mining company put $68 billion of projects on hold. Rio Tinto Group, the third-biggest, declined 2.7 percent.

Heineken NV dropped 1.1 percent after the brewer reported first-half earnings before interest and taxes that missed analysts’ estimates as Europeans bought less beer.

Cotton weakened for the first time in four days. Consumption of the fiber in China, the largest user, may shrink 11 percent this year, Zhang Hongxia, chairman of Weiqiao Textile Co., the country’s largest cotton-textile maker, said in an interview. Gold futures for December delivery rose after the release of the minutes, climbing 0.8 percent to $1,656.10 an ounce for a sixth straight gain.

The euro strengthened against 10 of 16 major peers. The shared currency recovered from earlier declines as European finance official Olli Rehn said Europe can overcome its debt crisis with determined work and the region’s central bank has an important role in ensuring stability in the financial system.

German Chancellor Angela Merkel signaled that she’s willing to discuss a Greek request for more time to meet the terms of its international rescue, leaving the door open to potential concessions. Merkel, speaking to reporters in the Moldovan capital Chisinau today, declined to discuss the request publicly before meeting with Greek Prime Minister Antonis Samaras in Berlin on Aug. 24, saying she’d “have the opportunity to communicate directly” with him on the matter then. “We won’t find solutions on Friday,” Merkel said.

“The global growth picture is still weak and this is evidenced by sluggish economic and corporate data,” said Allan Yu, who helps manage about $9.4 billion at Manila-based Metropolitan Bank & Trust Co. “These meetings in Europe will help set the global tone. If problems come about from these meetings, we will see a further deterioration in the global outlook.”

The MSCI Emerging Markets Index slid 0.5 percent. The Hang Seng China Enterprises Index of mainland companies listed in Hong Kong retreated 1.3 percent, and Russia’s Micex Index slipped 0.3 percent.

Vietnam’s benchmark stocks index slumped for a second day, losing 1.6 percent. The gauge plunged 4.7 percent yesterday, the most since 2008, as Vietnam’s arrest of Nguyen Duc Kien, the founder of several banks, sparked concern about the vulnerability of the country’s financial system.

Have a wonderful evening everyone.

Be magnificent!

No one can understand the sound of a drum,

without understanding both the drum and the drummer.

No one can understand the sound of a conch shell,

without understanding the shell and the one who blows it.

No one can understand the sound of a lute,

without understanding both the lute and the one who plays it.

As there can be no water without the sea, no touch without the skin,

no smell without the nose, no taste without the tongue no sound without the ear,

no thought without the mind, no work without the hands, and no walking without feet,

so there can be nothing without the soul.

Brihadaranyaka Upanishad

As ever,

Carolann

You have to keep digging, keep asking questions, because otherwise

you’ll be seduced or brainwashed into the idea that it’s somehow a

great privilege, an honor, to report the lies they’ve been feeding

you.

–David Halberstam, 1934-2007

The symbol of all relationships among such men, the moral symbol

of respect for human beings, is the trader.

-Ayn Rand, 1905-1982

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor

Queensbury Securities Inc.,

St. Andrew’s Square

Suite 340A, 730 View St.,

Victoria, B.C. V8W 3Y7