Dear Friends, the flowers are blooming…and another day has come upon us.

Space photos of the day: Looking deeper

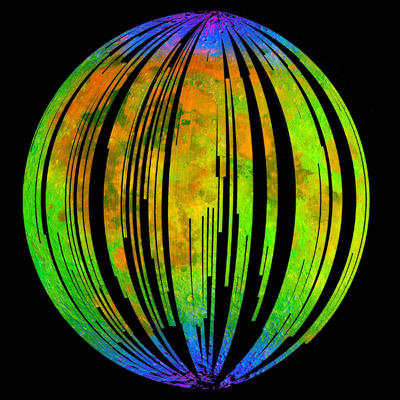

NASA’s Moon Mineralogy Mapper, an instrument on the Indian Space Research Organization’s Chandrayaan-1 mission, took this image of Earth’s moon. It is a three-color composite of reflected near-infrared radiation from the sun, and illustrates the extent to which different materials are mapped across the side of the moon that faces Earth. Small amounts of water were detected on the surface of the moon at various locations. This image illustrates their distribution at high latitudes toward the poles.

Bring sunshine into your spring shade garden with Hylomecon japonica, a small perennial woodland plant that will bode well in our climate.

Market Commentary:

Canada

By Matt Walcoff

Canada’s economy is seen by economists as able to withstand any weakness in commodity prices as it taps strengths that include political stability and the best fiscal outlook of any Group of Seven country.

Prime Minister Stephen Harper’s election victory last week allows him to move ahead with his deficit-cutting plans, and provide certainty in policy making that will help support Canada’s currency, said David Rosenberg, chief economist at Gluskin Sheff + Associates in Toronto.

“Canada as an attractive place to invest transcends the commodity story and a lot of that has to do with political stability and fiscal integrity,” Rosenberg said in a telephone interview, adding “the long-term trend line” for commodities “is still pointing up.”

Jim Flaherty, Harper’s finance minister, will speak today at the Bloomberg Canada Economic Summit in Toronto, in his first major remarks following an election that came the same week investors knocked $99 billion off the value of commodities. Other speakers include Frank Stronach, the founder of Aurora, Ontario-based Magna International Inc., Peter Munk, chairman of Toronto-based Barrick Gold Corp. (ABX), and Donald Guloien, CEO of Toronto-based Manulife Financial Corp. (MFC)

The Bloomberg Canada Economic Summit will feature 11 panels with topics ranging from the outlook for Canadian equities, to the global influence of Canada’s banks, to the climate for foreign investment.

Major Commodity Exporter

The Standard & Poor’s GSCI Index of 24 raw materials fell 11 percent last week, the most since December 2008, as slower growth in U.S. services and fewer German manufacturing orders stoked concern the economic recovery is faltering. The index rose as much as 2.8 percent yesterday after Goldman Sachs Group Inc. said commodities may recover.

Canada is the only G-7 economy that is a major exporter of commodities. Canada is the biggest foreign supplier of oil to the U.S., and as recently as January was supplying the country with twice what Saudi Arabia does.

“Commodities have cooled off but I don’t necessarily see that this is a horrible thing long-term,” said Stephen Lingard, senior vice president of Franklin Templeton Multi-Asset Strategies in Toronto, which oversees about C$8.3 billion ($8.6 billion) in assets. “Even producers don’t want to see oil at $130, $140 or $150 a barrel because it will begin to weigh on some of these big export markets from a demand scenario.”

Canadian Dollar

Since May 2, Canada’s dollar has gained 2 percent against the euro, while declining against the U.S. dollar like most other major currencies. The currency appreciated 0.1 percent to 96.08 cents versus the U.S. dollar at 10:51 a.m. in Toronto, from 96.18 cents yesterday. One Canadian dollar buys $1.0480. “If we get down close to par on the Canadian dollar I think it’s going to become a screaming buy” in the longer term, Rosenberg said.

The victory by Harper, 52, came three weeks after the International Monetary Fund predicted the world’s 10th largest economy will expand 2.8 percent this year, while inflation will end the year near the Bank of Canada’s 2 percent target. An average unemployment rate of 7.6 percent will be bettered only by Japan and Germany in 2011. Canada’s net debt, a measure of indebtedness that takes into account the value of assets such as government pension funds, is the lowest in the G-7 and half the level in the U.S.

Political Certainty

Certainty in policy making sets Canada apart from other major industrialized countries, Rosenberg said. The U.K. and Germany are run by coalition governments, French President Nicolas Sarkozy and Japan’s Prime Minister Naoto Kan have become unpopular with their electorates, while in the U.S., Democratic President Barack Obama must negotiate with a Republican-run House of Representatives.

“Canada is viewed as a bastion of political stability,” Rosenberg said.

Harper’s Conservatives won 167 districts, above the 155 needed to take control of the 308-seat legislature.

“You can do away with some of that uncertainty with respect to Canadians being sent back to the polls on a fairly regular basis, so we have a better outlook for fiscal spending from this side,” said David Tulk, Chief Macro Strategist at TD Securities in Toronto. Canada’s fiscal health is “night and day” compared with the “situation to the U.S. and many other developed markets.”

Weathering Recession

Canada weathered the financial crisis better than the rest of the G-7 even as pressures from abroad tipped it into recession and sent its jobless rate to a four-year high of 8.7 percent in August 2009. Toronto-based Royal Bank of Canada and the country’s other 20 banks received no public money during the credit turmoil, and the country’s financial regulations have inspired regulatory overhauls elsewhere.

Harper pledged during the campaign a review of government spending to find C$4 billion in annual savings, which would be used to balance the budget in three years and finance election promises. Control of the legislature may make it easier for him to move ahead with spending curbs, said Mark Chandler, head of Canadian currency and rates strategy at Royal Bank of Canada’s RBC Capital Markets in Toronto.

“I suspect the end game for this is to try to get down the deficit a little bit quicker,” Chandler said in a May 3 telephone interview. “You probably have more scope to do that under a majority government.”

Harper has been in power since 2006 without holding a majority, meaning he’s had to rely on support from opposition lawmakers to pass laws. Under Harper, program expenditures have increased by 40 percent to C$245 billion as the Conservative leader sought to placate opposition parties and win favor with voters.

The Conservative platform, which commits to reintroduce measures from the 2011 fiscal plan that wasn’t passed before the election was called, projects a C$2.8 billion surplus in the fiscal year that begins April 2014.

US

Mexican President Felipe Calderon said he’s “very comfortable” with the peso’s strength and inflation remains under control even as the economy grows faster this year than the government previously expected.

Calderon, in an interview, said a 6.7 percent rally in the currency this year is a “natural phenomenon” stemming from near-zero interest rates in the U.S. Stress tests performed by the nation’s banks indicate Mexico will be able to withstand any “hard movements” in global capital flows if rates in the U.S. rise or the European Union’s debt crisis expands, he said.

“If you analyze the beginning of the crisis until now Mexico’s peso is probably the currency that has appreciated the least,” Calderon said in an interview at Bloomberg’s headquarters in New York. “I feel very comfortable.”

Even as growth in Latin America’s second-biggest economy accelerates, policy makers have bucked a regional trend of rising interest rates and kept borrowing costs at a record-low 4.5 percent for more than a year. Inflation in April quickened to 3.36 percent, nearly half the 6.51 percent rate in Brazil.

The peso extended gains and rose 0.4 percent to 11.5621 per dollar at 3:08 p.m. New York time. The Mexican currency gained 6.7 percent this year to date, matching the gains by the Colombian peso, the best performer among seven Latin American currencies tracked by Bloomberg.

Calderon said that Mexican economic growth quickened to more than 5 percent in the first quarter from 4.6 percent in the fourth, and stands to gain considerably from an even mild recovery in the U.S. The Mexican president said manufacturing, especially of automobiles, jumped 50 percent last year as a result of stronger exports to the U.S., which buys 80 percent of the country’s sales abroad.

U.S. Demand

“The demand in the United States looks to me like it’s starting to recover — not enough, and my perception is that the American economy will suffer,” said Calderon. “However, even with a very small growth in the demand sector, it will be very positive for us.”

Mexico’s economy should grow 4.3 percent this year, more than a previous government estimate of 3.9 percent, Calderon said. The International Monetary Fund and private economists expect gross domestic product to expand by as much as 5 percent in 2011, he said. Mexico’s GDP grew 5.5 percent in 2010.

Calderon said he’s fighting monopolies and seeking to open the oil industry to more private investment to improve Mexico’s competitiveness. Antitrust legislation he signed yesterday aims to end “monopolistic behavior” by big companies including ones in the telecommunications industry owned by billionaire Carlos Slim, the Mexican president said.

Slim

While many of Slim’s companies follow “good practices” there are “big enterprises” in Mexico, including in telecommunications, that need to be better regulated for anti- competitive behavior, Calderon said.

“I really respect Carlos Slim, or any other Mexican enterprise,” he said. “But at the same time, I am the authority and I need to regulate the market in order to avoid monopolistic practices.”

In addition to tougher legislation, the Supreme Court ruled this month that Slim’s wireless carrier and biggest company by market value, America Movil SAB, can’t use injunctions to stave off cuts in the fees it charges competing carriers to connect calls. The ruling may let rivals reduce prices for consumers.

Calderon said he would consider selling shares in state- owned oil producer Petroleos Mexicanos as part of a bill he plans to submit to “modernize” the company and arrest six years of declining production.

Petrobras, Statoil Models

New legislation Calderon plans to present to Congress which convenes in September would seek to remake Pemex along the lines of Brazil’s Petroleo Brasileiro SA (PETR4) or Norway’s Statoil ASA (STL), he said.

“That could be an alternative,” said Calderon, when asked about a possible share sale for Pemex, in the Bloomberg Television interview.

Pemex, Latin America’s largest oil producer, is offering foreign oil companies performance-based contracts as it seeks technologies to extract oil from mature fields and stem six straight years of declines.

“My plan is to try another legal reform in order to modernize Pemex in a way similar to what Petrobras did 10 years ago,” said Calderon, a former energy minister. “It’s going to be difficult, but I think we are moving the perception of public opinion of how important it is to modernize the enterprise.”

Be magnificent!

Warm Regards,

Summer for Carolann

Carolann Steinhoff, B.Sc., CFP, CIM, FCSI

Senior Vice-President &

Senior Investment Advisor